The Michael Saylor Bitcoin method, described

Saylor’s thinking was driven by a deep issue about the future of fiat currency.

When Michael Saylor, then CEO of Technique, revealed in August 2020 that his service intelligence company was embracing Bitcoin (BTC) as its main treasury reserve possession, lots of saw it as a radical (even careless) choice.

Quick forward to June 2025, and Saylor’s relocation has actually not just protected Technique’s location as one of the biggest business holders of Bitcoin, it’s likewise altered how business consider money, worth and long-lasting monetary method.

No doubt, his method has actually assisted stimulate a wider wave of institutional Bitcoin purchasing and pressed digital properties deeper into business financing

With federal governments printing cash at record levels throughout the COVID-19 pandemic, inflation was climbing up quickly. Saylor thought the dollar (and other significant currencies) was declining. He saw Bitcoin as the very best possible hedge: a digital, fixed-supply possession that might hold buying power with time.

This concept, now commonly called the Michael Saylor Bitcoin method, had to do with safeguarding Technique’s treasury. Saylor called Bitcoin “digital gold,” and he thought it used much better long-lasting worth than holding dollars or bonds.

So in August 2020, Technique purchased 21,454 BTC for $250 million.

Over the next couple of years, Saylor improved Technique into a business with a double identity: a tech company and a Bitcoin business treasury lorry.

How Technique funds its Bitcoin acquisition

Saylor’s strategy was to keep purchasing Bitcoin strongly and at scale. To do that, Technique utilized a mix of monetary tools: convertible senior notes, protected loans and equity sales. This let them raise billions of dollars without selling existing properties.

