Mercurity Fintech Holding, a Nasdaq-listed digital fintech group structure blockchain-based payment facilities, prepares to raise $800 million to develop a Bitcoin treasury reserve as more business embrace the cryptocurrency for tactical functions.

Mercurity prepares to raise $800 million to develop a “long-lasting” Bitcoin (BTC) treasury reserve, which will be incorporated in its digital reserve structure through blockchain-native custody, staking combinations and tokenized treasury management services, the business stated in a Wednesday statement.

Mercurity stated it will shift a part of its treasury into a “yield-generating, blockchain-aligned reserve structure that strengthens long-duration possession direct exposure and balance sheet durability.”

Through the facility of its business Bitcoin treasury, the business intends to place itself to end up being a “essential gamer in the progressing digital monetary environment,” stated Shi Qiu, CEO of Mercurity Fintech, including:

” We’re constructing this Bitcoin treasury reserve based upon our belief that Bitcoin will end up being a necessary element of the future monetary facilities.”

Related: Bitcoin nears brand-new high as Trump states US-China trade ‘offer is done’

The $800 million capital raise would make it possible for the company to acquire about 7,433 BTC at existing rates.

This would make Mercurity the world’s 11th biggest business Bitcoin holder after Galaxy Digital Holdings, exceeding GameStop’s 4,710 BTC, Bitbo information programs.

Related: ‘ Apple must purchase Bitcoin,’ Saylor states, as share buyback dissatisfies

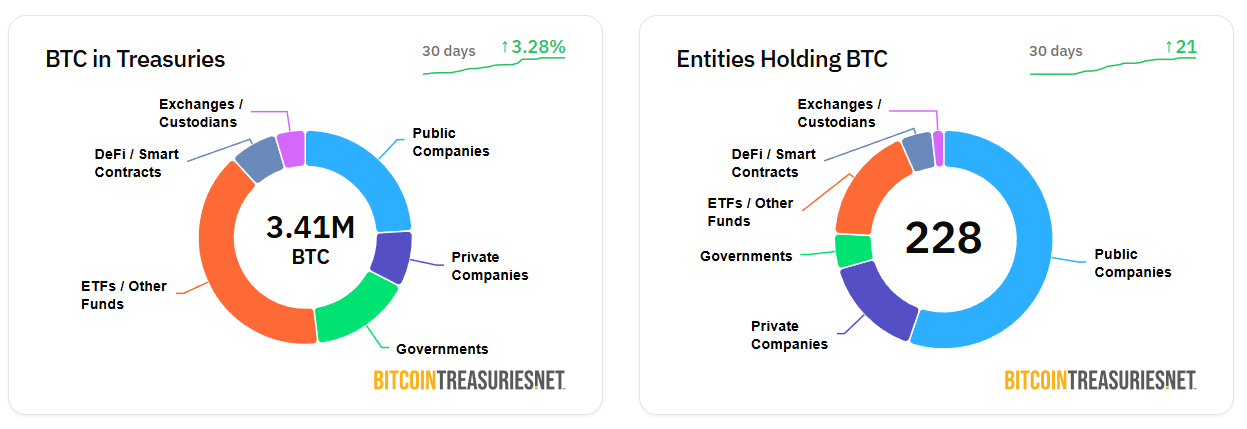

Business Bitcoin adoption increasing, 223 business hold BTC

Signaling growing institutional interest, a minimum of 223 public business are now holding Bitcoin as part of their business treasuries, up from simply 124 companies on June 5, Cointelegraph reported.

Over 819,000 BTC, representing 3.9% of the overall supply, is now kept in public business treasuries, according to information from BitcoinTreasuries.NET.

A long-lasting financial investment point of view is driving the wave of business Bitcoin adoption, a Binance Research study representative informed Cointelegraph, including:

” Business BTC adoption is driven by long-lasting balance sheet method, treasury diversity and capital-raising activity.”

Altcoins are likewise taking advantage of growing institutional interest. Interactive Strength, a Nasdaq-listed physical fitness devices maker, revealed strategies to raise approximately $500 million to develop a Fetch.ai (FET) token treasury, Cointelegraph reported on Wednesday.

Publication: Older financiers are running the risk of whatever for a crypto-funded retirement