Bitcoin’s (BTC) 7% decrease saw the cost drop from $88,060 on March 26 to $82,036 on March 29 and caused $158 million in long liquidations. This drop was especially worrying for bulls, as gold rose to a record high at the exact same time, weakening Bitcoin’s “digital gold” story. Nevertheless, lots of professionals argue that a Bitcoin rally impends as several federal governments take actions to prevent a recession.

The continuous worldwide trade war and costs cuts by the United States federal government are thought about short-lived obstacles. An obvious silver lining is the expectation that extra liquidity is anticipated to stream into the marketplaces, which might increase risk-on properties. Experts think Bitcoin is well-positioned to take advantage of this wider macroeconomic shift.

Source: Mihaimihale

Take, for instance, Mihaimihale, an X social platform user who argued that tax cuts and lower rates of interest are needed to “start” the economy, especially because the previous year’s development was “propped up” by federal government costs, which showed unsustainable.

The less beneficial macroeconomic environment pressed gold to a record high of $3,087 on March 28, while the United States dollar deteriorated versus a basket of foreign currencies, with the DXY Index dropping to 104 from 107.40 a month previously.

Furthermore, the $93 million in net outflows from area Bitcoin exchange-traded funds (ETFs) on March 28 more weighed on belief, as traders acknowledged that even institutional financiers are vulnerable to offering in the middle of increasing economic crisis threats.

United States inflation slows in the middle of financial recession worries

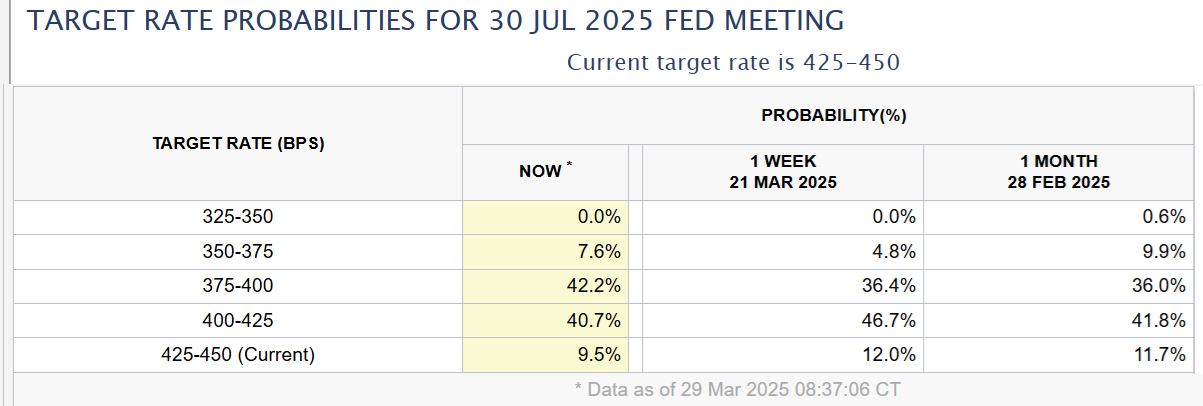

The marketplace presently designates a 50% likelihood that the United States Federal Reserve will cut rates of interest to 4% or lower by July 30, up from 46% a month previously, according to the CME FedWatch tool.

Indicated rates for Fed Funds on July 30. Source: CME FedWatch

The crypto market is currently in a “withdrawal stage,” according to Alexandre Vasarhelyi, the founding partner at B2V Crypto. Vasarhelyi kept in mind that current significant statements, such as the United States tactical Bitcoin reserve executive order mark development in the metric that matters the most: adoption.

Vasarhelyi stated real-world possession (RWA) tokenization is an appealing pattern, however he thinks its effect stays minimal. “BlackRock’s billion-dollar BUIDL fund is an advance, however it’s irrelevant compared to the $100 trillion bond market.”

Vasarhelyi included:

” Whether Bitcoin’s flooring is $77,000 or $65,000 matters little bit; the story is early-stage development.”

