Update (May 12, 1:25 pm UTC): This post has actually been upgraded to show that Technique raised its 2025 Bitcoin yield target from 15% to 25% in early May.

Michael Saylor’s Technique bought a fresh batch of Bitcoin as the cryptocurrency pressed above $100,000 recently.

Technique obtained 13,390 Bitcoin (BTC) for $1.34 billion in between Might 5 and Might 11, the company revealed in its filing with the United States Securities and Exchange Commission released on Might 12.

The acquisition has actually increased Technique’s overall Bitcoin holdings by 2.4% to an overall of 568,840 BTC, gotten for about $39.4 billion at a typical cost of $69,287 per coin.

The recently revealed purchases were made at a typical cost of $99,856 per BTC, with Bitcoin recovering the mental mark of $100,000 on Might 8.

Technique attains its previous Bitcoin yield target

Following the acquisition, Technique fulfilled its previous 2025 Bitcoin yield target, co-founder Michael Saylor stated in a Might 12 post on X.

The purchase brought Technique’s BTC yield– a sign representing the portion modification of the ratio in between its BTC holdings and presumed diluted shares– to 15.5%, Saylor stated in a declaration on X.

As formerly discussed, Technique was formerly looking for to keep the Bitcoin yield target at 15% for the whole 2025 after publishing a 74% BTC yield in 2015. The company has actually raised the yield target to 25% in Might 2025.

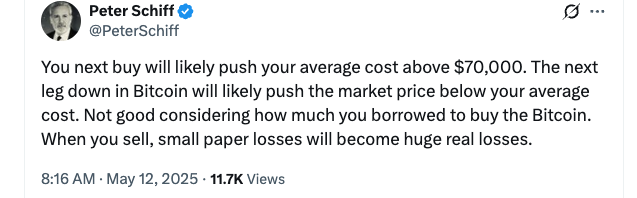

Peter Schiff voices a dismal forecast

In Spite Of Technique breaking through its 15% Bitcoin yield target, some critics have actually stayed doubtful of the business’s aggressive BTC purchasing program.

Significant Bitcoin critic Peter Schiff leapt in on Saylor’s purchase statement on X, anticipating some unfavorable situations possibly occurring from the constant development of the typical BTC expense in Technique’s purchases.

Related: Metaplanet now holds more Bitcoin than El Salvador

” You [your] next buy will likely press your typical expense above $70,000,” Schiff stated in action to an X post from Saylor, forecasting that the next drop in the BTC cost will “most likely push the marketplace cost listed below your typical expense.”

” Bad thinking about just how much you obtained to purchase the Bitcoin. When you offer, little paper losses will end up being substantial genuine losses,” Schiff included.

Schiff’s criticism comes simply days after Technique revealed strategies to double its capital raise to $42 billion in equity and $42 billion in fixed-income offerings to buy more Bitcoin, according to a May 1 declaration.

While Schiff is understood for his incorrect Bitcoin forecasts, some significant crypto companies have actually likewise supposedly selected to distance themselves from Technique’s aggressive Bitcoin build-up design.

According to a report by Bloomberg, cryptocurrency exchange Coinbase consistently thought about a Bitcoin financial investment method comparable to Saylor’s Technique, however chose versus it each time.

Publication: Adam Back states Bitcoin cost cycle ’10x larger’ however will still decisively break above $100K