The United States stock exchange’s V-shaped healing considering that April has actually driven the S&P 500 Index to tape highs– yet determined in Bitcoin, the standard is still down considerably this year, highlighting the digital possession’s strong outperformance.

On Thursday, the S&P 500 Index closed at a record high of 6,280.46, extending its year-to-date gain to 7%. Nevertheless, when determined in Bitcoin (BTC), the large-cap index is down 15% up until now in 2025, according to market analyst The Kobeissi Letter.

Pointing out information from Bitbo, The Kobeissi Letter likewise explained that the S&P 500 has actually dropped an incredible 99.98% versus Bitcoin considering that 2012.

Bitcoin’s rate rose to a brand-new all-time high up on Friday, briefly topping $118,800 on Coinbase, according to Cointelegraph Markets Pro. BTC has actually acquired 5.5% in the previous 24 hr, 9% over the recently and is up 24% up until now this year.

Although Bitcoin has actually drastically outshined the benchmark stock index considering that its beginning, its efficiency versus significant tech stocks like Nvidia (NVDA), Tesla (TSLA) and Netflix (NFLX) has actually been similarly impressive.

Expert Charlie Bilello highlighted Bitcoin’s meteoric increase over the previous years compared to these and other possessions, highlighting BTC’s standout outperformance.

Related: Bitcoin rate anticipated to speed up if day-to-day close above $113K is protected

From stocks to Bitcoin: ETF financiers stack into BTC in 2025

Bitcoin’s record rally this year has actually been sustained in part by growing institutional need, with financiers putting cash into BTC area exchange-traded funds (ETFs) along with standard equity funds.

Since Friday, the 12 United States area Bitcoin ETFs held a combined 1,264,976 BTC worth $148.6 billion, according to Bitbo information, representing over 6% of Bitcoin’s overall supply.

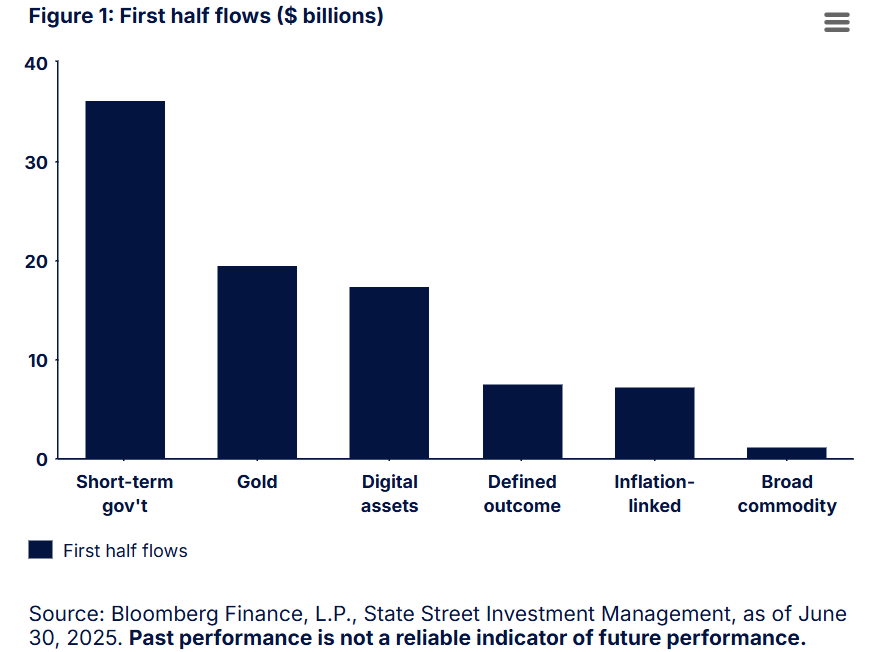

In the very first half of 2025, strong need for Bitcoin assisted press digital possession ETFs to the third-largest fund classification by inflows, behind just short-term federal government financial obligation and gold, according to State Street information.

On Thursday, United States area Bitcoin ETFs saw their second-largest day-to-day inflow on record, generating an overall of $1.17 billion.

Related: Ego Death Capital raises $100M to fund Bitcoin-focused start-ups