A crypto lobby group declares that the United States is back on track to lead the cryptocurrency market after the White Home’s newest crypto report required the country’s financing regulators to line up on digital properties.

The report, launched recently, marks a possible end to the enduring grass war in between the Securities and Exchange Commission and the Product Futures Trading Commission over how to categorize and manage cryptocurrencies.

” We have actually had legal precedent– Bitcoin, Ether and numerous other digital properties are far more similar to products,” stated Ji Hun Kim, freshly designated CEO of the advocacy group Crypto Council for Development, in a special interview with Cointelegraph.

” The President’s Working Group report shows this, [and] I do believe the CFTC will have an essential function to play when it pertains to the oversight of these properties, which are digital products– not securities.”

Kim, who went to the report’s public release at the White Home, stated “the time is now” for the United States to take the lead in the international crypto race. While other jurisdictions have a years-long running start, the United States is now in a “crypto sprint,” with both the SEC and CFTC signaling prepares to quickly carry out the report’s suggestions.

United States race to the crypto capital

The SEC under the previous administration dealt with extensive criticism from the crypto market for its regulation-by-enforcement method, submitting claims versus crypto companies based upon existing securities laws. That crackdown was combined with what happened called “Operation Chokepoint 2.0,” a wave of debanking that saw crypto companies lose access to standard monetary services.

” This is another example where the report is so specific and strong and favorable– it clarifies that banks ought to be permitted to take part in numerous digital possession activities,” stated Kim.

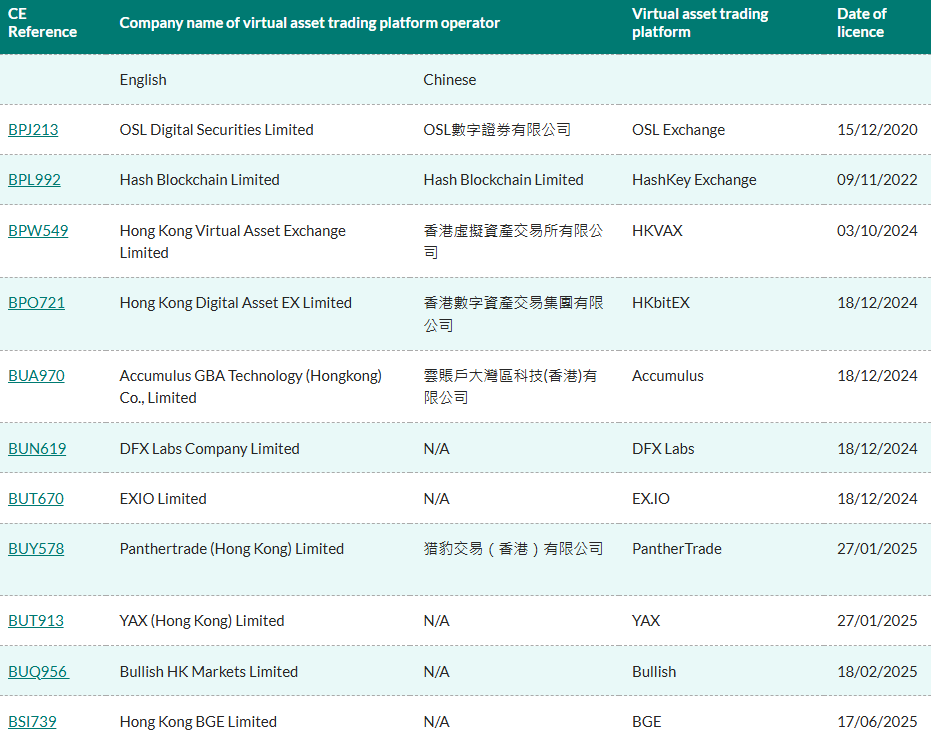

Previous unpredictability in the United States regulative environment pressed numerous crypto business offshore. Dubai rapidly became a leading location, with a devoted crypto regulator. Singapore and Hong Kong likewise increased in appeal, using beneficial tax treatment and official licensing programs for cryptocurrency exchanges.

However the lawn isn’t constantly greener. Though regulative clearness is enhancing internationally, market gamers are discovering that clearness does not constantly indicate crypto-friendly– something the United States is significantly ending up being.

Previously this year, Dubai’s Virtual Property Regulatory Authority tightened up guidance and provided companies 1 month to adhere to upgraded guidelines. Singapore expelled unlicensed companies making use of regulative loopholes by serving just abroad customers. And Hong Kong’s careful rate in releasing licenses has actually made it clear that it isn’t inviting all candidates.

Hong Kong’s Stablecoin Regulation, which worked last Friday, produced a brand-new licensing program for stablecoin providers. The European Union has its own stablecoin guidelines, part of its more comprehensive Markets in Crypto-Assets (MiCA) structure. The United States’s reaction can be found in the type of the GENIUS Act, which has actually been promoted as an essential tool for protecting the dollar’s supremacy in the international monetary system.

Related: Singapore’s ousted crypto companies might not discover shelter in other places

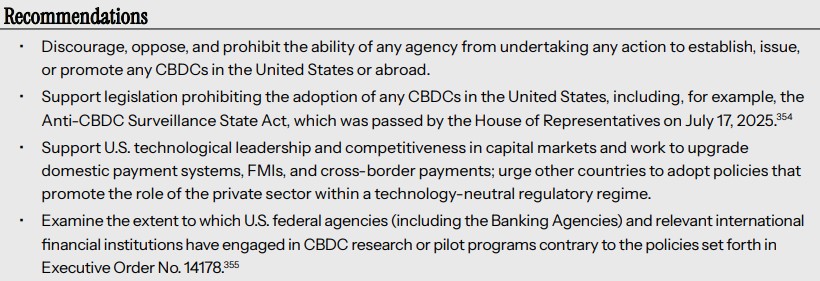

This is where crypto goes into the heart of a larger geopolitical power battle. China has actually been working to turbo charge the internationalization of its fiat currency, the renminbi, through its reserve bank digital currency (CBDC). On the other hand, United States President Donald Trump signed an executive order in January prohibiting any United States government-issued CBDC.

