REX Shares, an exchange-traded fund (ETF) service provider with over $6 billion in possessions under management (AUM), introduced its Bitcoin (BTC) Corporate Treasury Convertible Bond (BMAX) ETF that buys the convertible bonds of business with a BTC business reserve method.

According to the March 14 statement, the ETF will buy the convertible notes of business such as Technique. Convertible notes are business paper that can be transformed into equity at an established rate if a financier picks.

Generally, these convertible bonds are bought by institutional financiers, consisting of pension funds, a few of which focus on convertible note investing. Greg King, CEO of REX Financial, stated:

” Previously, these bonds have actually been challenging for private financiers to reach. BMAX gets rid of those barriers, making it much easier to buy the method originated by Michael Saylor– leveraging business financial obligation to obtain Bitcoin as a treasury possession.”

Purchasing convertible bonds, ETFs and the equity of business such as Technique, MARA and Metaplanet offers financiers with indirect direct exposure to Bitcoin that gets rid of the technical barrier to entry and self-custodial threats of holding BTC straight.

Technique co-founder Michael Saylor, who promoted business Bitcoin treasuries, discusses the benefits of BTC. Source: Cointelegraph

Related: Michael Saylor’s Technique to raise approximately $21B to buy more Bitcoin

Technique a proxy Bitcoin bet for institutional financiers

Institutional financiers might do not have the technical elegance to hold BTC straight or have legal or fiduciary restraints avoiding them from buying digital possessions.

A minimum of 12 US states presently hold Technique stock as part of their state pension funds and treasuries. Jointly, these states hold over $271 million in Technique stock utilizing existing market value.

The list makes up Arizona, California, Colorado, Florida, Illinois, Louisiana, Maryland, North Carolina, New Jersey, Texas, Utah and Wisconsin.

California’s State Educators’ Retirement Fund and its Public Worker Retirement System hold $67.2 million and $62.8 million in Technique stock, respectively.

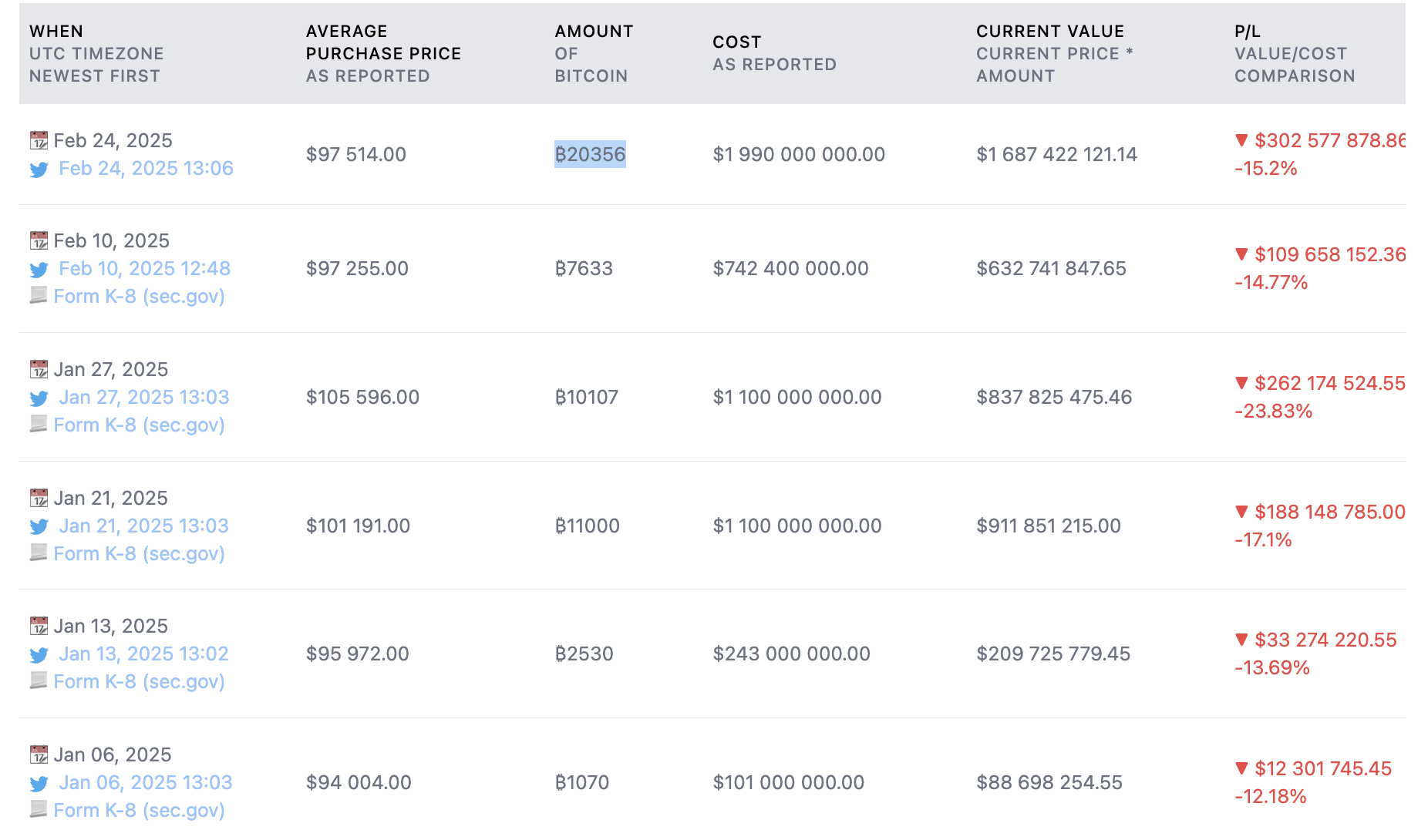

Technique’s Bitcoin purchases in 2025. Source: SaylorTracker

According to SaylorTracker, Technique presently holds 499,096 BTC, valued at over $41.4 billion, making the business among the biggest business BTC holders worldwide– eclipsing the United States federal government’s approximated 198,000 BTC.

Technique’s newest Bitcoin purchase happened on Feb. 24, when the business obtained 20,356 BTC for almost $2 billion.

Publication: ‘ China’s MicroStrategy’ Meitu offers all its Bitcoin and Ethereum: Asia Express