Michael Saylor’s Method, the world’s biggest business holder of Bitcoin, exposed its newest BTC purchases after the rate briefly dropped to $103,000 recently.

Method obtained 705 Bitcoin for $75.1 million in between May 26 and 30, the business revealed on June 2.

The most recent purchases were made at a typical rate of $106,495 per coin, with Bitcoin dropping from $110,000 last Monday to an intraweek low of $103,400 by the weekend.

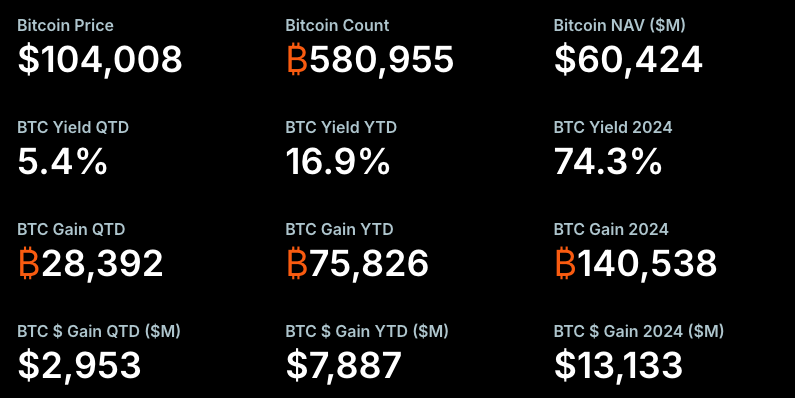

The purchase marked the business’s last Bitcoin purchase in Might, bringing Method’s overall (BTC) holdings to 580,955 BTC, gotten for about $40.7 billion at a typical rate of $70,023 per coin.

BTC yield of 16.9% YTD

With the brand-new acquisition, Method has actually a little increased its Bitcoin yield, a sign describing the portion boost in the worth of its Bitcoin holdings over a particular time period.

According to Method’s information, the current purchase brought the year-to-date BTC yield to 16.9%, up 0.1% from the previous 4,020 BTC purchase revealed last Monday. The quarter-to-date BTC yield is now 5.4%.

Method looks for to reach a BTC yield target of 25% YTD by the end of 2025. The business formerly targeted a 15% yield however increased it on May 1.

Related: Method’s Michael Saylor signals impending Bitcoin purchase

Method director offers MSTR shares

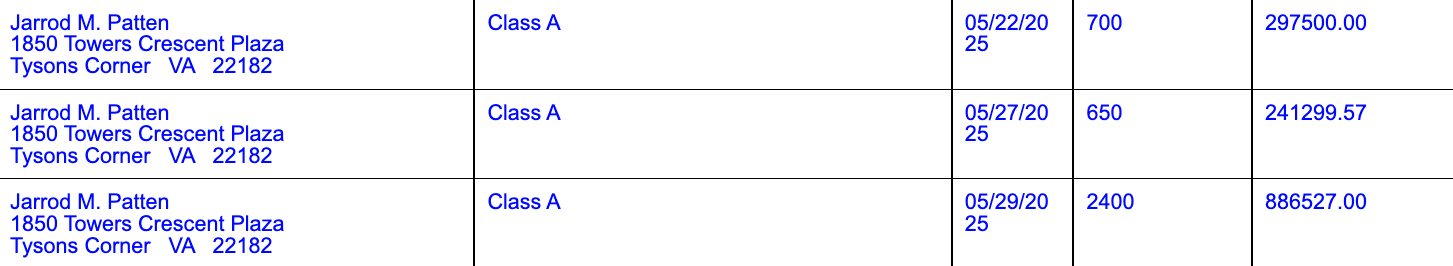

Method’s brand-new Bitcoin acquisition followed another series of Class A sales by Method director Jarrod Patten.

According to a Technique report of the proposed sale of securities submitted on Might 30, Patten offered 3,750 shares in the duration in between Might 22 and 29, worth almost $1.4 million.

Method’s stock, trading under the ticker MSTR, saw down pressure following the sales, briefly falling listed below $360 on both Might 28 and Might 30.

Related: Metaplanet ends up being 8th biggest Bitcoin holder with $118M buy

TradingView stated Method shares recuperated to close recently at $369, however were trading at 1.6% down in pre-market.

In spite of current drops, Method stock is still up about 23% year-to-date, with yearly gains of 123%.

According to Method expert Jeff Walton, Saylor’s business is well-positioned to end up being the “top openly traded equity in the whole market” one day due to its enormous stake in Bitcoin.

By the time of the statement, Method owned almost 581,000 BTC, or 2.9% of all Bitcoin that had actually been mined to date.

Publication: Bitcoin $200K ‘apparent’ breakout, GameStop’s very first BTC buy: Hodler’s Digest, May 25– 31