Area Ether exchange-traded funds (ETFs) continued their bullish momentum on Tuesday, tape-recording a net inflow of $533.87 million and extending their streak to 13 successive trading days of inflows, according to information from SoSoValue.

BlackRock’s iShares Ethereum Trust (ETHA) led the rise with $426.22 million in everyday net inflow. The fund now holds over $10 billion in properties, commanding the biggest share of the Ether (ETH) ETF market. Fidelity’s FETH followed with $35 million in inflows.

Area Ether ETF inflows have actually been driven by falling BTC supremacy and growing institutional cravings for ETH direct exposure. As liquidity deepens and macro conditions hold, this need pattern is most likely to sustain,” Vincent Liu, primary financial investment officer at Kronos Research study, informed Cointelegraph.

The cumulative internet inflow throughout all Ether ETFs has actually now exceeded $8.32 billion, up from $4.25 billion at the start of the streak on July 2. The overall net properties secured these items have actually reached $19.85 billion, representing 4.44% of Ethereum’s market cap.

Related: The increase of ETFs difficulties Bitcoin’s self-custody roots

Area Ether ETFs draw in $4 billion over 13-day inflow streak

The overall net inflows throughout the 13-day streak starting July 3 total up to over $4 billion. The streak likewise consists of record-breaking activity on July 16, when Ethereum ETFs signed up a $726.74 million everyday inflow, the biggest given that their launching. Thursday followed with $602.02 million, the second-largest yet.

” ETP Investors stay considerably underweight Ethereum vs. Bitcoin: Although ETH’s market cap has to do with 19% the size of BTC, Ethereum ETPs have actually generated less than 12% of the properties of Bitcoin ETPs,” Matt Hougan, primary financial investment officer at Bitwise, composed in a Tuesday post on X.

He stated the pattern of business holding ETH on their balance sheets is most likely to speed up. He approximated that in between exchange-traded items (ETPs) and these business, need might reach $20 billion worth of ETH over the next year, or about 5.33 million ETH at present rates.

In contrast, Ethereum’s network is anticipated to release just 0.8 million ETH because time, recommending need might exceed supply nearly 7 times.

” In the short-term, the rate of whatever is set by supply and need. And for the time being, there is considerably more need for ETH than there is brand-new supply. I presume we go higher,” he stated.

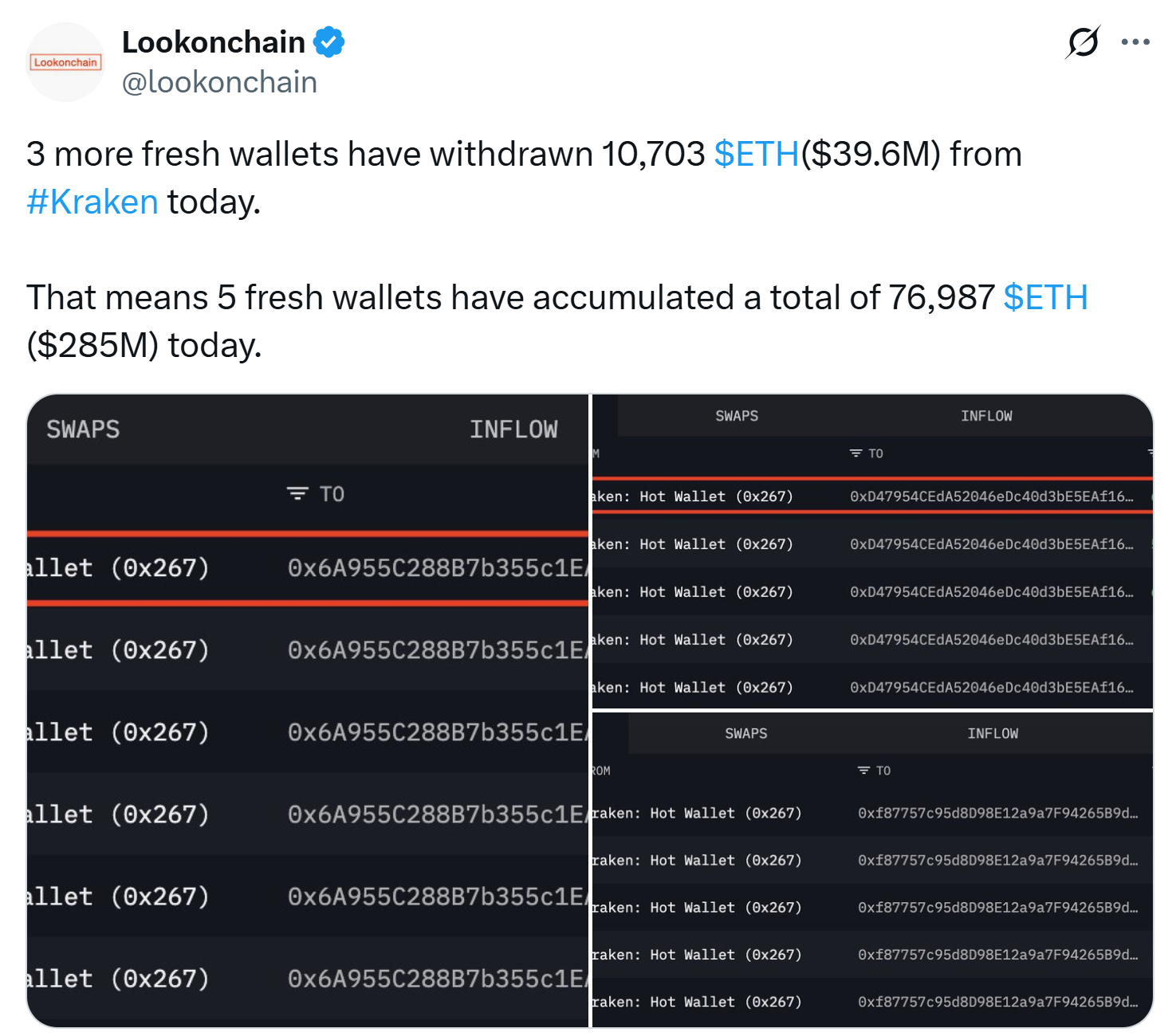

In a Wednesday post on X, Lookonchain exposed that 5 fresh wallets have actually withdrawn a combined 76,987 ETH ($ 285 million) from Kraken on Wednesday, recommending a pattern of build-up and diminishing exchange supply.

Related: Solana SSK ETF breaks $100M as Wall Street warms to crypto staking

Area Bitcoin ETFs publish $67 million in outflows

On the other hand, area Bitcoin (BTC) ETFs published a net outflow of $67.93 million on Tuesday. The biggest withdrawals originated from Bitwise’s BITB and Ark’s ARKB, which saw everyday internet outflows of $42.27 million and $33.18 million, respectively. Grayscale’s GBTC was the only item in the green, tape-recording a modest inflow of $7.51 million.

The pullback followed a wave of institutional purchasing previously in July, consisting of standout inflows of $1.18 billion on July 10 and $1.03 billion on July 11.

Publication: Bitcoin ETFs make Coinbase a ‘honeypot’ for hackers and federal governments– Trezor CEO