Secret takeaways:

-

Area Bitcoin and Ethereum exchange-traded funds (ETFs) taped a combined $1.7 billion in weekly outflows.

-

Solana and a choose couple of altcoins continued to bring in stable inflows in spite of market weak point.

-

Onchain information reveals that big whales are building up BTC, which has actually kept BTC rates above the $100,000 level.

Area Bitcoin (BTC) and Ether (ETH) exchange-traded funds (ETFs) dealt with another week of heavy redemptions, extending a pattern of financier care. From Nov. 3 to Nov. 7, area Bitcoin ETFs saw $1.22 billion in net outflows, the third-largest weekly overall on record, while area Ether ETFs published $508 million in outflows, for a combined $1.72 billion.

According to CryptoQuant CEO Ki Young Ju, BlackRock’s IBIT alone represented $570 countless the Bitcoin outflows, its biggest in 9 months, as financiers rearranged amidst year-end profit-taking and tax factors to consider.

On the other hand, area Solana ETFs drew in $137 million in inflows throughout the very same duration, led by Bitwise’s BSOL ETF with $127 million, highlighting a selective shift towards high-performing altcoin direct exposure.

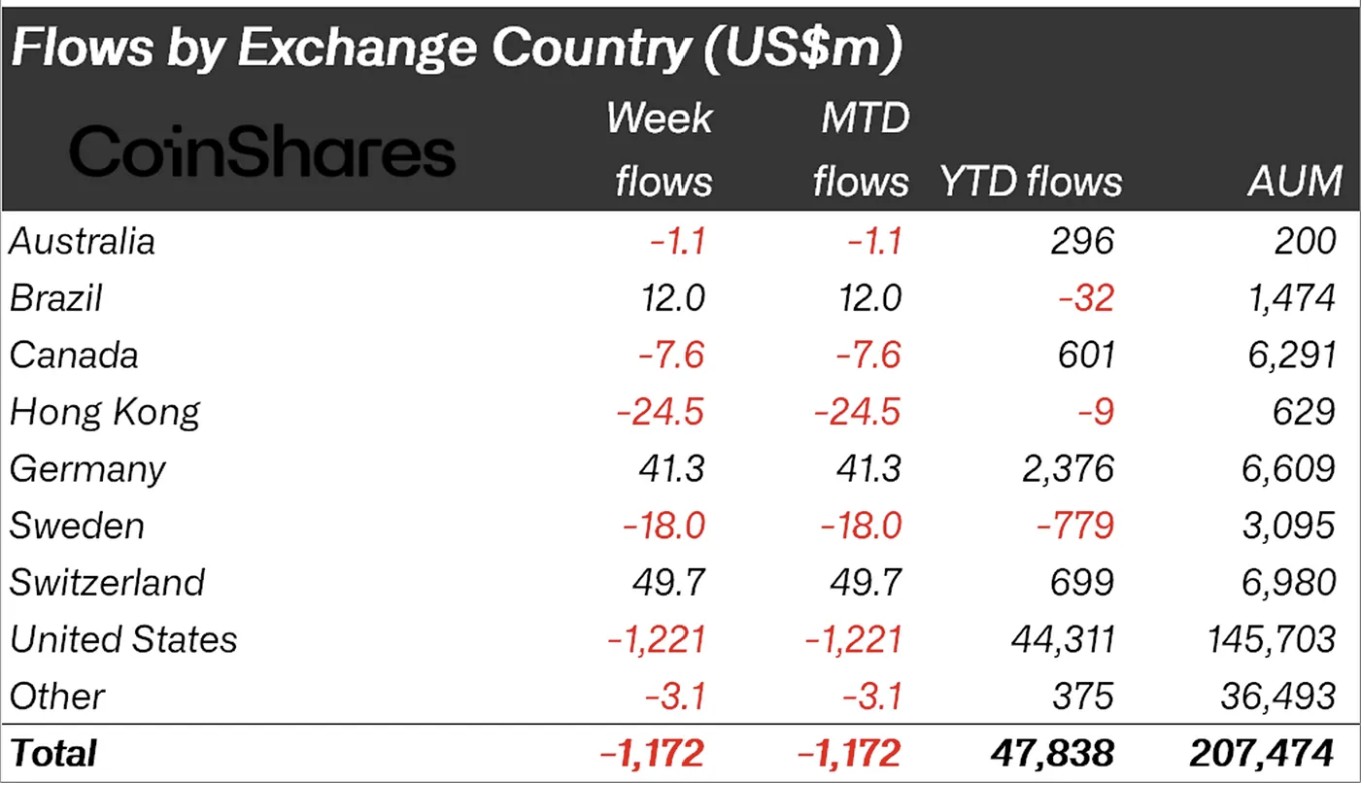

More comprehensive fund information from CoinShares Research study showed comparable patterns. Digital property financial investment items saw a 2nd successive week of outflows amounting to $1.17 billion, controlled by Bitcoin ($ 932 million) and Ether ($ 438 million).

