Area Bitcoin exchange-traded funds (ETFs) signed up a net outflow of $131.35 million on Monday, marking completion of a 12-day streak that drew in $6.6 billion of inflows.

The biggest outflow was from ARK Invest’s ARKB, which shed $77.46 million in a single day. Grayscale’s GBTC followed with $36.75 million in outflows, while Fidelity’s FBTC lost $12.75 million, according to information from SoSoValue.

Bitwise’s BITB and VanEck’s HODL likewise published moderate outflows of $1.91 million and $2.48 million, respectively. BlackRock’s IBIT, the biggest fund by net possessions ($ 86.16 billion), saw no inflows or outflows.

On the other hand, cumulative net inflows stay robust at $54.62 billion and overall net possessions throughout all area Bitcoin (BTC) ETFs stand at $151.60 billion, representing 6.52% of Bitcoin’s overall market capitalization.

Related: Area Bitcoin ETFs get $363M, extend 12-day inflow streak to $6.6 B

Financiers take revenue near all-time highs

The $131 million in outflows came as financiers and organizations secured some gains to handle threat, according to Vincent Liu, primary financial investment officer at Kronos Research study.

” The current ETF outflows show profit-taking near the highs and determined institutional rebalancing to secure gains,” Liu informed Cointelegraph.

He stated the outflows were a regular correction following a considerable cost run, not an indication of worry amongst big holders. “It’s not panic however placing– a natural time out after a strong upward run,” Liu kept in mind.

The abrupt outflow follows a duration of record-setting inflows previously in July, with July 10 and 11 generating $1.18 billion and $1.03 billion, respectively, the very first time in history 2 successive days saw billion-dollar inflows into Bitcoin ETFs.

Related: Bitcoin ETF inflows reveal organizations ‘doubled down’ on BTC at $116K

Ether ETFs extend winning streak

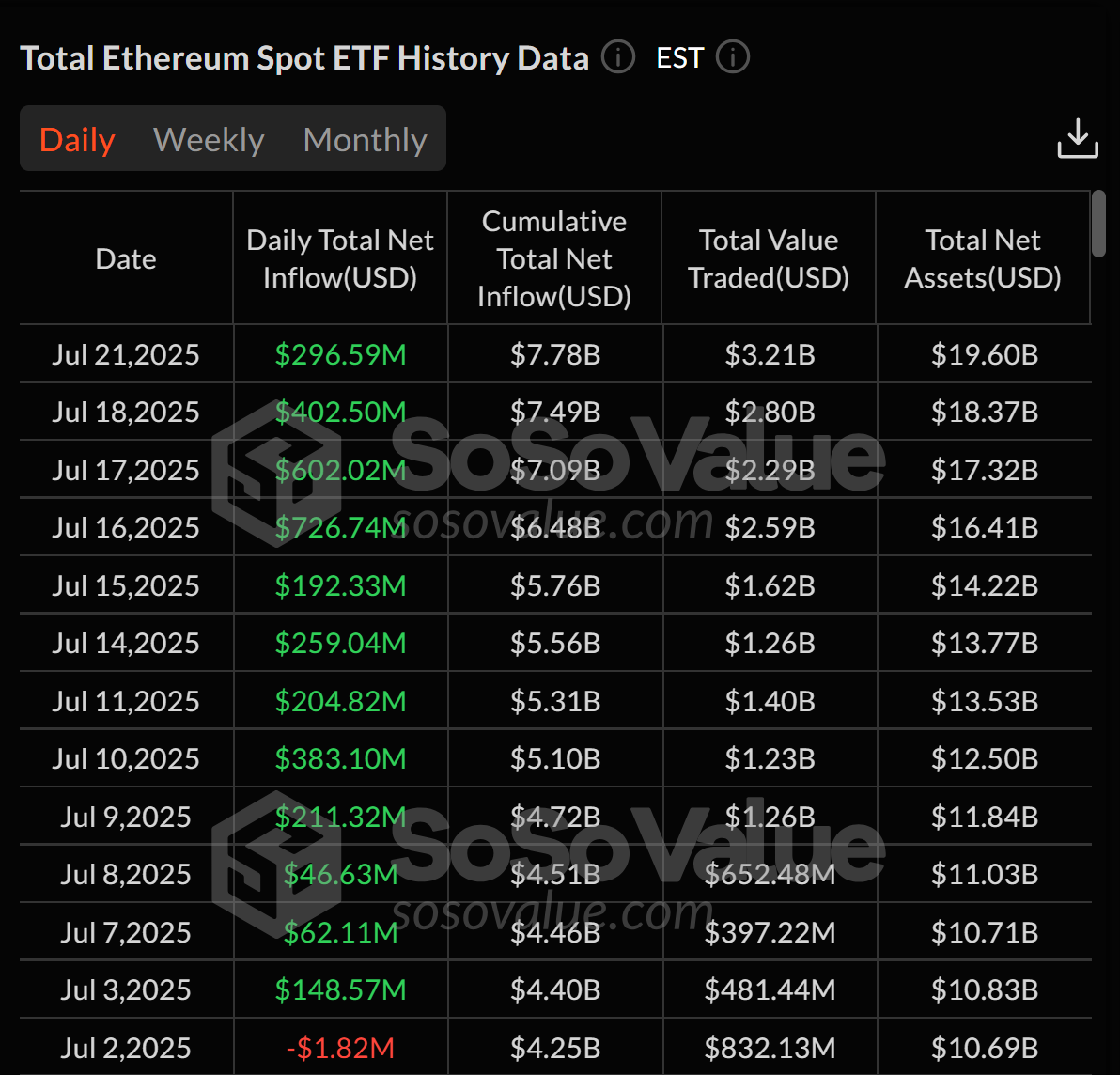

Area Ether (ETH) ETFs extended their excellent inflow streak, notching another $296.59 million in net inflows on Monday. This pressed the cumulative overall net inflow to $7.78 billion, as financier interest continues to increase.

The existing streak, now in its 12th successive day, consists of record-breaking activity on Wednesday, when Ethereum ETFs signed up a $726.74 million day-to-day inflow, the biggest because their launching. Thursday followed with $602.02 million in the middle of a growing cravings for Ether items.

Publication: Will Robinhood’s tokenized stocks truly take control of the world? Benefits and drawbacks