Bitcoin (BTC) treasury business Method has actually broadened the scope its STRC offering two times given that releasing the business security on July 22.

The business revealed an at-the-market offering of approximately $4.2 billion of its Variable Rate Series A Continuous Stretch Preferred Stock (STRC), a hybrid business security, to acquire more BTC on Thursday.

STRC is a dividend-paying security with variable yields that has actually no set maturity date and can be called or redeemed by the business under particular conditions, making the regards to payment versatile, according to Thursday’s statement.

The business introduced STRC in July, pegging each share of the business security to $100, and was at first looking for a $500 million capital raise.

Method broadened the scope of the raise to $2 billion 2 days after introducing STRC to choose financiers through a going public (IPO), and bought over 21,000 BTC with the taking place funds.

Its financial obligation and equity-fueled BTC purchasing continues to divide the crypto and financial investment neighborhood. Some experts have actually argued that Method and other BTC treasury plays are bubbles waiting to burst, which might produce fallout in the crypto markets.

Related: Michael Saylor signs up with chorus for clearness as United States works to lawfully specify crypto

Financier suits versus Method accumulate

Numerous law office have actually submitted lawsuits versus the business on behalf of complainants who declare that the business misrepresented Bitcoin’s volatility threats and predicted earnings.

Cointelegraph consulted with several lawyers, who were divided on the compound of the claims and stated the suits might take years to deal with.

” Complainants are declaring that success was overemphasized which threats were downplayed, not that these things were completely missing from disclosures,” lawyer Brandon Ferrick informed Cointelegraph.

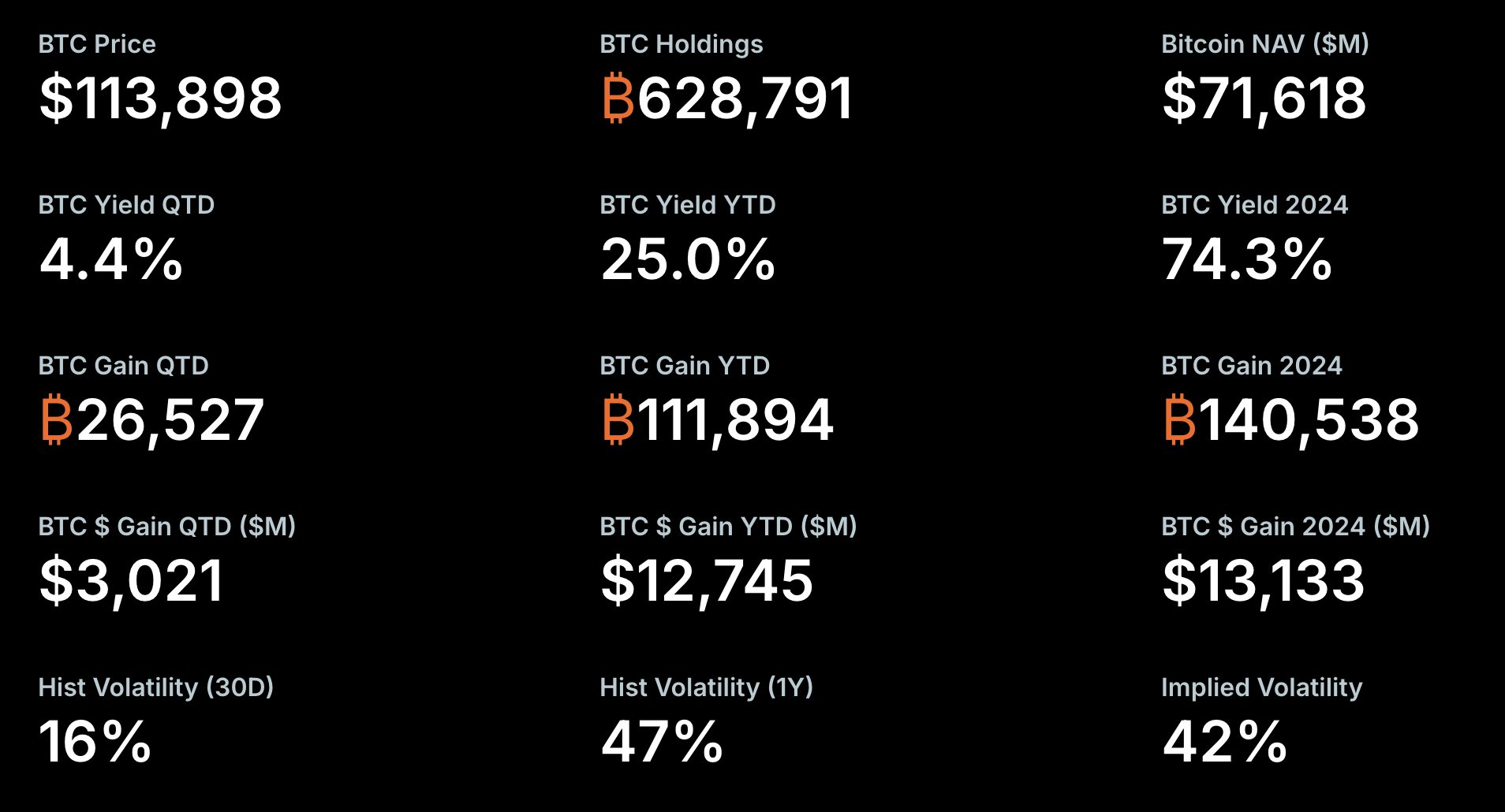

A lot of the suits included comparable claims, particularly that Method’s usage of alternative monetary metrics was misleading, permitting the business to camouflage monetary losses that would appear if various accounting techniques were utilized.

” The business presented a number of brand-new essential efficiency signs (KPIs)– particularly, BTC Yield, BTC Gain, and BTC dollar Gain– to determine its monetary outcomes,” among the class action suits stated.

Method co-founder and Bitcoin supporter Michael Saylor pressed back versus criticisms of the business’s organization design, arguing that Method is a misconstrued business.

” We’re profited from the most ingenious innovation and possession in the history of humanity; on the other hand, we’re perhaps the most misinterpreted and underestimated stock in the United States and possibly the world,” Saylor stated throughout the business’s newest profits call.

Publication: Pakistan will release Bitcoin reserve in DeFi for yield, states Bilal Bin Saqib