Almost half of exchange-traded fund (ETF) financiers are preparing to purchase a crypto ETF, matching those who stated they ‘d purchase a bond ETF, according to a report from brokerage giant Schwab Property Management.

In its ETFs and Beyond report launched on Thursday, Schwab discovered that 52% of participants to its study were preparing to buy a United States equities-tracking ETF, while 45% stated they had an interest in crypto ETFs, incorporated 2nd location with those who had an interest in funds tracking United States bonds.

Bloomberg’s senior ETF expert Eric Balchunas stated in an X post on Thursday that the outcomes were a surprise, offered the large size of the bond market in contrast.

” This was likewise stunning to see crypto connected with bonds for 2nd location in where individuals prepare to invest,” he stated. “Majorly punching above weight offered crypto is 1% of overall ETF aum [assets under management] while bonds are 17%.”

Schwab’s study polled 2,000 specific financiers aged in between 25 and 75, with half having actually either purchased or offered ETFs in the previous 2 years, and with a minimum of $25,000 of investable properties.

Millennials reveal greater interest in crypto ETFs

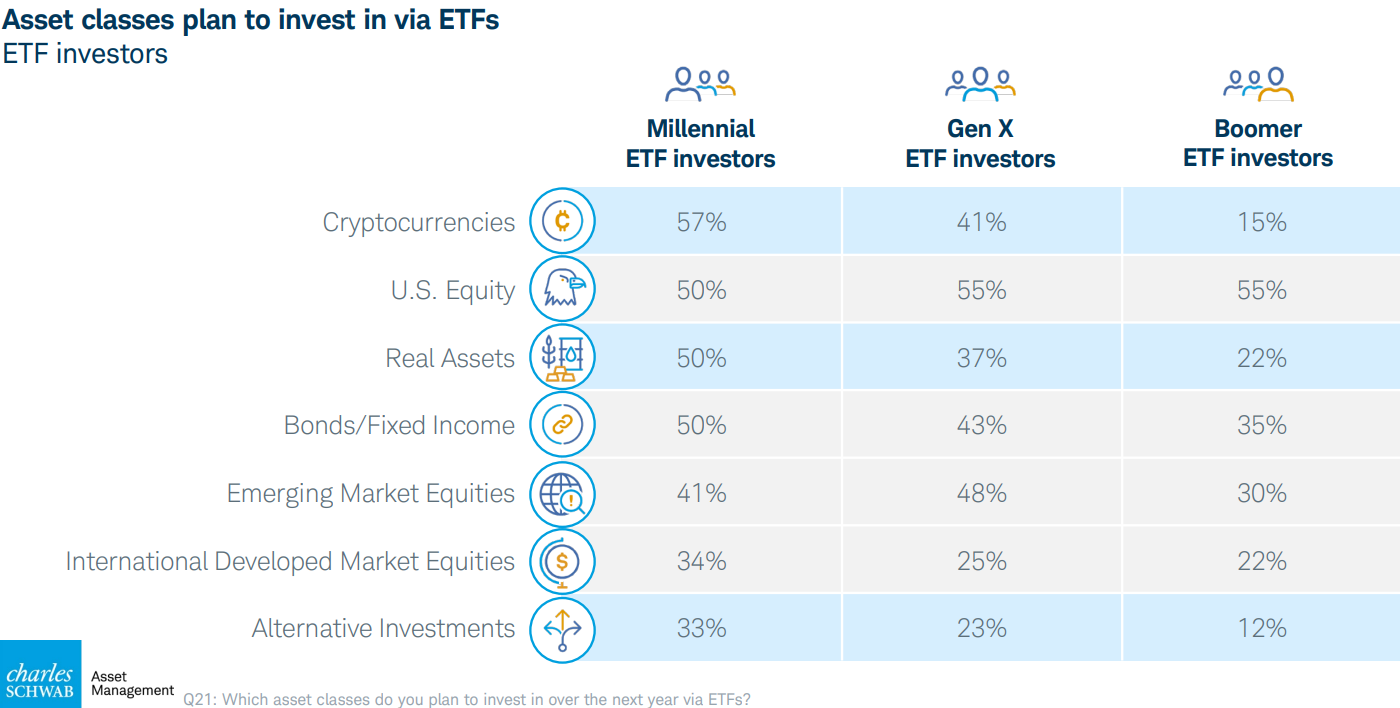

The report discovered that Millennial financiers, individuals born in between 1981 to 1996 and aged in between 29 and 44, revealed a greater interest in crypto ETFs than other age brackets.

Approximately 57% of Millennial participants showed they prepared to buy crypto through ETFs, compared to 41% of Gen X, those born in between 1965 and 1980.

Child boomers, individuals born in between 1946 and 1964, revealed the least interest in crypto ETFs, with just 15% showing they prepared to invest.

Balchunas stated the “entire study was super-optimistic” for ETFs in basic, with “essentially everybody preparing to increase use,” specifically the more youthful generations.

Low expense and ease of access driving ETF adoption

Secret chauffeurs for ETF adoption were discovered to be low expenses and ease of access, with 94% of participants responding to that ETFs assist keep expenses down in their portfolios.

Related: United States area Bitcoin ETFs bleed over $2B in second-worst outflow streak ever

About half likewise highly concurred that ETFs permit them to buy more specific niche or targeted methods different from their long-lasting portfolio and supply access to other kinds of possession classes.

David Botset, the handling director at Schwab Property Management, stated the “world of investing is going through a quick change as specific financiers access to brand-new possession classes, investing methods and lorries.”

” ETF financiers are at the leading edge of this developing landscape. They are utilizing ETFs, which now surpass specific stocks in the United States, not just for affordable core portfolio financial investments however likewise to check out the broadening universe of financial investment chances.”

Publication: All the best taking legal action against crypto exchanges, market makers over the flash crash