Abundant Daddy Poor Daddy author Robert Kiyosaki has actually doubled down on his bullish outlook for tough possessions, stating he’s purchasing more gold, silver, Bitcoin and Ethereum even as markets brace for a prospective crash.

In a post shared on X on Sunday, Kiyosaki cautioned of an approaching financial slump however stated he’s getting ready for it by building up possessions he calls “genuine cash.”

” Crash coming: Why I am purchasing, not offering,” he composed, setting enthusiastic targets of $27,000 for gold, $100 for silver and $250,000 for Bitcoin (BTC) by 2026.

Kiyosaki stated his gold forecast originated from economic expert Jim Rickards, while his $250,000 Bitcoin target lines up with his long-held view of BTC as security versus the Federal Reserve’s “phony cash.”

Related: Bitcoin is having its IPO minute, states Wall Street veteran

Kiyosaki turns bullish on Ether, mentioning Tom Lee’s call

Kiyosaki is likewise turning bullish on Ether (ETH). Influenced by Fundstrat’s Tom Lee, Kiyosaki stated he sees Ethereum as the blockchain powering stablecoins, providing it a special edge in international financing.

He discussed that his conviction in these possessions originates from Gresham’s Law, which states that bad cash eliminates excellent, and Metcalfe’s Law, which connects network worth to the variety of users.

Kiyosaki, who declares to own both gold and silver mines, slammed the United States Treasury and Federal Reserve for “printing phony cash” to cover financial obligations, calling the United States “the most significant debtor country in history.” He duplicated his widely known mantra that “savers are losers,” prompting financiers to purchase genuine possessions even throughout market corrections.

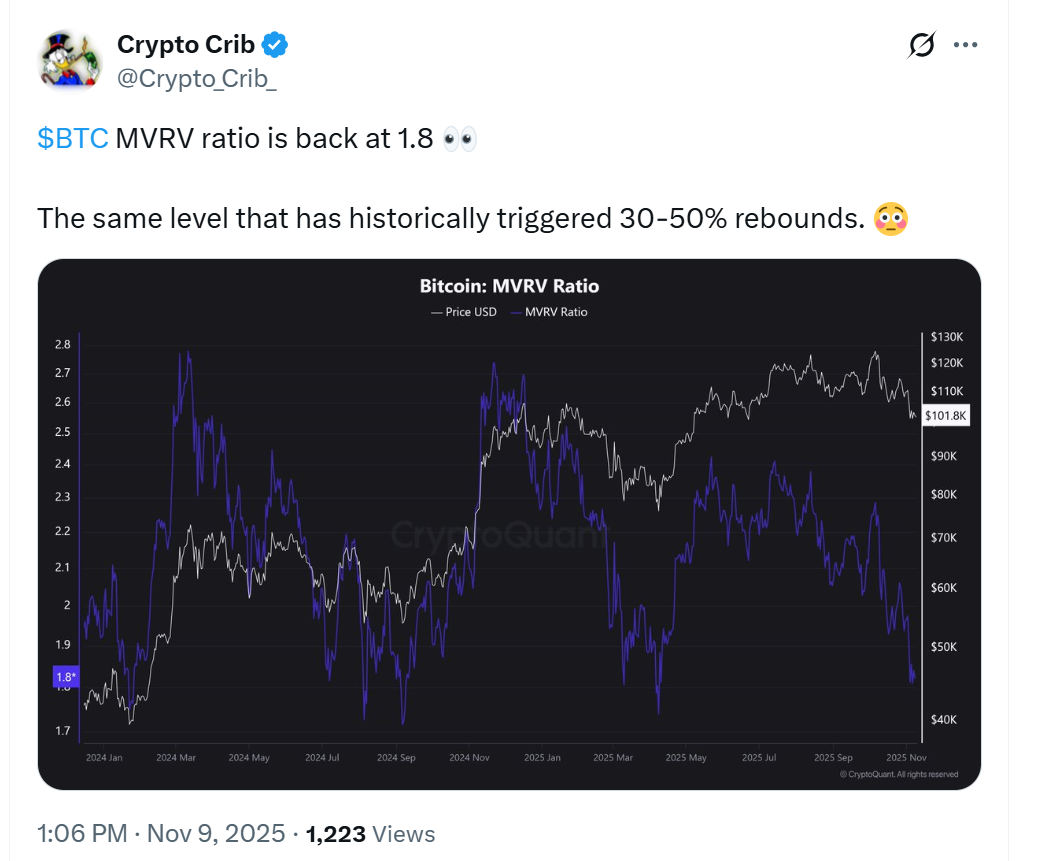

On the other hand, on-chain information appears to support a prospective turn-around for Bitcoin. Market analytics platform Crypto Baby crib kept in mind that Bitcoin’s Market price by Realised Worth (MVRV) ratio, a crucial sign of market price versus recognized worth, has actually gone back to 1.8, a level that has actually traditionally preceded 30– 50% rebounds.

Related: French Gov’ t Set to Evaluation Movement to ‘Em brace Bitcoin and Cryptocurrencies’

Hayes states increasing United States financial obligation will sustain Bitcoin rally

Recently, previous BitMEX CEO Arthur Hayes stated that the Federal Reserve will be pushed into a type of “stealth quantitative easing (QE)” as United States federal government financial obligation continues to rise. He stated the Fed will likely inject liquidity into the monetary system through its Standing Repo Center to assist fund Treasury financial obligation without formally calling it QE.

According to Hayes, this peaceful balance sheet growth will be “dollar liquidity favorable”, eventually increasing possession rates, especially Bitcoin and other cryptocurrencies.

Publication: Bitcoin OG Kyle Chassé is one strike far from a YouTube permaban