The memecoin sector’s market capitalization was up to levels last seen in July, as meme-based tokens had a hard time to recuperate from losses sustained throughout the crypto market’s sharp crash on Friday.

CoinMarketCap information revealed that on Saturday, the memecoin sector dropped to a low of $44 billion, a practically 40% plunge from $72 billion the previous day. On Sunday, the memecoin market a little recuperated to $53 billion, a level last seen in July before a Solana-based memecoin craze fired up the sector’s late-summer rally.

Over the last 4 months, the memecoin market cap has actually regularly stayed above $60 billion, as meme-based tokens have actually preserved strong retail interest, sustained by Solana and BNB Chain. Nevertheless, the current plunge marked a shift in momentum.

At the time of composing, the memecoin sector’s market cap hovers at $57 billion, still much lower than its current efficiencies.

Leading memecoins battle to recuperate from Friday’s bloodbath

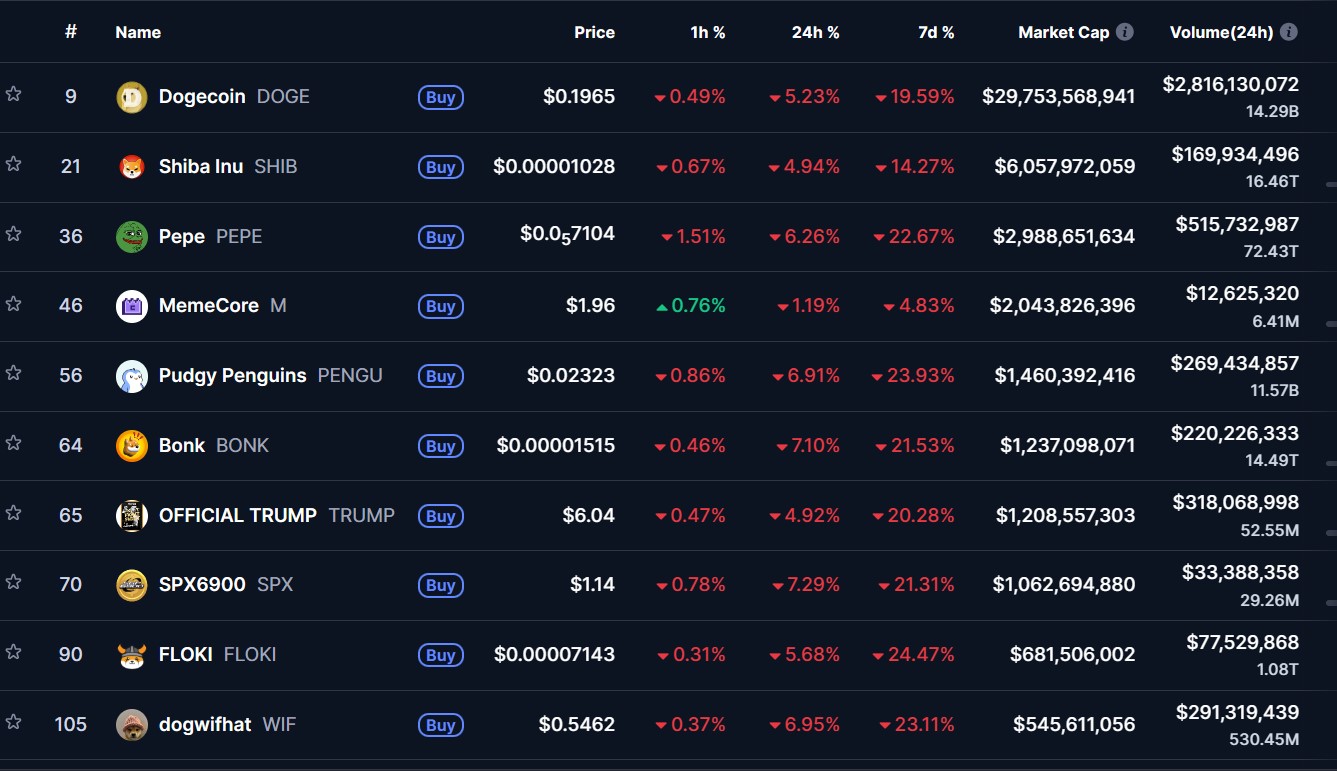

According to CoinMarketCap, the leading 10 memecoins represent about $47 billion, more than 82% of the sector’s overall market capitalization. At the time of composing, all these tokens were selling the red, both on the 24-hour and seven-day charts.

The most significant meme tokens like Dogecoin (DOGE), Shiba Inu (SHIB) and Pepe (PEPE) all published weekly losses from 13%– 22%. Other top-ranked memecoins like Bonk (BONK) and Floki (FLOKI) come by over 20% in the recently.

United States President Donald Trump’s main memecoin token was likewise struck by the crash and is 20% down in the weekly charts.

Related: High-leverage crypto trader James Wynn liquidated once again, this time for $4.8 M

Other sectors rapidly supported after the marketplace crash

While memecoins are still recuperating from the after-effects of the crash, numerous other sectors have actually revealed indications of faster stabilization and healing.

A day after the crash, non-fungible tokens (NFTs) began to recuperate. Throughout the marketplace sell-off, the general worth of the NFT area stopped by 20%, with about $1.2 billion in worth eliminated from the sector. Nevertheless, the specific niche rapidly recuperated, restoring 10% the day after the crash.

Crypto exchange-traded funds (ETFs) likewise rapidly drew in fresh inflows after a wave of outflows following the current market disaster. On Tuesday, area Bitcoin ETFs saw $102 million in net inflows, while Ether ETFs taped $236 million in net inflows.

More recognized cryptocurrencies were likewise fast to recuperate. Bitcoin (BTC), which dropped to $102,000, is trading above $111,000, according to CoinGecko. Ether (ETH), which decreased to listed below $3,700, has actually recuperated to levels above $4,000.

Publication: Sharplink officer surprised by level of BTC and ETH ETF hodling: Joseph Chalom