Bitcoin miners MARA Holdings and Hut 8 published strong third-quarter outcomes on Tuesday, with both reporting dramatically greater revenues and broadening Bitcoin reserves.

MARA’s earnings climbed up 92% year-over-year to $252 million in the 3rd quarter of 2025, swinging from a $125 million loss to $123 million in earnings over the duration, while Hut 8’s earnings almost doubled to $83.5 million with revenues of $50.6 million.

Both miners likewise enhanced their balance sheets. MARA Holdings ended the quarter with 52,850 Bitcoin (BTC), almost doubling its reserves from 26,747 BTC a year previously. Hut 8 reported 13,696 BTC in its tactical reserve, up from 9,106 BTC in the exact same duration in 2015.

The outcomes highlight both business’ ongoing diversity beyond Bitcoin mining into massive calculate and energy facilities. MARA explained itself as a “digital energy and facilities” business concentrated on transforming excess energy into digital capital, consisting of financial investments in low-carbon AI information centers through its $168 million acquisition of Exaion, a subsidiary of France’s state-owned energy EDF.

Hut 8 is pursuing a comparable course, with 1.02 gigawatts of capability under management and prepares to broaden to more than 2.5 gigawatts throughout The United States and Canada as it develops out high-performance computing websites to serve both Bitcoin and AI work.

The outcomes appeared to disappoint financier expectations, with both stocks trading lower on Tuesday. Hut 8 shares traded down about 9%, while MARA slides 5% at this writing.

Bitcoin traded near $99,000, down approximately 6% over the previous 24 hr, according to Cointelegraph Markets Pro.

Related: Bitcoin slips listed below $100K as experts state BTC is set to drop lower: Here’s why

The United States leads in Bitcoin mining

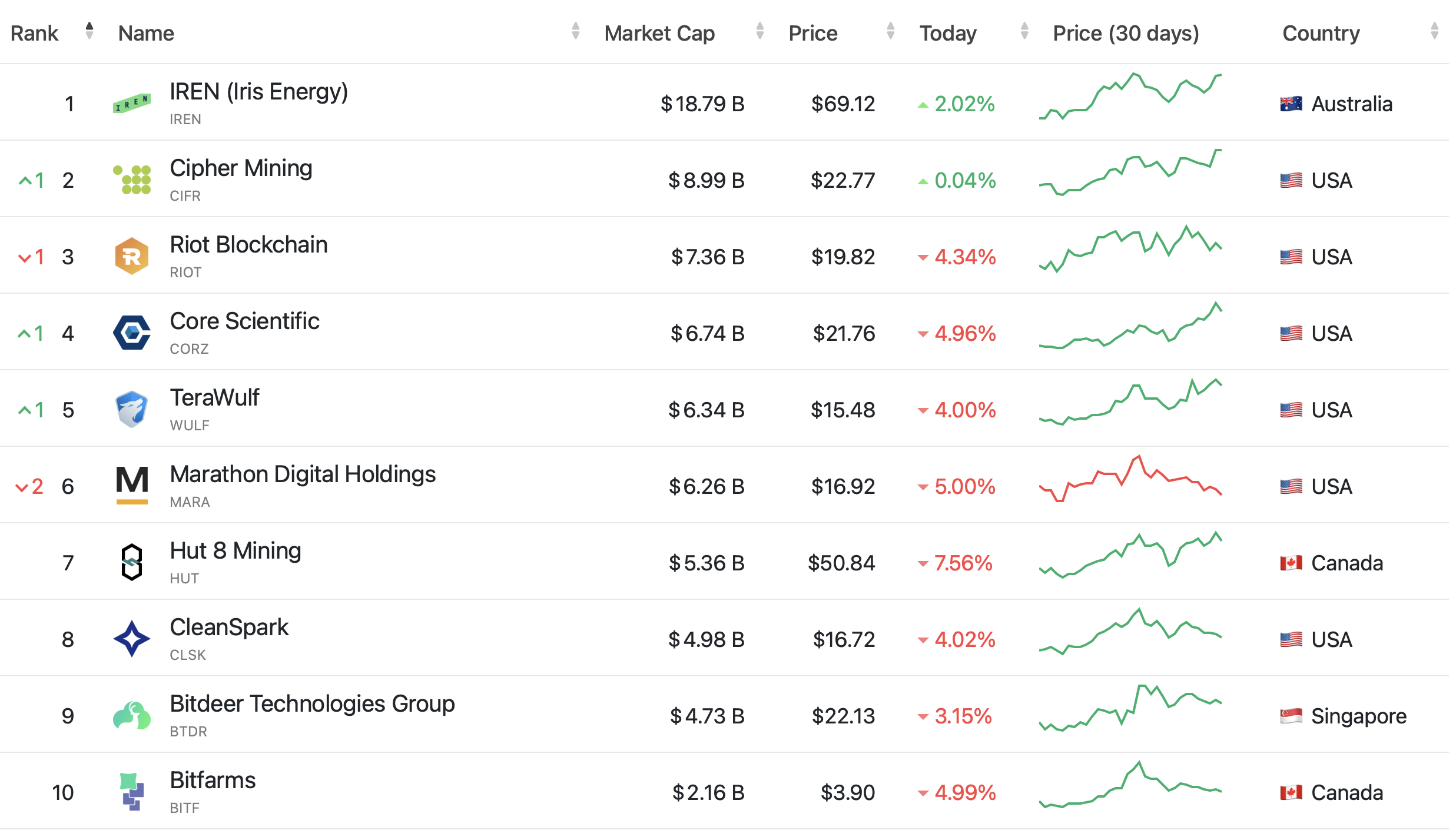

Following China’s 2021 Bitcoin mining restriction, much of the market’s hash power moved to the United States, which now represents an approximated 37% of international Bitcoin hashrate, making it the single biggest mining center worldwide. 6 of the world’s 10 biggest openly traded mining business are based in the United States.

Texas has actually become the prominent state for United States Bitcoin mining, providing inexpensive electrical power, plentiful eco-friendly power, and a business-friendly power grid. Significant miners, consisting of MARA, Riot Platforms, CleanSpark, Bitdeer, and Hut 8, run there, and it has actually even been called “a sanctuary for Bitcoin” by United States Senator Ted Cruz.

On the other hand, some states are still discussing how to manage the sector. In New Hampshire, the Senate Commerce Committee deadlocked Friday on an expense to relieve constraints on crypto mining, following a rise in public feedback because the step was last talked about.

Publication: China formally dislikes stablecoins, DBS trades Bitcoin alternatives: Asia Express