Bitcoin (BTC) traders highlighted several signals, anticipating a “enormous” cost increase. Still, onchain information reveals that BTC cost healing might be postponed as market individuals take a more protective position.

Secret takeaways:

-

Bitcoin rose 600% in 2021 after a comparable crucial bullish cross was verified.

-

Onchain information indicate consistent sell-side pressure, recommending that a BTC cost healing may require time.

BTC bullish cross mean a bull run ahead

Expert Coinvo Trading found the look of a bullish cross including the Stochastic RSI of the United States 10-Year Treasury Yield (US10Y) and China 10-Year Federal Government Bond Yield (CN10Y) versus Bitcoin’s weekly chart.

Related: Bitcoin financier belief cools amidst United States shutdown worries, Fed policy jitters

This is “Bitcoin’s most precise bull run signal” and has just took place 4 other times in the past, causing enormous cost rallies, Coinvo Trading stated in a current post on X.

The last time Stoch RSI of the US10Y and CN10Y crossed remained in October 2020, signalling the start of a 600% BTC rally to its 2021 all-time highs of $69,000.

Fellow expert Matthew Hyland likewise visualizes a possible BTC cost breakout, based upon the efficiency of the United States dollar strength index (DXY).

He prepares for the BTC/USD set to rally when the DXY edges listed below 96, as seen in 2017 and 2022.

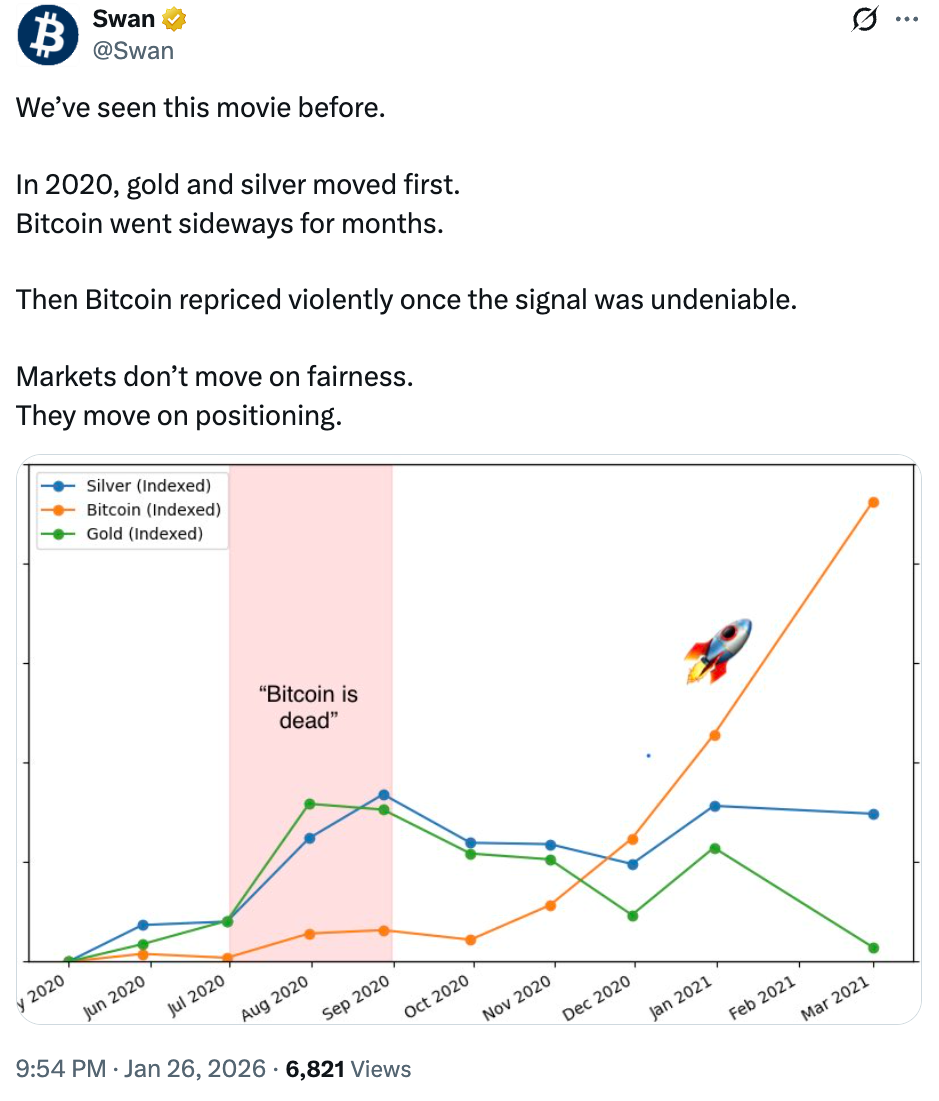

On the other hand, gold struck a record high above $5,000, while Bitcoin stays rangebound as the divergence in between the 2 possessions expanded.

Experts at Swan stated financiers must not be stressed over this divergence, nevertheless, as gold generally moves initially while Bitcoin relocations sideways for months before “strongly” breaking out.

Bitcoin market stays “delicate”

Bitcoin’s capability to stage a continual healing above crucial levels might be restricted due to the lack of purchasers.

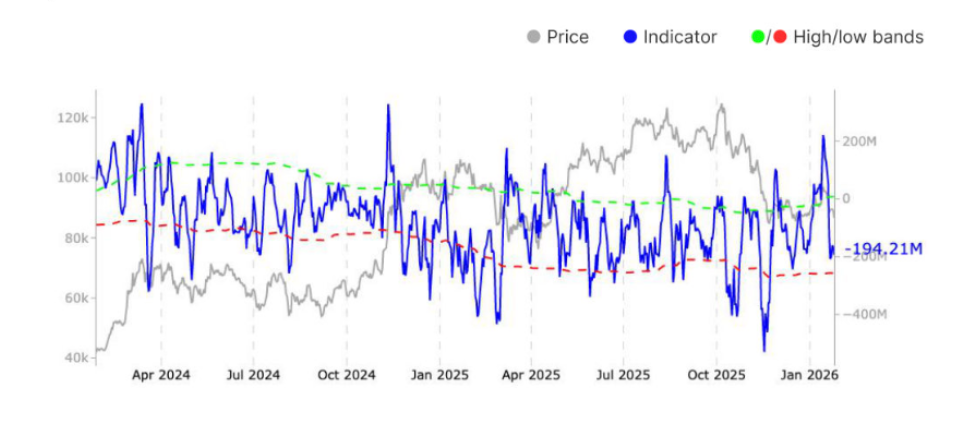

Bitcoin’s area cumulative volume delta (CVD) metric, an indication that determines the net distinction in between purchasing and offering trade volumes, has actually turned dramatically unfavorable, verifying a clear shift towards sell-side supremacy.

This metric saw a high drop to -$ 194.2 million recently from $54.2 million the week prior, recommending “trader habits has actually turned meaningfully risk-off, and shows fading self-confidence in near-term upside cost extension,” Glassnode stated in its most current Weekly Market Impulse report.

On the other hand, area Bitcoin ETF weekly net circulations turned from a $1.6 billion inflow to a $1.7 billion outflow, recommending “cooling institutional need and increasing near-term disadvantage pressure,” the onchain information supplier stated, including:

” General, market conditions have actually moved more protective, while consistent sell-side pressure and increasing hedging need recommend the marketplace stays delicate.”

As Cointelegraph reported, Bitcoin might be in for another extended duration of debt consolidation, mentioning stiff overhead resistance, offering pressure from area BTC ETFs and growing macroeconomic unpredictability.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we make every effort to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might include positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage emerging from your dependence on this info.