The United States led redemptions with $1.22 billion, while Germany ($ 41.3 million) and Switzerland ($ 49.7 million) continued to tape inflows, highlighting the local divergence in between United States and Euro-zone belief.

Similarly, altcoins supplied a counterweight to the unfavorable tone. Solana (SOL) taped $118 million in inflows recently, extending its nine-week streak to $2.1 billion, while HBAR ($ 26.8 million) and Hyperliquid ($ 4.2 million) likewise saw restored financier interest.

Related: Bitcoin rate eyes $112K liquidity grab as United States federal government shutdown nears end

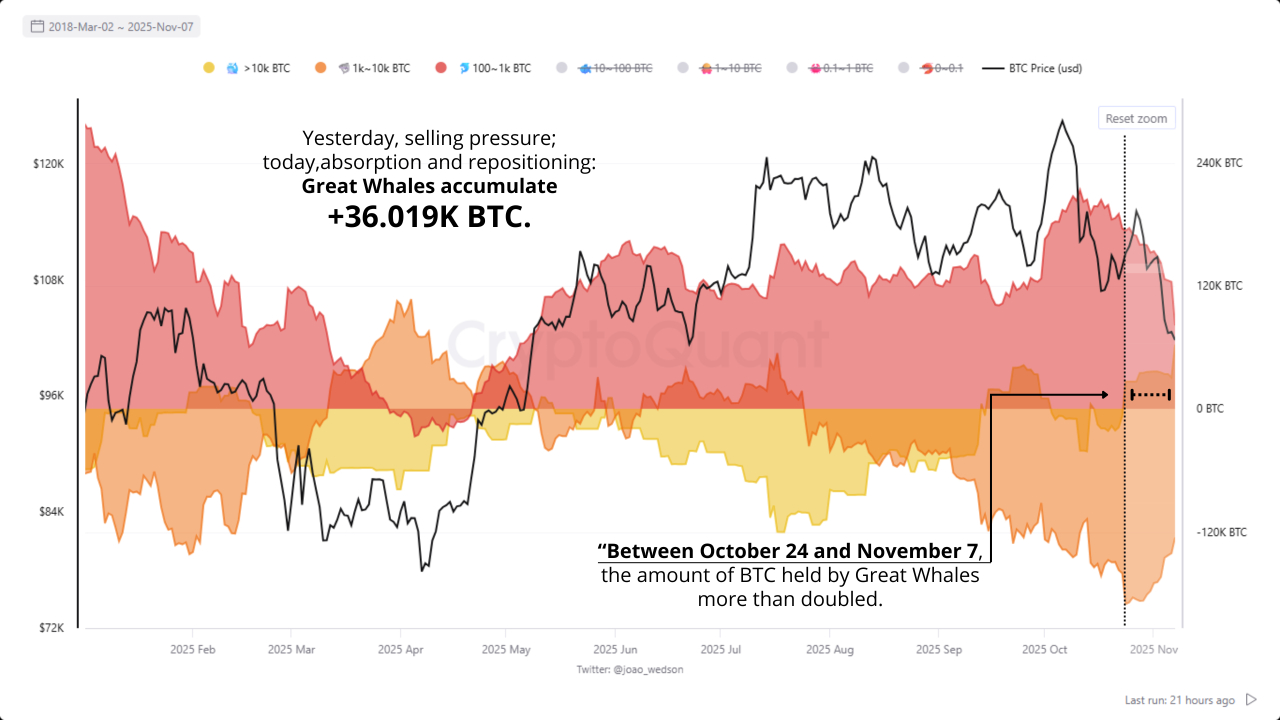

” Terrific Whales” build up 36,000 BTC

According to Promote’s head of research study, Dr. Martin Hiesboeck, some long-lasting Bitcoin holders are liquidating positions to rebuy through ETFs for tax benefits and higher versatility, while others are reallocating into wider blockchain tasks.

Onchain information from CryptoQuant strengthened this behavioral shift, exposing a significant redistribution of Bitcoin holdings in between Oct. 24 and Nov. 7, 2025. Throughout this duration, mid-sized financiers (” Dolphins,” holding 100– 1,000 BTC) greatly lowered their build-up from 173,982.8 BTC to 81,453.5 BTC, while “Great Whales” (holding over 10,000 BTC) more than doubled their holdings, leading to a net boost of over 36,000 BTC.

This stable build-up by high-capital entities has actually assisted anchor Bitcoin above the $100,000 level. The information signified a steady transfer of supply to more powerful holders, maintaining a structurally bullish long-lasting structure for Bitcoin in spite of the underlying ETF-driven turbulence.

Related: End to United States gov’ t shutdown triggers institutional purchasing, ETF ‘floodgate’ hopes

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.