Method, the biggest Bitcoin treasury business, sent feedback to index business MSCI on Wednesday about the proposed policy modification that would omit digital possession treasury business holding 50% or more in crypto on their balance sheets from stock exchange index addition.

Digital possession treasury business are running business that can actively change their services, according to the letter, which mentioned Method’s Bitcoin-backed credit instruments as an example.

The proposed policy modification would predisposition the MSCI versus crypto as a property class, rather of the index business functioning as a neutral arbiter, the letter stated.

The MSCI does not omit other kinds of services that buy a single possession class, consisting of property financial investment trusts (REITs), oil business and media portfolios, according to Method. The letter stated:

” Numerous banks mostly hold particular kinds of properties and after that bundle and offer derivatives backed by those properties, like property mortgage-backed securities.”

The letter likewise stated carrying out the modification “weakens” United States President Donald Trump’s objective of making the United States the worldwide leader in crypto. Nevertheless, critics argue that consisting of crypto treasury business in worldwide indexes presents a number of threats.

Related: Strive get in touch with MSCI to reassess its ‘impracticable’ Bitcoin blacklist

Crypto treasury business can develop systemic threats and spillover impacts

Crypto treasury business display attributes of mutual fund, instead of running business that produce items and services, according to MSCI.

MSCI kept in mind that business profited from cryptocurrencies do not have clear and consistent assessment techniques, making appropriate accounting a difficult job and possibly skewing index worths.

Method held 660,624 BTC on its balance sheet at the time of this writing. The stock has actually lost over 50% of its worth over the in 2015, according to Yahoo Financing.

Bitcoin (BTC) is likewise 15% listed below its worth at the start of 2025, when it was trading over $109,000, indicating that the hidden possession has actually surpassed the equity wrapper.

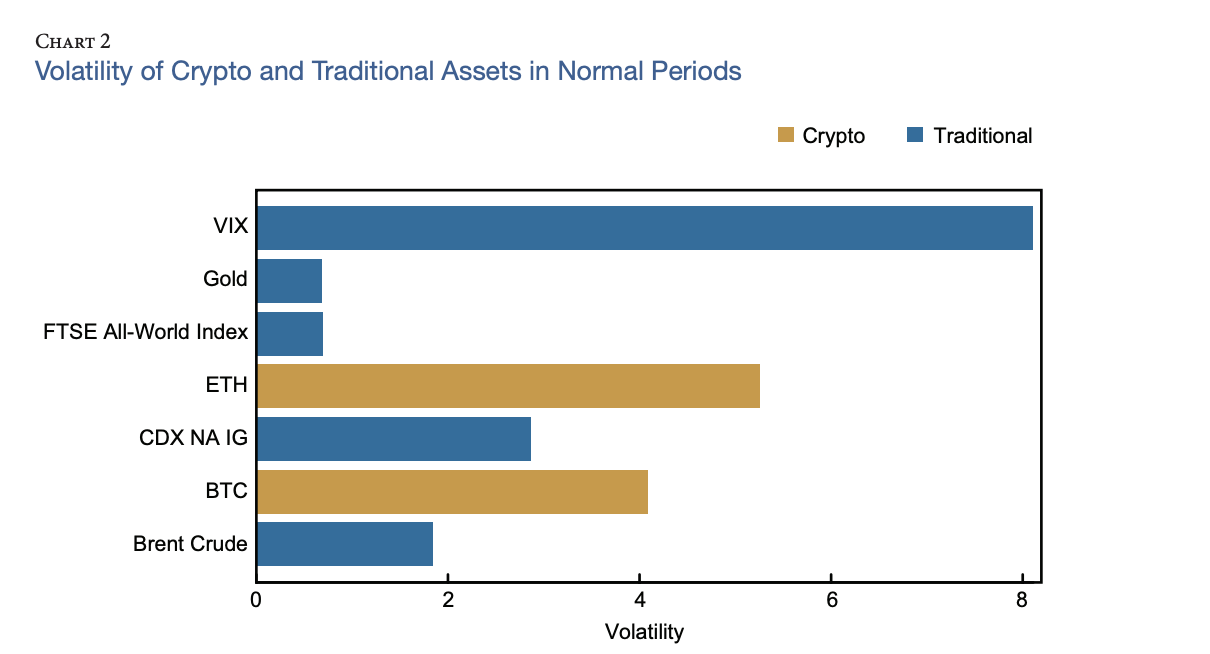

The high volatility of cryptocurrencies might increase the volatility of the indexes tracking these business or develop connection threats, where the index efficiency would mirror crypto market efficiency, according to a paper from the Federal Reserve.

The “typical usage” of utilize by crypto traders magnifies volatility and provides to crypto’s fragility as a property class, the Federal Reserve composed.

MSCI’s proposed policy modification, set to work in January, might likewise trigger treasury business to divest their crypto holdings to satisfy the brand-new eligibility requirements for index addition, producing extra selling pressure for digital possession markets.

Publication: The something these 6 worldwide crypto centers all share …