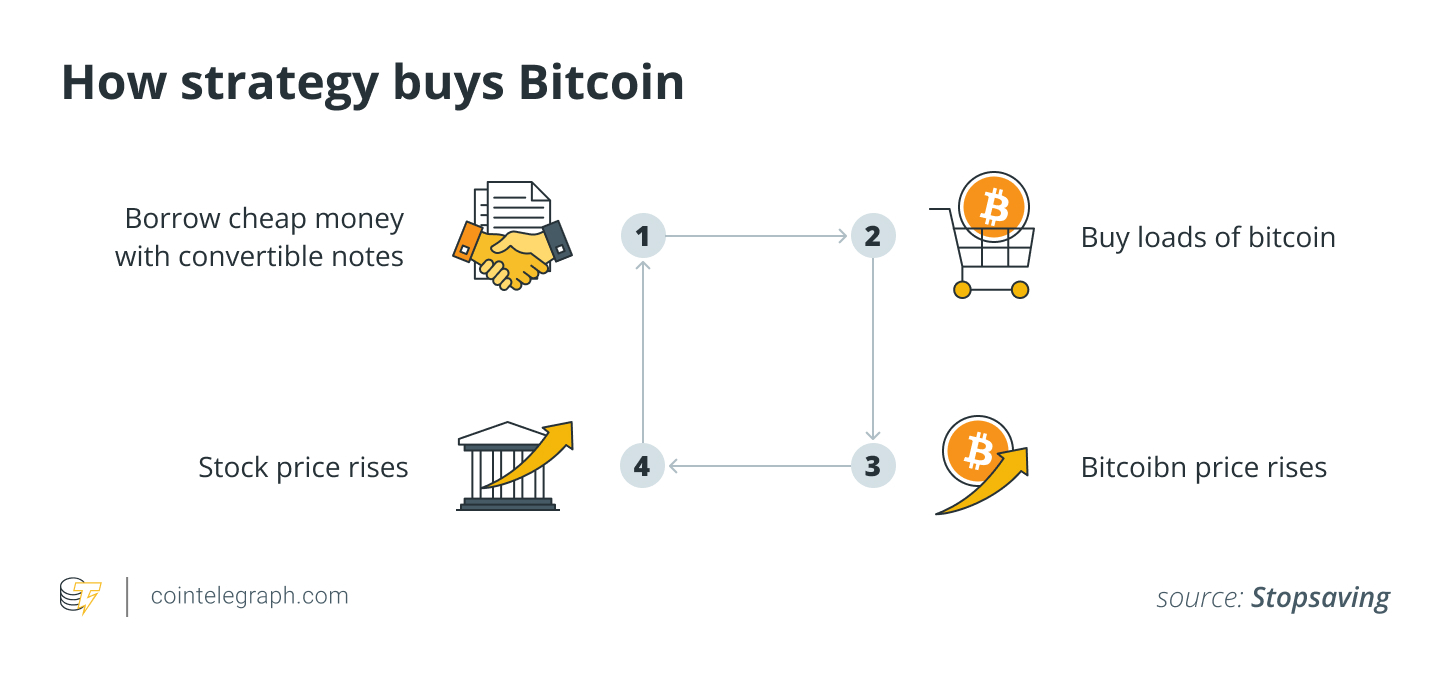

This developed what many now call a Bitcoin build-up method or “Bitcoin flywheel”:

- Raise funds: Technique released low-interest financial obligation or offered stock to raise capital.

- Buy Bitcoin: The cash raised was utilized to purchase big quantities of Bitcoin.

- Market increase: As Bitcoin’s cost increased, Technique’s stock, MSTR, likewise rose. Financiers saw the business as a method to get direct exposure to Bitcoin.

- Reinvest: With the stock cost increasing, Technique might raise much more cash, cycle it back into more BTC purchases, and repeat the procedure.

This monetary design enabled the business to scale up its Bitcoin holdings rapidly and effectively. It likewise placed Saylor as one of the boldest voices in business financing.

By June 2025, Technique had actually obtained 582,000 BTC at a typical cost of approximately $70,086 per Bitcoin. That amounts to an overall financial investment of around $40.79 billion.

While Technique isn’t the most significant general Bitcoin holder (that would be Satoshi Nakamoto, big crypto exchanges or Bitcoin ETFs like BlackRock’s IBIT), it is without a doubt the biggest openly traded business holding Bitcoin straight on its balance sheet.

Did you understand? Blockchain scientists, utilizing sophisticated clustering strategies like the Patoshi Pattern, have actually traced roughly 22,000 addresses that likely come from Satoshi Nakamoto. Integrated, they hold an approximated 1.096 million BTC (about 5% of the overall Bitcoin supply), valued today at over $106 billion.

Why Technique’s Bitcoin method is both vibrant and dangerous

From an efficiency point of view, Saylor’s Bitcoin financial investment approach has actually provided huge outcomes. Because that very first Bitcoin purchase, Technique’s stock has actually risen– at one point getting more than 2,500%. That development outmatched both Bitcoin itself and practically every other significant possession.

Since June 2025, the business’s market cap is approximately $106 billion. Its Bitcoin holdings deserve about $62.6 billion. That 70% premium suggests just how much self-confidence financiers have in Saylor’s BTC method and the business’s function as a Bitcoin holding business.

However this type of aggressive method features danger.

The most significant risk is Bitcoin’s cost volatility. A sharp drop in the marketplace might considerably diminish the worth of Technique’s properties. Likewise, since the business utilized financial obligation to purchase Bitcoin, a crash might make it more difficult to fulfill loan commitments.

In Spite Of that, the business has actually held company in its business Bitcoin method. Up until now, long-lasting cost development has actually assisted balance out those dangers. However Technique still has billions in financial obligation coming due, and if Bitcoin fails, they’ll require to count on brand-new funding– or make money from their initial software application service– to survive.

Not everybody is on board with Saylor’s strategy. Critics like short-seller Jim Chanos have actually called it “monetary mumbo jumbo,” cautioning that blending a tech service with a speculative possession is a harmful mix.

