Semler Scientific has actually purchased roughly $10 million worth of Bitcoin considering that Feb. 14, the health care innovation business stated in an April 25 declaration.

The business acquired 111 Bitcoin (BTC) for $10 million at a typical rate of approximately $90,000 per coin, Semler stated. It holds an overall of more than 3,300 Bitcoin worth roughly $300 million in aggregate.

Semler stated its Bitcoin purchases have actually made investors a Bitcoin yield of 23.5% in the year to date. Bitcoin yield determines the ratio of BTC holdings to impressive shares, showing growing direct exposure per share for financiers.

” Semler Scientific utilizes BTC Yield as a [key performance indicator] to assist evaluate the efficiency of its method of getting bitcoin in a way Semler Scientific thinks is accretive to investors,” it stated.

The business stated it got its Bitcoin treasury for a typical rate of almost $89,000. Since April 25, Bitcoin trades at roughly $95,000 per coin, according to information from Cointelegraph.

Semler Scientific is a health care innovation business that establishes and offers medical diagnostic items, with a main concentrate on finding persistent illness. The business has actually partly funded its Bitcoin purchases by releasing approximately $125 million in brand-new stock, it stated. Semler likewise revealed strategies to raise $75 million through the personal offering of convertible senior notes in January.

Related: Bitcoin, revealing ‘indications of strength’, beats stocks, gold as equities fold– Binance

Business Bitcoin purchasing

In 2024, Bitcoin’s surging rate pressed Michael Saylor’s Method (previously MicroStrategy) up more than 350%, according to information from FinanceCharts. Method’s success has actually influenced lots of other business, such as Semler, to begin collecting Bitcoin treasuries.

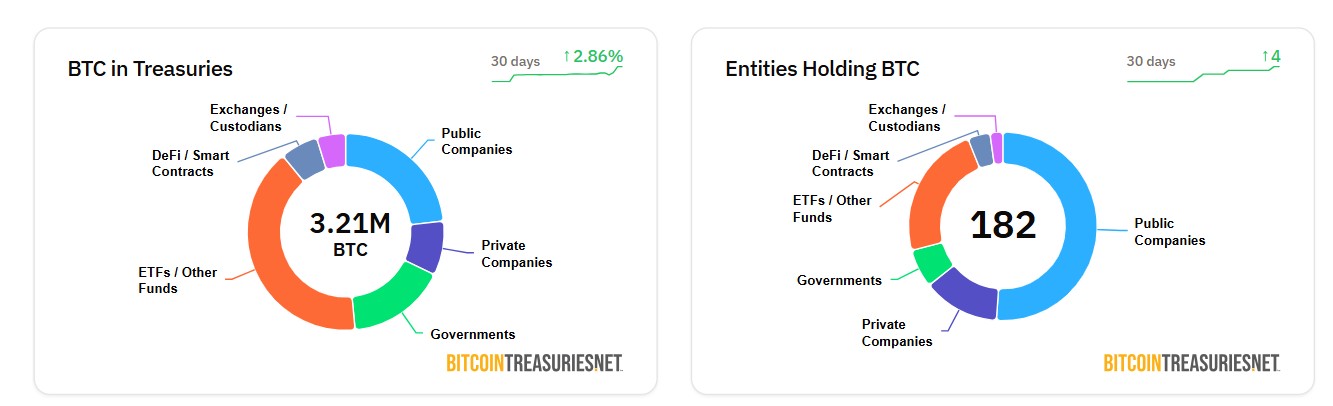

Public business are now amongst the biggest institutional Bitcoin holders. Since April 25, business Bitcoin holdings deserve roughly $71 billion in the aggregate, according to information from BitcoinTreasuries.NET.

Method is still the biggest business Bitcoin holder, with a treasury worth more than $50 billion. Throughout the week of April 14, Method bagged 6,556 Bitcoin for a typical rate of $84,785 per coin.

Amongst institutional purchasers, business treasuries still lag exchange-traded funds (ETFs), which cumulatively hold roughly $110 billion in Bitcoin since April 25, according to Coinglass information.

Publication: Pokémon on Sui reports, Polymarket bets on Filipino Pope: Asia Express