Technique co-founder and executive chairman Michael Saylor has actually seen his net worth skyrocket by $1 billion considering that the start of the year, accompanying his launching on the Bloomberg Billionaire 500 Index.

Saylor ranks 491st on the Bloomberg Billionaire Index with a projected net worth of $7.37 billion, up 15.80% considering that Jan. 1. Over the exact same duration, shares of his business Technique (MSTR) have actually gotten almost 12%, based on Google Financing.

According to the Index, which tracks the world’s wealthiest 500 individuals based upon their net worth, roughly $650 countless Saylor’s fortune remains in money, while the staying $6.72 billion is bound in Technique equity.

Saylor signs up with other crypto billionaires on the list

Saylor signs up with other crypto billionaires on Bloomberg’s list, consisting of Coinbase CEO Brian Armstrong, who is ranked 234th with a net worth of $12.8 billion, and Binance creator Changpeng “CZ” Zhao, holding the 40th area with $44.5 billion.

Previous FTX CEO Sam Bankman-Fried was likewise on the list before the crypto exchange collapsed in November 2022.

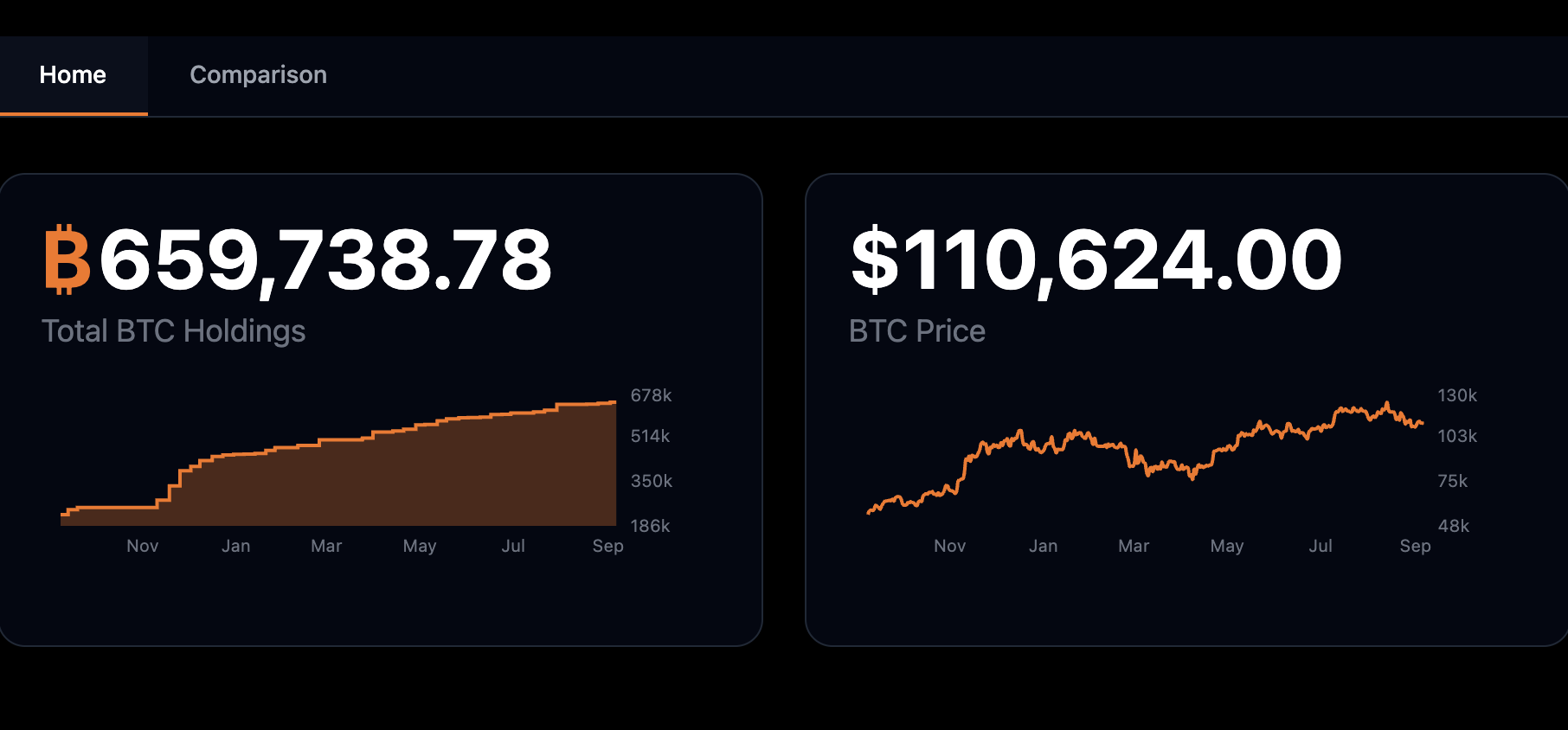

Technique is best understood for its aggressive Bitcoin (BTC) build-up technique. The company presently holds roughly 659,739 BTC, worth $72.9 billion at the time of publication, or about 3.42% of Bitcoin’s flowing supply, according to StrategyTracker.

Nevertheless, Technique insists its substantial Bitcoin purchasing does not sway the marketplace. “The method we purchase Bitcoin is we do stagnate the cost of the Bitcoin,” Technique’s business treasurer and head of financier relations, Shirish Jajodia, just recently stated.

Technique’s stock cost is down over the previous thirty days

On Friday, Technique stock closed the day 2.53% greater, though it stays down 12.4% over the previous thirty days.

Related: Technique includes $449M in Bitcoin, raising August overall to 7.7 K BTC

It comes as Technique was excluded of the S&P 500 in August– a dissatisfaction for some market individuals who had actually anticipated the Bitcoin-accumulation business to make it.

On Friday, Cointelegraph reported that regardless of the business satisfying all the requirements and currently being consisted of in the Nasdaq 100, it might still be rejected addition if the committee entrusted with examining business guidelines versus including it after taking a “holistic” view of the potential prospect.

Publication: Bitcoin might sink ‘listed below $50K’ in bear? Justin Sun’s WLFI legend continues: Hodler’s Digest, Aug. 31– Sept. 6