Digital possession treasury business might deal with “significant pressure” if the stock exchange index MSCI chooses to omit them in January, according to an expert, who informed Cointelegraph that this is most likely.

The MSCI Index revealed in October that it was speaking with the financial investment neighborhood about whether to omit Bitcoin (BTC) and other digital possession treasury business (DATs) that have a balance sheet with more than 50% crypto properties.

A few of the feedback has actually been that DATs can “show qualities comparable to mutual fund, which are presently not qualified for index addition,” according to the MSCI.

Speaking With Cointelegraph, Charlie Sherry, Head of Financing at Australian crypto exchange BTC Markets, stated in his view, the chances of the MSCI omitting DATs are “sturdily in favour of it,” as the index “just puts modifications like this into assessment when they’re currently leaning that method.”

The assessment is open till Dec. 31, with the conclusion to be revealed on Jan. 15 next year, and any resulting modifications entering into force throughout February.

Input is likewise being looked for about whether extra criteria need to be thought about, such as if a business specifies itself as a DAT, or has actually raised capital mainly to collect crypto.

If the MSCI chooses to omit DATs, Sharry stated index-tracking funds would require to offer, which alone develops significant pressure on the impacted names.

An initial list notes 38 crypto business on MSCI’s radar, consisting of Michael Saylor’s Technique, Sharplink Video gaming, and crypto miners Riot Platforms and Marathon Digital Holdings, to name a few.

” When the majority of the worth originates from a balance-sheet possession instead of the underlying service, MSCI deals with that as outside the scope of a standard equity criteria,” Sherry stated. ” It’s a risk-management choice created to keep indexes lined up with foreseeable service basics.”

” This likewise marks a shift in tone from the previous year. Crypto-heavy business techniques were praised as a capital markets development. Now the big index suppliers are tightening their meanings, and it reveals that the marketplace is vacating its whatever is adoption stage and back towards a more conservative filter.”

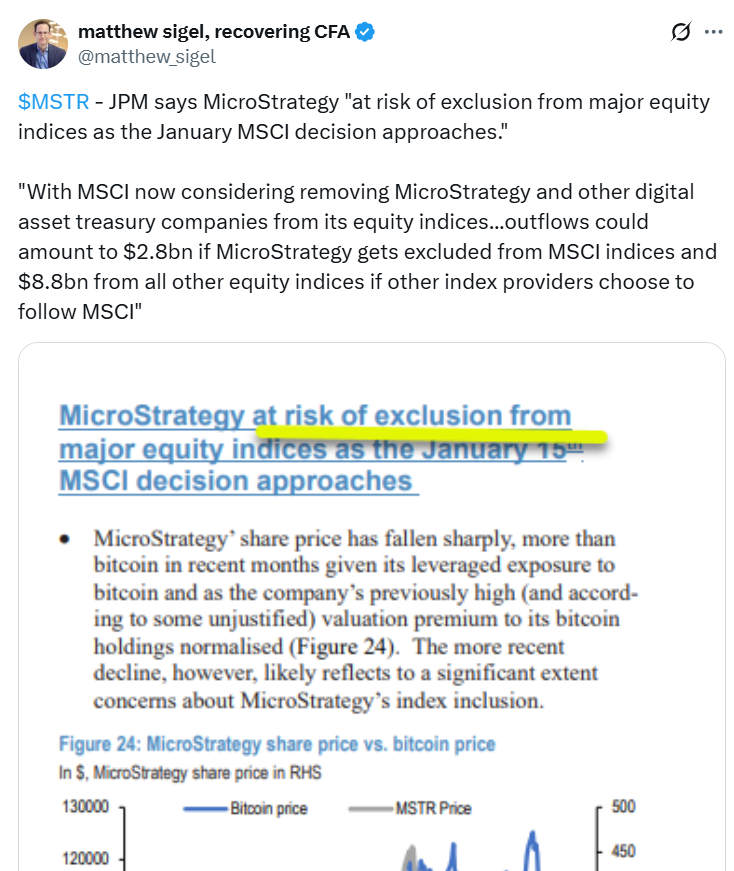

A Wednesday note from JPMorgan experts cautioned that Technique might shed $2.8 billion

if the MSCI continues, and approximately $9 billion of its approximated $56 billion market price is being in passive funds tracked by indexes, Bloomberg reports.

Uncertain if other indexes might do the same

Sherry stated it’s “tough to call at this phase” if the MSCI’s choice would affect other index suppliers.

” Index suppliers frequently see each other’s relocations, however they do not constantly relocate lockstep. S&P’s treatment of MicroStrategy reveals there’s precedent for taking a more stringent view, yet each company has its own approach and customer base to think about,” he stated.

Related: Technique actions up Bitcoin purchases with 8,178 BTC purchase

” If MSCI makes a modification, it might unlock for others to evaluate their own guidelines, however it does not ensure a domino effect.”

Technique still appears on track for possible addition in the S&P 500, according to crypto market intelligence business 10X Research study, which likewise anticipated in October that there was a 70% opportunity it will be contributed to the index before completion of the year.

Clearer guidelines benefit crypto

On the other hand, Sherry likewise stated, clearer guidelines around business category eventually assist the area.

” When business comprehend precisely how their treasury choices will be dealt with, it eliminates unpredictability for both companies and financiers,” he included.

” Distinct structures tend to reinforce long-lasting institutional self-confidence, even if the short-term effect is unpleasant for stocks constructed around Bitcoin holdings.”

Publication: Bitcoin to see ‘another huge thrust’ to $150K, ETH pressure develops