Tokyo-listed Bitcoin-focused business Metaplanet authorized an abroad capital raise of as much as $137 million, integrating brand-new typical shares and stock acquisition rights as it aims to broaden its Bitcoin holdings and decrease financial obligation.

In a Thursday filing, Metaplanet stated it prepares to provide 24.5 million typical shares at 499 Japanese yen per share, raising about 12.24 billion yen ($ 78 million) upfront. It likewise authorized the issuance of 159,440 stock acquisition rights, representing approximately 15.9 million extra shares, which might raise about $56 million if worked out.

The warrants offer financiers the choice to purchase shares later on at a repaired rate above the existing market level, however just over the next year. Both the shares and warrants will be offered independently to abroad financiers, based on regular closing conditions, according to the filing.

Metaplanet Bitcoin method director Dylan LeClair stated the structure was developed to raise capital while handling dilution. “The funding structure makes it possible for Metaplanet to capitalize upon the volatility of its typical stock to offer shares at a premium to market while raising capital today,” LeClair composed on X.

Usage of earnings and Bitcoin method

In the function area of the filing, Metaplanet stated earnings from the offering are designated mainly to extra Bitcoin purchases, financial investment in its Bitcoin earnings service and a partial payment of loanings under an existing credit center.

The business stated the financial obligation payment was meant to restore its loaning capability and protect versatility for future capital actions.

Metaplanet likewise restated its positioning as a “Bitcoin Treasury Business,” mentioning Bitcoin (BTC) deficiency and mobility as factors to hold it as a medium- to long-lasting shop of worth.

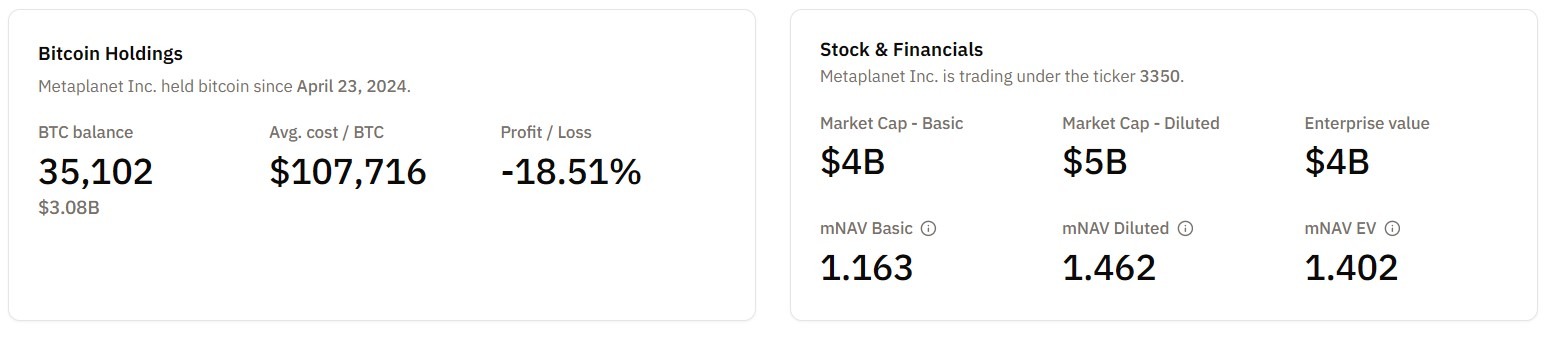

The business stays the fourth-largest business Bitcoin holder worldwide. According to Bitcoin Treasuries, Metaplanet holds 35,102 BTC, worth more than $3 billion.

Related: Metaplanet has crucial benefit over US-based Bitcoin treasuries: Expert

Metaplanet expands fundraising reach

The current capital raise develops on Metaplanet’s current efforts to diversify its financing sources beyond typical equity, integrating shares, warrants and chosen instruments to tap abroad financiers.

On Dec. 22, the business cleared the issuance of dividend-paying favored shares for abroad organizations, broadening its capital-raising toolkit. The relocation marked a shift towards utilizing several capital instruments together with its Bitcoin-focused balance sheet method.

The brand-new filing likewise follows a different disclosure on Monday, in which the business raised its 2026 profits outlook in spite of scheduling a big non-cash Bitcoin problems.

Publication: Huge concerns: Would Bitcoin endure a 10-year power interruption?