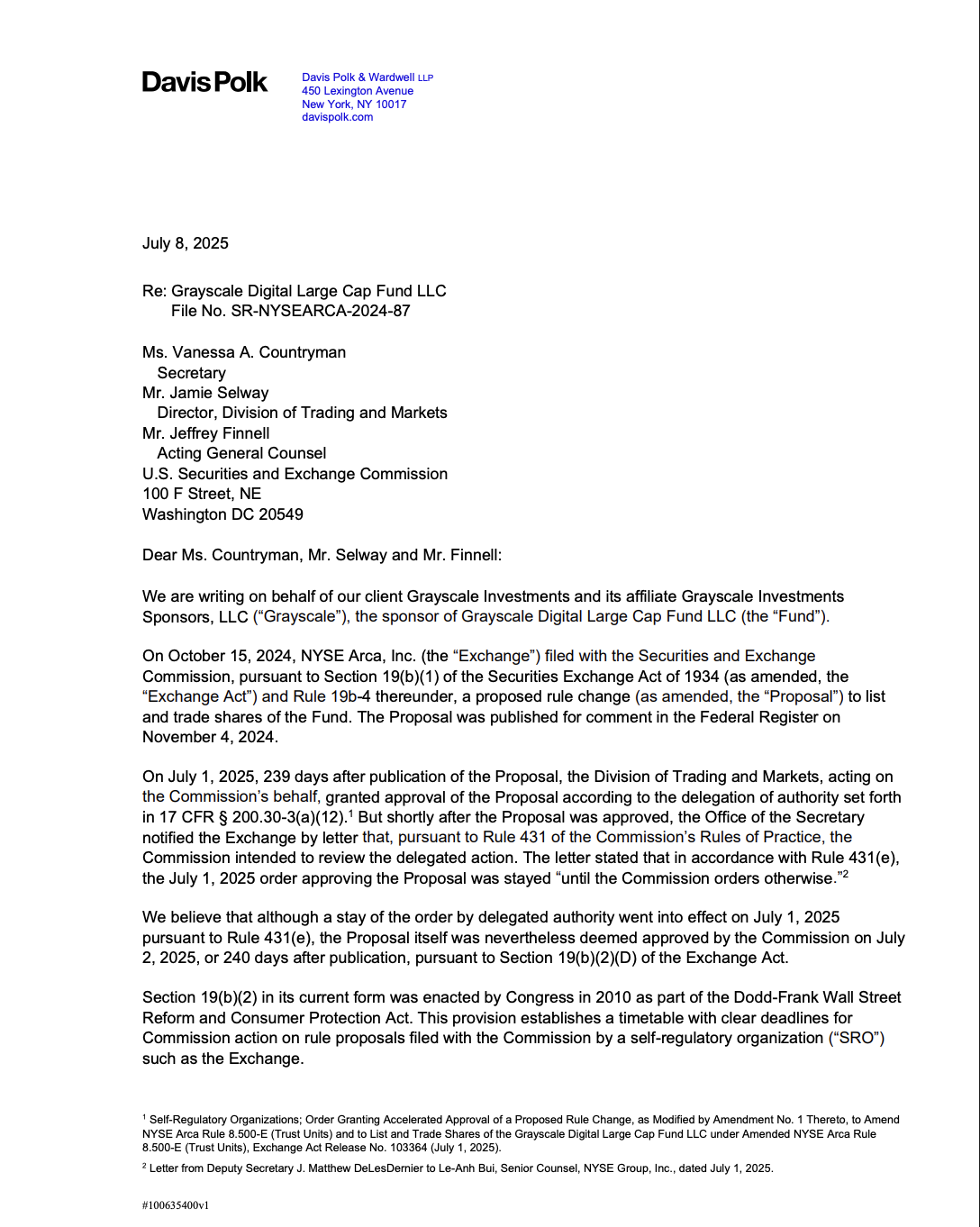

Lawyers for digital property supervisor Grayscale pressed back versus the United States Securities and Exchange Commission’s (SEC) hold-up on authorizing its Digital Big Cap exchange-traded fund (ETF) in a letter sent out on Tuesday.

The SEC’s Department of Trading and Markets at first authorized the ETF proposition, however the SEC’s Workplace of the Secretary chose to examine the action right away later, stopping the choice, Grayscale’s lawyers stated.

This breaches the “statutory approval or displeasure due date” set by the SEC and disputes with recognized treatment, according to the lawyers. The letter checked out:

” The effects of a failure to satisfy the statutory approval or displeasure due date, despite the factor, are clear: under Area 19( b)( 2 )( D), the guideline proposition is considered authorized. Grayscale, the Exchange, and the Fund’s existing financiers are suffering damage as an outcome of the hold-up in the general public launch of the Fund.”

Grayscale’s conversions of its crypto-based trusts, which were a few of the earliest crypto financial investment lorries, into ETFs indicate the maturation of the crypto market from a specific niche market into a traditional property class readily available to conventional monetary financiers.

Related: Bitcoin financiers have actually now sprinkled over $50B on United States area ETFs

SEC thinks about streamlining ETF approval procedure

Stock market, fund supervisors and the SEC are checking out streamlining the ETF approval procedure for choose crypto financial investment lorries.

The expedited procedure would automate parts of the existing application treatments, permitting particular ETF providers to prevent 19b-4 filings totally, reporter Eleanor Terrett stated in a post on X.

SEC Chair Paul Atkins just recently declared the firm’s dedication to regulative reform and ending policy through enforcement to motivate development in the United States.

” My entire objective is to make things transparent from the regulative element and offer individuals a company structure upon which to innovate and bring out brand-new items,” Atkins informed CNBC in July.

Streamlining the listing procedure might open the floodgates and launch a gush of brand-new digital property financial investment lorries, consisting of altcoin ETFs, tokenized funds, and tokenized stocks, offering conventional market financiers access to crypto.

The increased direct exposure might likewise bring fresh capital injections into the crypto markets, driving property costs up.

Publication: SEC’s U-turn on crypto leaves essential concerns unanswered