Tether CEO Paolo Ardoino has actually rejected current reports that the stablecoin provider is unloading its Bitcoin holdings to purchase gold.

In a Sunday post on X, Ardoino stated the business “didn’t offer any Bitcoin,” and declared its method of designating earnings into properties like “Bitcoin, gold, and land.”

The remarks can be found in action to speculation from YouTuber Clive Thompson, who pointed out Tether’s Q1 and Q2 2025 attestation information from BDO to declare the company had actually lowered its Bitcoin (BTC) position. Thompson indicated a drop from 92,650 BTC in Q1 to 83,274 BTC in Q2 as proof of a sell-off.

Nevertheless, Jan3 CEO Samson Cut unmasked the claim, keeping in mind that Tether moved 19,800 BTC to a different effort called Twenty One Capital (XXI) throughout the exact same duration. That consisted of 14,000 BTC sent out in June and another 5,800 BTC in July.

Related: Tether holds speak to invest throughout gold supply chain: Report

Tether moves $3.9 billion in BTC to XXI

In early June, Tether moved over 37,000 BTC, worth around $3.9 billion, throughout many deals to support XXI, a Bitcoin-native monetary platform led by Strike CEO Jack Mallers.

” Tether would have had 4,624 BTC more than at the end of Q1 if the transfer is represented,” Cut discussed, including that the company in fact increased its net holdings.

Ardoino echoed the description, stating the Bitcoin was moved, not offered. “While the world continues to get darker, Tether will continue to invest part of its earnings into safe properties,” he composed.

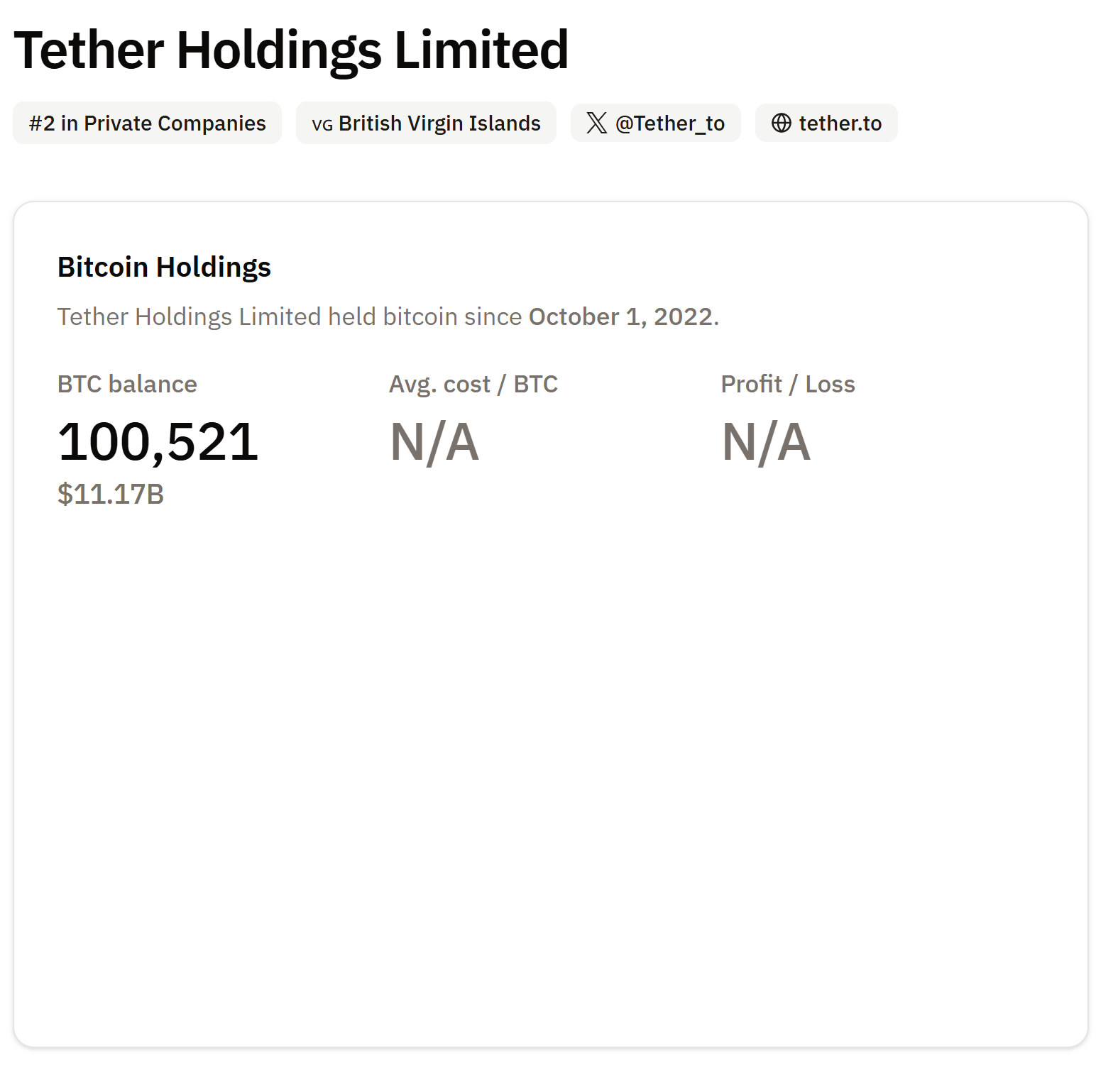

Tether, the provider of the USDt (USDT) stablecoin, holds over 100,521 BTC, worth around $11.17 billion, according to information from BitcoinTreasuries.NET.

Related: Tether scraps prepare to freeze USDT on 5 blockchains

El Salvador purchases $50 million in gold

Tether’s Bitcoin sell-off reports came as El Salvador exposed it has actually included 13,999 troy ounces of gold worth $50 million to its foreign reserves, marking its very first gold acquisition given that 1990. The reserve bank stated the relocation becomes part of a diversity method to decrease dependence on the United States dollar.

Before turning to gold, El Salvador developed a $700 million Bitcoin reserve, holding 6,292 BTC. Nevertheless, an International Monetary Fund report in July declared that the Main American nation has actually not made any brand-new Bitcoin purchases given that February.

Publication: Bitcoin is ‘amusing web cash’ throughout a crisis: Tezos co-founder