Update (Feb. 11, 10:00 am UTC): This short article has actually been upgraded to fix the reported variety of shares.

United States area Bitcoin exchange-traded funds (ETFs) extended their inflow streak to 3 sessions, with this week’s gains almost balancing out recently’s outflows.

Area Bitcoin (BTC) ETFs taped $166.6 million in inflows on Tuesday, bringing overall inflows today to $311.6 million, according to information from SoSoValue.

Recently, the funds saw net outflows of $318 million, marking 3 successive weeks of losses amounting to more than $3 billion.

Bitcoin ETF momentum has actually gotten in current sessions, in spite of BTC rate decreasing 13% over the previous 7 days and briefly slipping listed below $68,000 on Tuesday, according to CoinGecko.

Previously today, experts observed indications of a possible pattern shift throughout crypto exchange-traded items, keeping in mind a downturn in the rate of selling.

Goldman trims Bitcoin ETF direct exposure, includes XRP and Solana ETFs

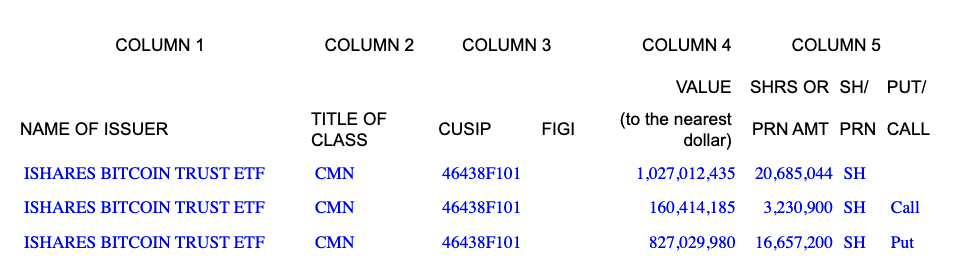

United States financial investment bank Goldman Sachs reported the other day that it cut its Bitcoin ETF direct exposure in the 4th quarter of 2025, according to a Kind 13F filing with the Securities and Exchange Commission.

The bank particularly minimized holdings in BlackRock’s iShares Bitcoin Trust ETF (IBIT), cutting shares exceptional by 39%, from around 34 million in Q3 to 20.7 million in Q4, worth around $1 billion.

It likewise reduced stakes in other Bitcoin funds and business, consisting of Fidelity Wise Origin Bitcoin (FBTC) and Bitcoin Depot, and minimized its Ether (ETH) ETF positions.

At the very same time, Goldman Sachs divulged its first-ever positions in XRP (XRP) and Solana (SOL) ETFs, obtaining 6.95 million shares of XRP ETFs, worth $152 million, and 8.24 million shares of Solana ETFs, valued at $104 million.

Related: Bernstein calls Bitcoin sell-off ‘weakest bear case’ on record, keeps $150K 2026 target

According to SoSoValue information, area altcoin ETFs saw modest inflows Tuesday, with Ether funds including around $14 million, while XRP and Solana ETFs acquired $3.3 million and $8.4 million, respectively.

On Thursday, Eric Balchunas, senior ETF expert at Bloomberg, kept in mind that most of Bitcoin ETF financiers had actually held their positions in spite of the current slump, approximating that just about 6% of overall possessions left the funds even as Bitcoin costs fell greatly.

He included that, although BlackRock’s IBIT saw its possessions drop to $60 billion from a peak of $100 billion, the fund might stay at this level for several years while still holding the record as the “all-time-fastest ETF to reach $60 billion.”

Publication: Bitcoin trouble plunges, Buterin sells Ethereum: Hodler’s Digest, Feb. 1– 7