After the 2024 halving, Bitcoin mining entered its 5th date and block benefits were decreased from 6.25 BTC to 3.125 BTC. This forced miners to reconsider their operations, enhance effectiveness, cut energy expenses and upgrade hardware to stay lucrative. Cointelegraph Research study, with insights from market professionals at Uminers, analyzes this improvement in its most current report. The analysis covers ASIC effectiveness enhancements, business efficiency, geographical growth and brand-new income designs. As miners adjust, Bitcoin moves into a brand-new period where institutional momentum and sovereign adoption might redefine its function in the international monetary system.

Download the complete report to reveal how miners are browsing this shift and what the future holds for Bitcoin’s mining market.

The mining market’s reaction to increasing hashrate and diminishing margins

Regardless of the unfavorable monetary effect of the halving, Bitcoin’s network hashrate has actually continued to climb up. Since Might 1, 2025, the overall computational power of the network reached 831 EH/s. Previously in the month, hashrate peaked at 921 EH/s, marking a 77% boost from the 2024 low of 519 EH/s. This fast healing highlights the market’s unrelenting drive for effectiveness as bigger mining companies reinvest in fleet upgrades and energy optimization to keep success.

The mining arms race has actually constantly focused on power effectiveness. With energy expenses increasing, the current ASIC designs from Bitmain, MicroBT and Canaan are more enhancing the energy needed per hash. Bitmain’s Antminer S21+ provides 216 TH/s at 16.5 J/TH, while MicroBT’s WhatsMiner M66S+ presses immersion-cooled efficiency to 17 J/TH. On the other hand, semiconductor giants TSMC and Samsung are driving the next wave of development, with 3-nm chips currently in usage and 2-nm innovation on the horizon.

Post-halving success: The international shift towards low-priced energy

Bitcoin mining success has actually tightened up substantially post-halving. Hashprice, the day-to-day income per terahash per 2nd, dropped from $0.12 in April 2024 to about $0.049 by April 2025. At the exact same time, network trouble has actually risen to an all-time high of 123T, making it harder for miners to produce returns. To remain competitive, operations should draw out optimal worth from every watt of power taken in. This shift has actually magnified the look for low-cost, trusted power, driving mining growth into areas where energy expenses stay low.

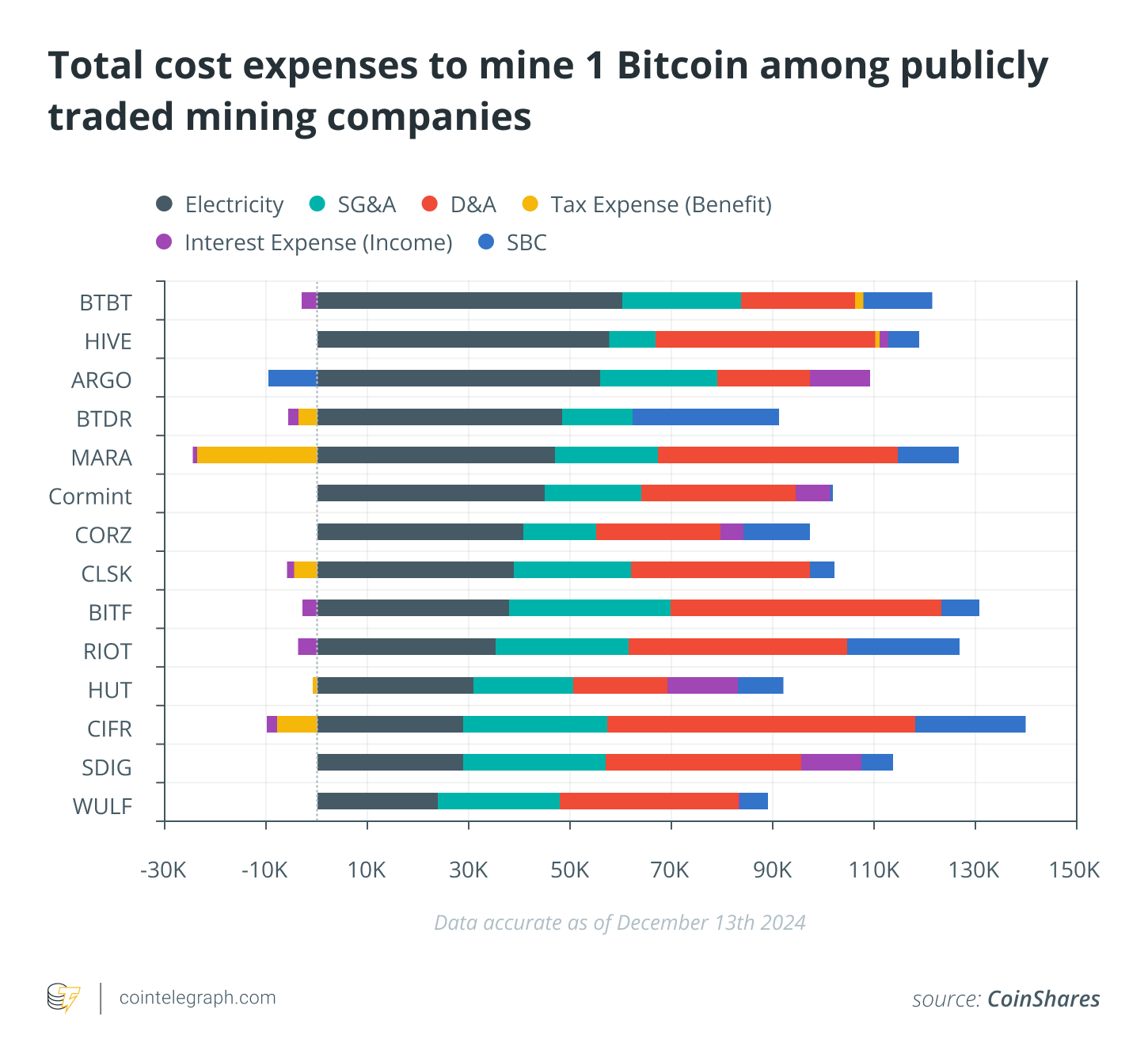

Electrical power prices now determines mining success. In Oman, certified miners gain from government-backed aids, protecting electrical power at $0.05–$ 0.07 per kWh, while in the UAE, semi-governmental jobs run at even lower rates of $0.035–$ 0.045 per kWh. These rewards have actually turned the area into a prime location for institutional-scale mining. On the other hand, in the United States, where commercial power expenses frequently surpass $0.1 per kWh, miners deal with diminishing margins, requiring a migration towards more cost-effective places. Africa, the Middle East and Central Asia have actually become crucial battlefields in this race, providing the energy arbitrage chances miners require to endure.

Download the complete report to reveal how miners are browsing this shift and what the future holds for Bitcoin’s mining market.

What’s next for Bitcoin mining?

The 2024 halving has actually strengthened a tough fact: Performance is no longer optional; it’s a requirement. The market is moving towards leaner, more enhanced operations, where just the most power-efficient miners can flourish. The increase of AI computing, international regulative shifts and continuous hardware developments will continue to form the sector over the next 12– 18 months.

Cointelegraph Research study’s Bitcoin mining report: Post-halving insights and patterns uses a data-driven breakdown of the crucial forces forming mining success, facilities financial investments, and tactical decision-making.

Download the complete report to reveal how miners are browsing this shift and what the future holds for Bitcoin’s mining market.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.

This short article is for basic details functions and is not meant to be and ought to not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.

Cointelegraph does not back the material of this short article nor any item discussed herein. Readers ought to do their own research study before taking any action associated to any item or business discussed and bring complete obligation for their choices.