Bitcoin monetary services firm River stated its service customers are reinvesting approximately 22% of revenues into Bitcoin, indicating growing grassroots adoption.

Of River’s customer base, property companies have actually been the most significant adopters with almost 15% reinvesting revenues into Bitcoin (BTC), while hospitality, financing and software application sectors are designating in between 8% and 10%, River research study expert Sam Baker stated in a report on Wednesday.

Even physical fitness studios, painting and roof business and spiritual nonprofits are amongst the adopters.

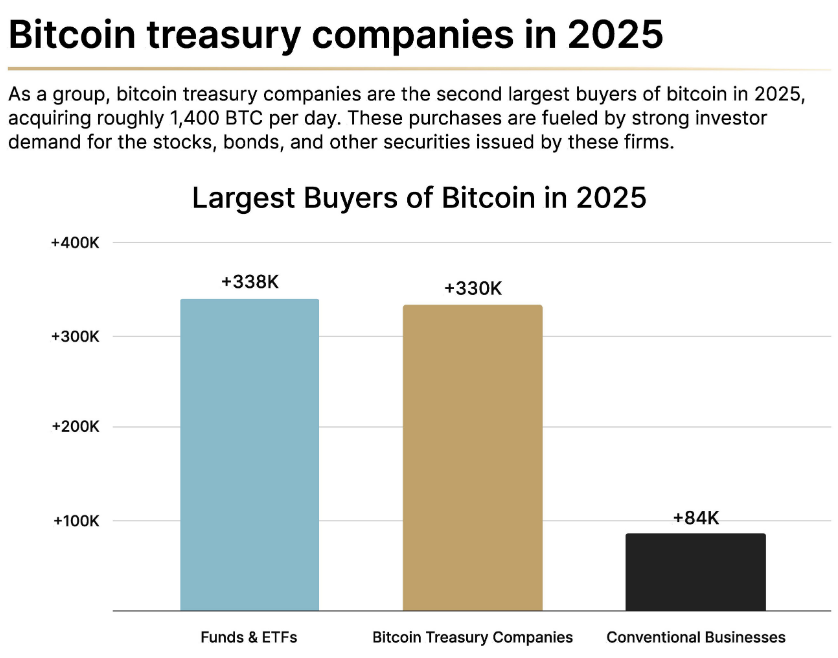

Baker stated services like these have actually silently gotten 84,000 Bitcoin in 2025– a substantial stash representing about a quarter of the holdings of institutional fund supervisors and business Bitcoin treasuries have actually collected.

” While Bitcoin treasury business have actually recorded the majority of the media spotlight, what is frequently neglected is adoption by standard services that utilize Bitcoin to match their existing service designs,” he included.

Baker stated enhancements in Bitcoin’s accounting requirements, regulative clearness, increasing institutional approval and a strong booming market have actually produced the “perfect conditions for the extensive adoption we are seeing today.”

Organization and institutional Bitcoin adoption has actually been among the most significant drivers behind Bitcoin’s bull go to $124,450 this cycle.

There have actually been durations where area Bitcoin exchange-traded fund providers have actually scooped up 10 times more Bitcoin than what miners had the ability to produce, rising Bitcoin’s cost.

It contrasts considerably with the 2020-2021 bull cycle, where services mainly rested on the sidelines as Bitcoin topped $69,000 primarily on retail buzz.

Smaller sized services have a simpler course to Bitcoin adoption

Baker kept in mind that 75% of business it serves have 50 staff members or less, arguing that the little business will have a simpler time embracing Bitcoin as less obstacles are included.

On the other hand, bigger business with committee-based decision-making are more likely to follow standards and prevent debate, Baker stated, describing why so couple of S&P 500 business hold Bitcoin.

” Even if a CEO or CFO is personally encouraged of Bitcoin’s long-lasting worth, they are not likely to promote for adoption unless peer business have actually currently done so.”

Numerous are just investing modest quantities into Bitcoin

Nevertheless, River discovered that over 40% of business designate in between 1% to 10% into Bitcoin, while just 10% invest over half of their earnings into the cryptocurrency.

Related: Tether USDT stablecoin seen on Bolivian shop price

For smaller sized business, Bitcoin purchases can be rather little– less than $10,000. Recently, Rhode Island-based Western Main Self Storage included simply 0.088 Bitcoin, worth $9,830, in a single purchase, bringing its overall holdings to 0.43 Bitcoin.

In spite of the increased adoption, Baker stated the majority of services aren’t even thinking about Bitcoin due to “extensive misconceptions and restricted awareness.”

He indicated a Cornell University study where just 6% of Americans knew that Bitcoin’s supply is topped at 21 million, while another study discovered 60% of Americans confessed they “do not understand much” about the cryptocurrency.

” To put it simply, Bitcoin is frequently dismissed not due to the fact that it has actually been assessed and declined, however due to the fact that the majority of decision-makers do not have the understanding to examine it in the very first location.”

Publication: The something these 6 international crypto centers all share …