Gold decouples from stocks, bonds and Bitcoin

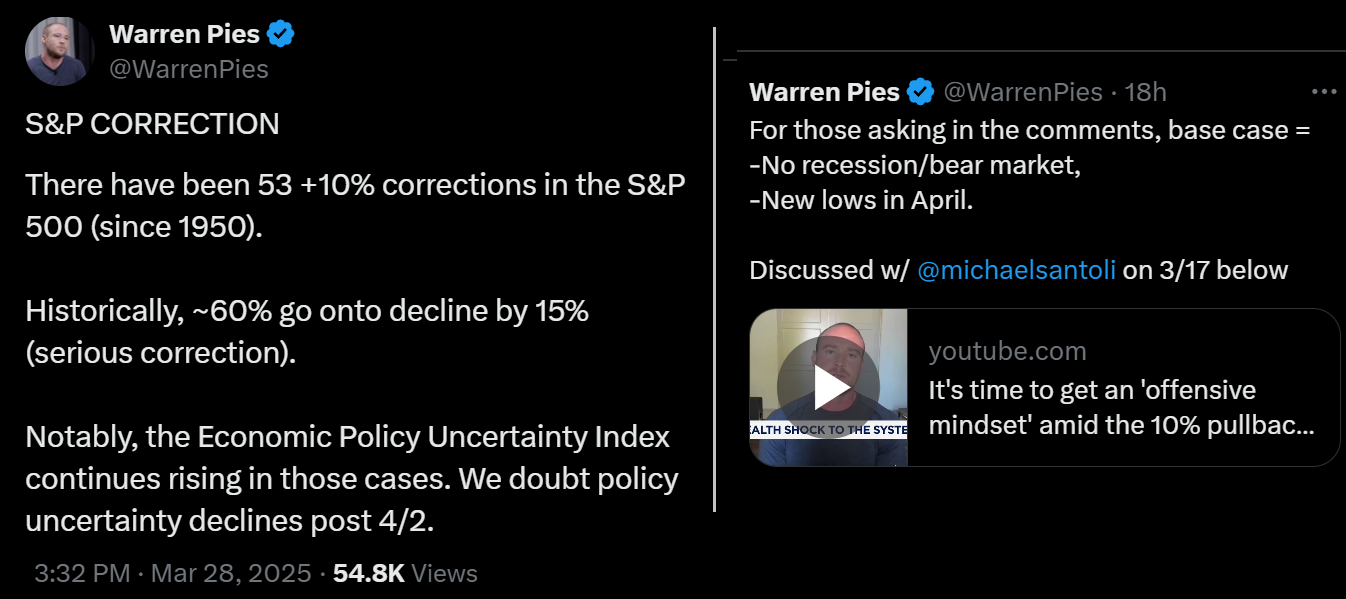

Knowledgeable traders see a 10% stock exchange correction as regular. Nevertheless, some expect a decrease in “policy unpredictability” by early April, which would minimize the probability of an economic downturn or bearish market.

Source: WarrenPies

Warren Pies, creator of 3F Research study, anticipates the United States administration to soften its position on tariffs, which might support financier belief. This shift might assist the S&P 500 remain above its March 13 low of 5,505. Nevertheless, market volatility stays an aspect as financial conditions develop.

Related: Bitcoin cost falls towards variety lows, however information programs ‘whales going wild today’

For some, the reality that gold decoupled from the stock exchange while Bitcoin caught “severe worry” is proof that the digital gold thesis was flawed. Nevertheless, more skilled financiers, consisting of Vasarhelyi, argue that Bitcoin’s weak efficiency shows its early-stage adoption instead of a failure of its basic qualities.

Vasarhelyi stated,

” Legal shifts lead the way for easy to use items, trading a few of crypto’s versatility for traditional appeal. My take is adoption will speed up, however 2025 stays a structure year, not a tipping point.”

Experts see the current Bitcoin correction as a response to economic crisis worries and the short-lived tariff war. Nevertheless, they anticipate these aspects to activate expansionist steps from reserve banks, eventually producing a beneficial environment for risk-on properties, consisting of Bitcoin.

This post is for basic info functions and is not meant to be and must not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.