Others fret about the premium at which MSTR trades compared to its real BTC holdings. If that premium collapses, the stock might take a significant hit.

Still, Saylor stays unshaken. He’s argued that Technique is developing a more effective, contemporary variation of business financing. Rather of leaving money to decline, he’s provided financiers direct, regulated access to Bitcoin, without the inconvenience of personal secrets or self-custody. His long-lasting vision hasn’t altered.

Turning Points on the Bitcoin business treasury journey

Technique’s Bitcoin journey is filled with vibrant relocations and significant funding turning points that show Michael Saylor’s Bitcoin method in action:

- August 2020: The business kicks things off with the purchase of 21,454 BTC for $250 million, its initial step towards ending up being a Bitcoin business treasury leader.

- December 2020: Technique raises $650 million through its very first convertible notes using to purchase more Bitcoin.

- February 2021: A brand-new round of convertible notes is followed by a public stock offering, once again with the objective of getting BTC.

- 2022-2023: Even throughout the crypto bearishness, Technique continues purchasing, revealing the world that Saylor’s dedication isn’t simply talk.

- Early 2025: 2 significant offers take place back-to-back: a $2-billion convertible notes round in February followed by a $2.1-billion chosen stock sale in March. Both are utilized to money more Bitcoin purchases at scale.

These minutes highlight a Bitcoin build-up method that has actually assisted Technique end up being the biggest openly traded Bitcoin holder worldwide.

Did you understand? Michael Saylor resigned as MicroStrategy’s CEO on Aug. 8, 2022, right in the middle of a significant crypto bearishness. The business had actually simply reported a $918-million problems on its Bitcoin holdings, and Bitcoin had actually fallen listed below $20,000. Saylor moved into the function of executive chairman to concentrate on the business’s Bitcoin acquisition method while handing CEO tasks to Phong Le.

The future of institutional Bitcoin purchasing

Michael Saylor’s crypto financial investment thesis has actually altered how some financiers, executives and even regulators see Bitcoin in the more comprehensive monetary system. Looking towards the rest of 2025 and beyond, his method continues to control the discussion.

1. Bitcoin gets business reliability

By making such a public dedication, Saylor assisted legitimize Bitcoin as a genuine possession for business treasuries.

His vibrant positioning motivated other business to believe seriously about designating to BTC, even if at a much smaller sized scale. The concept that Bitcoin belongs on a business balance sheet is now being gone over in conference rooms worldwide.

2. A brand-new design for treasury management

The “Technique design” has actually developed a plan for organizations aiming to hedge versus inflation and diversify with digital properties.

The majority of business will not follow Saylor’s high-risk method, however his structure has actually pressed business financing in a brand-new instructions.

More companies are checking out Bitcoin allotment methods as part of a longer-term hedge, especially those looking beyond simply holding money.

3. TradFi and crypto are assembling

The success of Bitcoin area ETFs has actually made it much easier for conventional financiers and organizations to get direct exposure. Tools like BlackRock’s IBIT and brand-new Financial Accounting Standards Board (FASB) standards permitting business to report crypto at reasonable market price have actually made digital properties more available than ever.

This merging in between conventional financing and crypto is precisely what Saylor has actually been banking on and assisting drive.

4. Michael Saylor’s vision: Bitcoin to $1 million

Saylor still anticipates Bitcoin striking $1 million with time, and he’s openly stated that the days of deep bearishness might lag us. In his view, we’re going into a digital gold rush, and Technique’s BTC holdings are the business’s stake because brand-new frontier.

Likewise, while a few of Huge Tech’s giants (like Apple or Google) have actually remained mindful about including Bitcoin to their balance sheets, the more comprehensive pattern is clear. Studies reveal increasing digital possession adoption amongst corporations and funds. Saylor’s impact is all over.

Whether you concur with him or not, Michael Saylor’s Bitcoin relocations have actually assisted specify a brand-new age– one where business develop balance sheets with Bitcoin.