Solana-based business treasuries have actually risen past $4 billion as business continue to build up the cryptocurrency, according to brand-new information.

Information from the reserve tracker, Strategic Solana Reserve, revealed on Tuesday that Solana treasuries struck 17.11 million tokens, worth $4.03 billion at present costs. The reserves represent almost 3% of Solana’s (SOL) distributing supply of more than 600 million tokens.

The biggest individual is Forward Industries, which holds more than 6.8 million SOL, worth $1.61 billion. Other companies such as Sharps Innovation, DeFi Advancement Corp. and Upexi each hold approximately 2 million SOL, with private allowances surpassing $400 million.

Organizations continue SOL build-up

Forward Industries revealed the development of its Solana reserve last Monday, stating that crypto native business like Galaxy Digital, Multicoin Capital and Dive Crypto will money its efforts to form the reserve.

The statement was followed by a SOL purchasing spree, with Galaxy scooping up as much as $306 million in Solana tokens in one day.

In addition to Forward Industries, Helius Medical Technologies introduced a $500-million Solana treasury reserve on Monday. Its efforts were led by crypto equity capital and hedge fund Pantera Capital, along with fund supervisor Summer season Capital.

In a Monday CNBC interview, Pantera Capital CEO Dan Morehead called Solana the “fastest, least expensive, most-performing” blockchain network. At the very same time, he likewise exposed that their business has a $1.1 billion position on the Solana token.

Related: Pump.fun day-to-day volume crosses $1B as memecoins rise in September

Bitcoin and Ether reserves

While Solana reserves are beginning to get traction, it has a long method to precede reaching crypto reserves based upon Bitcoin (BTC) and Ether (ETH).

The BitcoinTreasuries.NET site information reveals that there are 3.71 million BTC in treasuries. At the time of composing, the quantity deserves about $428 billion and has to do with 17% of the whole Bitcoin supply of 21 million.

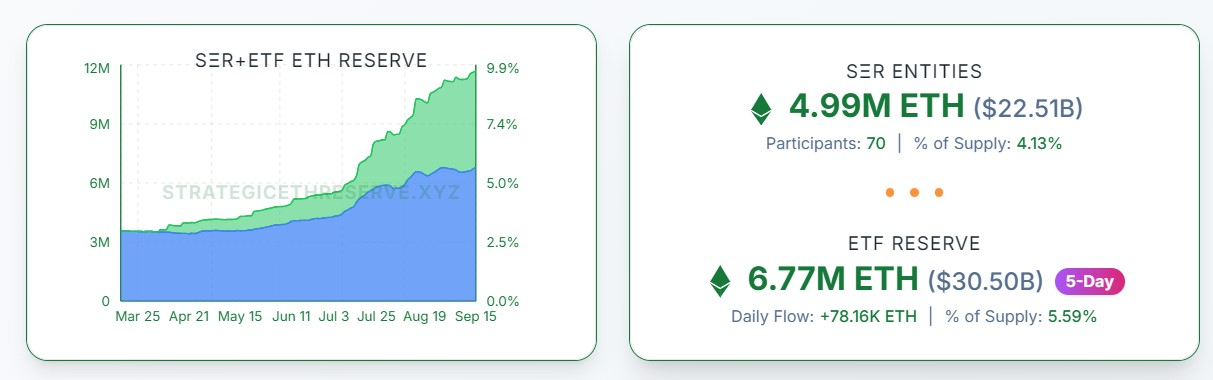

On the other hand, Ether-based reserves are likewise considerably bigger. Information from the Strategic ETH Reserve website reveals that business entities hold almost 5 million ETH, worth over $22 billion.

The information likewise revealed that the ETH kept in ETFs has to do with 6.77 million, which deserves over $30 billion.

Publication: Fulfill the Ethereum and Polkadot co-founder who wasn’t in Time Publication