The brand-new trade tariffs revealed by United States President Donald Trump might position additional pressure on the Bitcoin mining community both locally and internationally, according to one market executive.

While the United States is home to Bitcoin (BTC) mining production companies such as Auradine, it’s still “not possible to make the entire supply chain, consisting of products, US-based,” Kristian Csepcsar, primary marketing officer at BTC mining tech supplier Braiins, informed Cointelegraph.

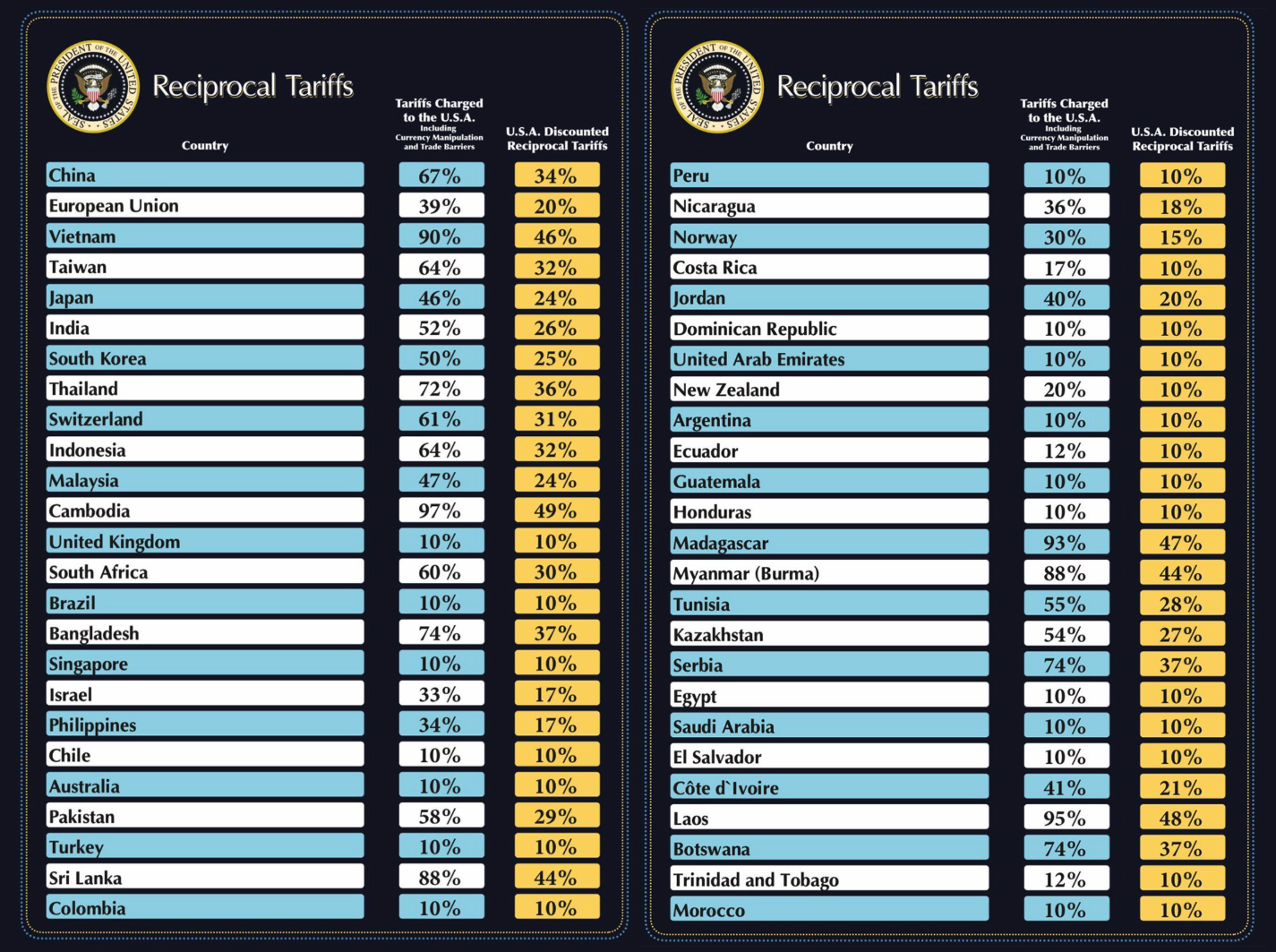

On April 2, Trump revealed sweeping tariffs, enforcing a 10% tariff on all nations that export to the United States and presenting “mutual” levies targeting America’s essential trading partners.

Neighborhood members have actually disputed the possible results of the tariffs on Bitcoin, with some stating their effect has actually been overemphasized, while others see them as a considerable danger.

Tariffs substance existing mining difficulties

Csepcsar stated the mining market is currently experiencing bumpy rides, indicating essential indications like the BTC hashprice.

Hashprice– a procedure of a miner’s day-to-day income per system of hash power invested to mine BTC blocks– has actually been on the decrease because 2022 and dropped to lowest levels of $50 for the very first time in 2024.

According to information from Bitbo, the BTC hashprice was still hovering around all-time low levels of $53 on March 30.

Bitcoin hashprice because late 2013. Source: Bitbo

” Hashprice is the essential metric miners follow to comprehend their bottom line. It is the number of dollars one terahash makes a day. A crucial success metric, and it is at lowest levels, ever,” Csepcsar stated.

He included that mining devices tariffs were currently increasing under the Biden administration in 2024, and mentioned remarks from Summertime Meng, basic supervisor at Chinese crypto mining provider Bitmars.

Source: Summertime Meng

” However they keep getting more stringent under Trump,” Csepcsar included, describing business such as the China-based Bitmain– the world’s biggest ASIC producer– which undergoes the brand-new tariffs.

Trump’s newest procedures consist of a 34% extra tariff on top of an existing 20% levy for Chinese mining imports. In action, China apparently enforced its own vindictive tariffs on April 4.

BTC mining companies to “lose in the short-term”

Csepcsar likewise kept in mind that advanced chips for crypto mining are presently enormously produced in nations like Taiwan and South Korea, which were struck by brand-new 32% and 25% tariffs, respectively.

” It will take a years for the United States to overtake advanced chip production. So once again, business, consisting of American ones, lose in the short-term,” he stated.

Source: jmhorp

Csepcsar likewise observed that some nations in the Commonwealth of Independent States area, consisting of Russia and Kazakhstan, have actually been intensifying mining efforts and might possibly surpass the United States in hashrate supremacy.

Related: Bitcoin mining utilizing coal energy down 43% because 2011– Report

” If we continue to see trade war, these areas with low tariffs and more beneficial mining conditions can see a significant boom,” Csepcsar alerted.

As the recently revealed tariffs possibly harm Bitcoin mining both internationally and in the United States, it might end up being harder for Trump to keep his pledge of making the United States the worldwide mining leader.

Trump’s position on crypto has actually moved several times throughout the years. As his administration welcomes a more pro-crypto program, it stays to be seen how the current financial policies will affect his long-lasting technique for digital properties.

Publication: Bitcoin ATH earlier than anticipated? XRP might drop 40%, and more: Hodler’s Digest, March 23– 29