Kim supports the position, arguing that CBDCs position a direct hazard to personal privacy. Rather, he indicated the GENIUS Function as using a practical, market-driven option.

” With GENIUS, you can see a great deal of development and advancement[in private stablecoins] I believe the main focus needs to be on these kinds of stablecoins,” he included.

On The Other Hand, Hong Kong’s stablecoin program is anticipated to play a tactical function in China’s CBDC aspirations. Chinese academics argue that Hong Kong’s stablecoin network might enable Beijing’s digital currency to incorporate into the international stablecoin environment.

United States SEC’s “Job Crypto” and CFTC’s “crypto sprint”

Soon after the White Home’s crypto report was released, the SEC revealed “Job Crypto,” an effort focused on establishing official assistance for digital possession companies and drawing in crypto business back to the United States as a reaction to the White Home report.

The SEC proposed to improve licensing by permitting brokerages to run throughout numerous possession classes with a combined license. It likewise intends to develop a clearer department in between securities and products.

” It needs to not be a scarlet letter to be considered a security,” Atkins stated. “Numerous providers will choose the versatility in item style that the securities laws manage, and financiers will take advantage of the chance to make circulations, voting rights, and other functions common of securities.”

Related: The lessons discovered at Operation Chokepoint 2.0 Congressional hearings

The CFTC, on the other hand, is placing itself to play a more main function in controling non-security digital properties. Performing CFTC Chair Caroline Pham stated on Aug. 1 that the CFTC will start a “crypto sprint” to carry out the Presidential Working Group’s crypto suggestions.

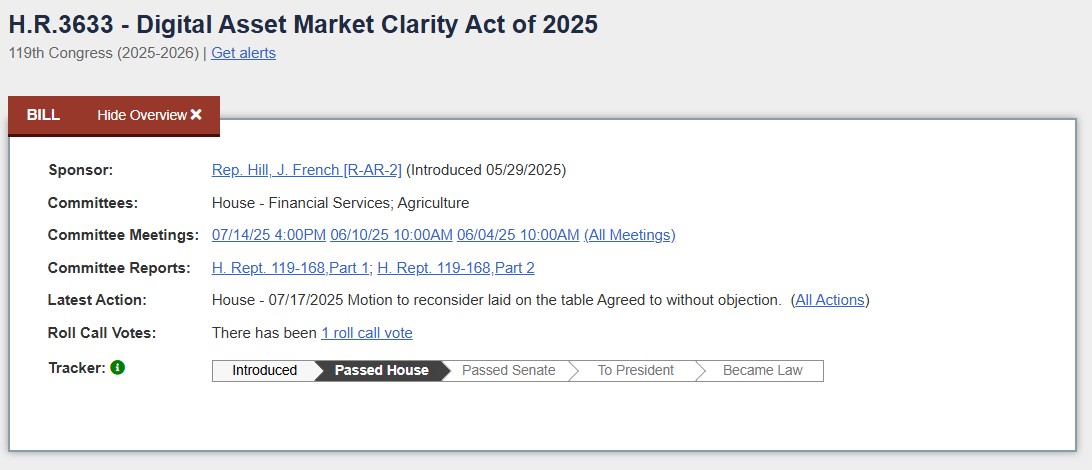

That department of labor– with the CFTC controling area markets for digital products and the SEC concentrating on tokenized securities– is at the heart of the clearness Act, which Kim referred to as important to ending the jurisdictional tug-of-war in between the 2 firms. While the expense has actually passed in your house, it still waits for motion in the Senate.

” You’ll see increased cooperation in between the 2 firms. That’s a style lots of people neglect in this report. It was likewise consisted of in the president’s executive order back in January, which directed the firms to collaborate on supplying clearness, assistance and rulemaking,” Kim stated.

United States crypto clearness is not deregulation, CCI states

Bitcoin (BTC) supporters voiced how the White Home’s crypto report fizzled, as it did not have an expected upgrade to the Bitcoin reserve.

The issue echoes outside the crypto market also. A union of over 80 companies representing civil liberties and customer groups opposed the clearness Act, declaring it “decontrols” the crypto market by legitimizing dangers.

More just recently, Senator Elizabeth Warren, signed up with by Senators Chris Van Hollen and Ron Wyden, has actually advised the Workplace of the Comptroller of the Currency to resolve prospective disputes of interest originating from the Trump household’s cryptocurrency endeavors.

However Kim disagrees with that framing. To him, the White Home report and current regulative advancements including the GENIUS and clearness acts represent a shift in regulative viewpoint, not deregulation.

” I do not believe this is deregulation,” he stated. “I believe this is stating, ‘Hey, we acknowledge the distinct characteristics of digital properties. We wish to deal with the market to make certain that we finest battle illegal financing, safeguard customers and financiers and offer the market clear guidelines of the roadway.'”

With 2 of the country’s leading financing guard dogs now mostly lined up with the White Home, the United States appears all set to move previous infighting and obscurity.

Publication: Ethereum’s roadmap to 10,000 TPS utilizing ZK tech: Dummies’ guide