Tether, the $143 billion stablecoin giant, was the world’s seventh-largest purchaser of United States Treasurys, exceeding a few of the world’s biggest nations.

Tether, the provider of USDt (USDT), the world’s biggest stablecoin, was the world’s seventh-largest United States Treasury purchaser, exceeding Canada, Taiwan, Mexico, Norway, Hong Kong, and many other nations.

The stablecoin provider gotten over $33.1 billion worth of Treasurys, compared to over $100 billion bought by the Cayman Island in the very first location in worldwide rankings, according to Paolo Ardoino, the CEO of Tether.

” Tether was the 7th biggest purchaser of United States Treasurys in 2024, compared to Nations,” composed Ardoino in a March 20 X post.

Source: Paolo Ardoino

Nevertheless, Luxembourg and the Cayman Islands figures consist of “all the hedge funds purchasing into t-bills,” kept in mind Ardoino in the replies, whereas Tether’s figures represent the financial investments of a single entity.

Tether is purchasing United States Treasurys as extra support possessions for its United States dollar-pegged stablecoin because treasuries are short-term financial obligation securities provided by the United States federal government and are thought about a few of the best and most liquid financial investments offered.

Related: United States Bitcoin reserve marks ‘genuine action’ towards worldwide monetary combination

Tether’s considerable development comes throughout a duration of growing stablecoin adoption amongst both financiers and United States legislators.

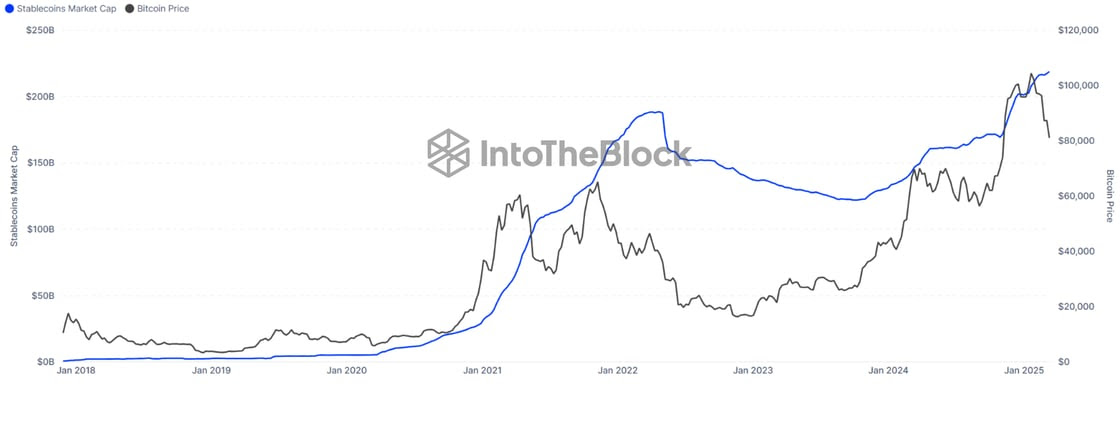

Source: IntoTheBlock

The growing stablecoin supply just recently exceeded $219 billion and continues to increase, recommending that the marketplace is “most likely still mid-cycle” rather than the top of the bull run, according to IntoTheBlock experts.

Related: Paolo Ardoino: Rivals and political leaders mean to ‘eliminate Tether’

Stablecoin expense might pass as quickly as August: Blockchain Association

United States legislators are on track to pass legislation setting guidelines for stablecoins and cryptocurrency market structure by August, Kristin Smith, CEO of market advocacy group the Blockchain Association, stated throughout Blockworks’ 2025 Digital Possession Top in New York City.

Smith’s timeline echoes a comparable projection by Bo Hines, the executive director of the President’s Council of Advisers on Digital Assets, who stated on March 18 that he anticipates to see detailed stablecoin legislation in the coming months.

” I believe we’re close to having the ability to get those provided for August […] they’re doing a great deal of deal with that behind the scenes today,” Smith stated on March 19 at the Top, which Cointelegraph participated in.

United States President Donald Trump sits next to Treasury Secretary Scott Bessent at the March 7 White Home Crypto Top. Source: The Associated Press

” I’m positive when you have the chairs of the appropriate committees in your house and the Senate and the White Home that wish to do something, and you have actually got bipartisan votes in Congress to get it there,” she included.

Publication: ETH might bottom at $1.6 K, SEC hold-ups several crypto ETFs, and more: Hodler’s Digest, March 9– 15