Michael Saylor’s Method, the world’s biggest public holder of Bitcoin, continued intensifying its BTC holdings recently in the middle of rebounding financier belief and increasing rates.

Method obtained 4,980 Bitcoin (BTC) for $531.1 million throughout the week ending Sunday, the business revealed in a United States Securities and Exchange Commission filing on Monday.

Method’s most current Bitcoin purchases balanced $106,801 per coin, with Bitcoin rising from around $101,000 on June 23 to above $108,000 by the end of the week, according to CoinGecko information.

The brand-new acquisition has actually increased Method’s Bitcoin holdings to 597,325 BTC, acquired for about $42.4 billion at a typical cost of $70,982 per coin.

Method’s gain YTD is now 85,871 BTC

With the current purchases, Method’s Bitcoin year-to-date (YTD) gain totaled up to 85,871 BTC, or $9.5 billion, compared to a 140,538 BTC gain for the whole 2024, or $13 billion, according to Method’s information.

Method’s Bitcoin yield was up 0.5% at 19.7%, inching closer to the business’s targeted YTD yield objective of 25% by the end of 2025.

Method’s quarter-to-date BTC yield likewise edged up about 0.4% to 7.8%.

Did Method move $796 million in BTC?

The current Method purchases were anticipated by lots of, as Saylor has actually regularly been hinting about impending purchases each Sunday.

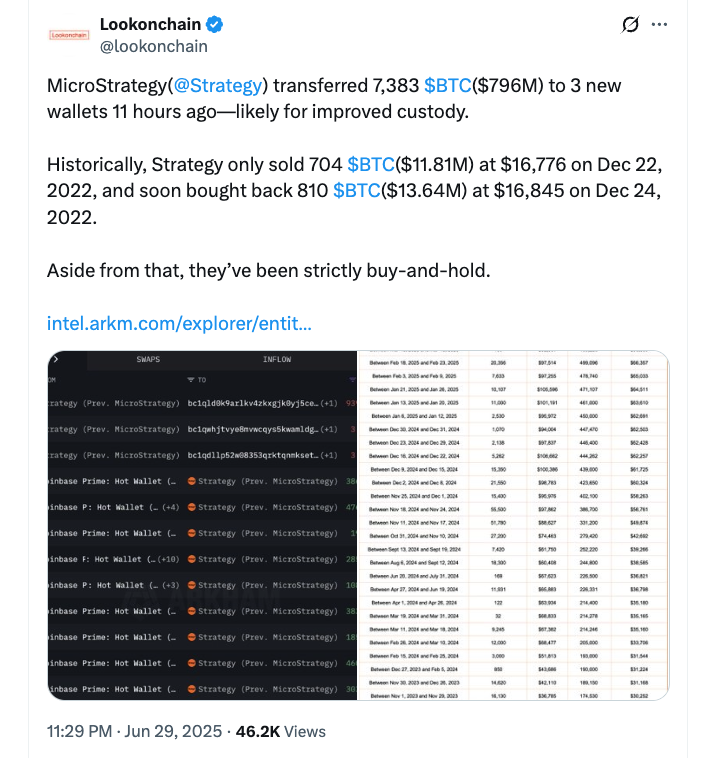

Numerous blockchain experts identified Method likewise moving 7,383 BTC worth around $796 million to 3 brand-new wallets on Sunday. According to the blockchain analytics platform Lookonchain, the deal was “most likely for enhanced custody.”

” Historically, Method just offered 704 BTC ($ 11.81 M) at $16,776 on Dec. 22, 2022, and quickly redeemed 810 $BTC ($ 13.64 M) at $16,845 on Dec. 24, 2022,” Lookonchain composed.

Related: Gemini launches tokenized Michael Saylor’s Method stock for EU financiers

” Aside from that, they have actually been strictly buy-and-hold,” the post included.

Saylor shares how Method wagered whatever on Bitcoin

Prior to publishing Method’s most current purchases on X, Saylor remembered the business’s early days with Bitcoin, reposting his 2020 interview with RealVision creator Raoul Buddy.

In the interview, Saylor shared a story on how he “very first chosen to get irresponsibly long with Bitcoin,” with Method making its very first BTC financial investment in August 2020.

” There’s a great deal of traders in the market. They do not comprehend the frame of mind of long,” Saylor stated in the historical interview, including:

” I’m purchasing it for the man that’s going to work for the man that’s going to get worked with by the guy who takes control of my task in 100 years. I’m not offering it. When it increases by an element of 100, I might be obtaining a little to go purchase something that I desire, however what am I going to purchase with it that’s much better than what I’m purchasing?”

Publication: Why being a Gen Z crypto creator is a ‘true blessing and a curse’