World Liberty Financial (WLFI), the crypto company related to the household of United States President Donald Trump, made waves when it debuted late in 2015.

WLFI triggered a stir when it introduced ahead of the president’s inauguration. Observers have actually implicated the task of front-running essential crypto-related occasions, like the White Home Crypto top, and providing a dispute of interest.

Trump remains in a distinct position to affect results that would impact his portfolio, however WLFI is not insulated from the wider market patterns, which have actually seen crypto and stock costs drop in the middle of substantial macroeconomic issues.

The Trump administration will quickly mark 100 days in workplace. Here’s what WLFI has actually depended on, and how the president’s crypto financial investments are cleaning.

Establishing and ownership of Trump’s crypto financial investment WLFI task

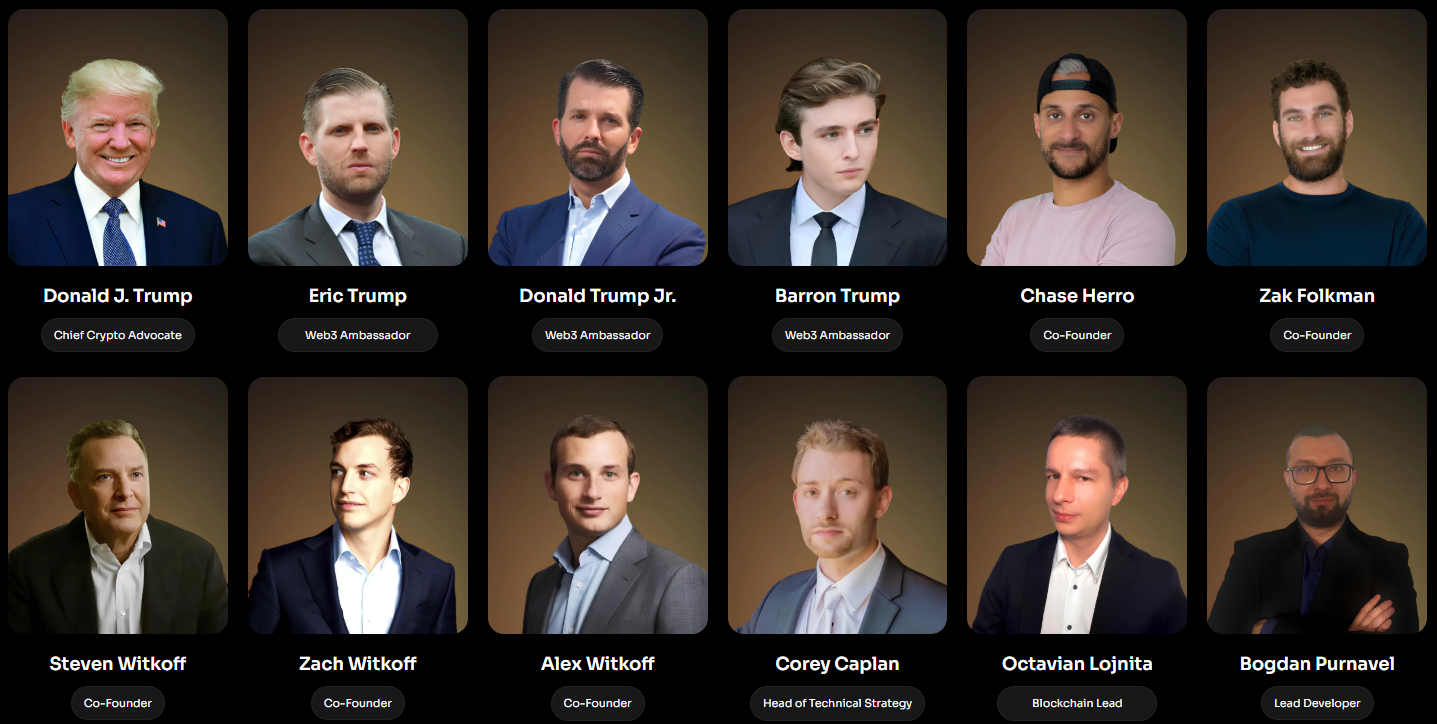

WLFI introduced on Sept. 16, with then-President-elect Donald Trump revealing the carry on X. Established under the assistance of property tycoon Steve Witkoff and his boy Zach, the co-founders likewise consist of Chase Herro, a crypto financier and self-described “sleazebag of the web,” and Zak Folkman, a social networks influencer and previous pickup artist.

The Trump household likewise includes plainly. President Trump is noted as “primary crypto supporter,” while his kids Eric, Donald Jr. and Barron are “Web3 ambassadors.”

WLFI token sales

Among World Liberty Financial’s very first relocations was to offer its own token. The very first token sale opened on Oct. 15, 2024, making the business about $300 million by offering 20 billion WLFI $WLFI for $0.015 each.

On Jan. 20, 2025, the day Trump was inaugurated, WLFI revealed a 2nd token sale, pointing out “huge need and frustrating interest.” The company used 5 billion tokens at $0.05 each, representing a cost boost of 230% from the very first sale. The 2nd sale was finished almost 2 months later March 14, having actually satisfied its complete target of $250 million.

According to the task’s “gold paper,” the WLFI tokens will provide citizen rights to holders on concerns impacting the procedure, such as upgrades. The awaited token circulation is:

-

35% through token sales,

-

32.5% for rewards and neighborhood development,

-

30% for “preliminary advocate” allowance,

-

and 2.5% for “core group and advisors.”

All informed, WLFI left with $550 million in token sales. $WLFI was just readily available to recognized financiers and can not be moved or traded on exchanges per the terms. There is yet to be a revealed listing date for the token.

WLFI’s portfolio

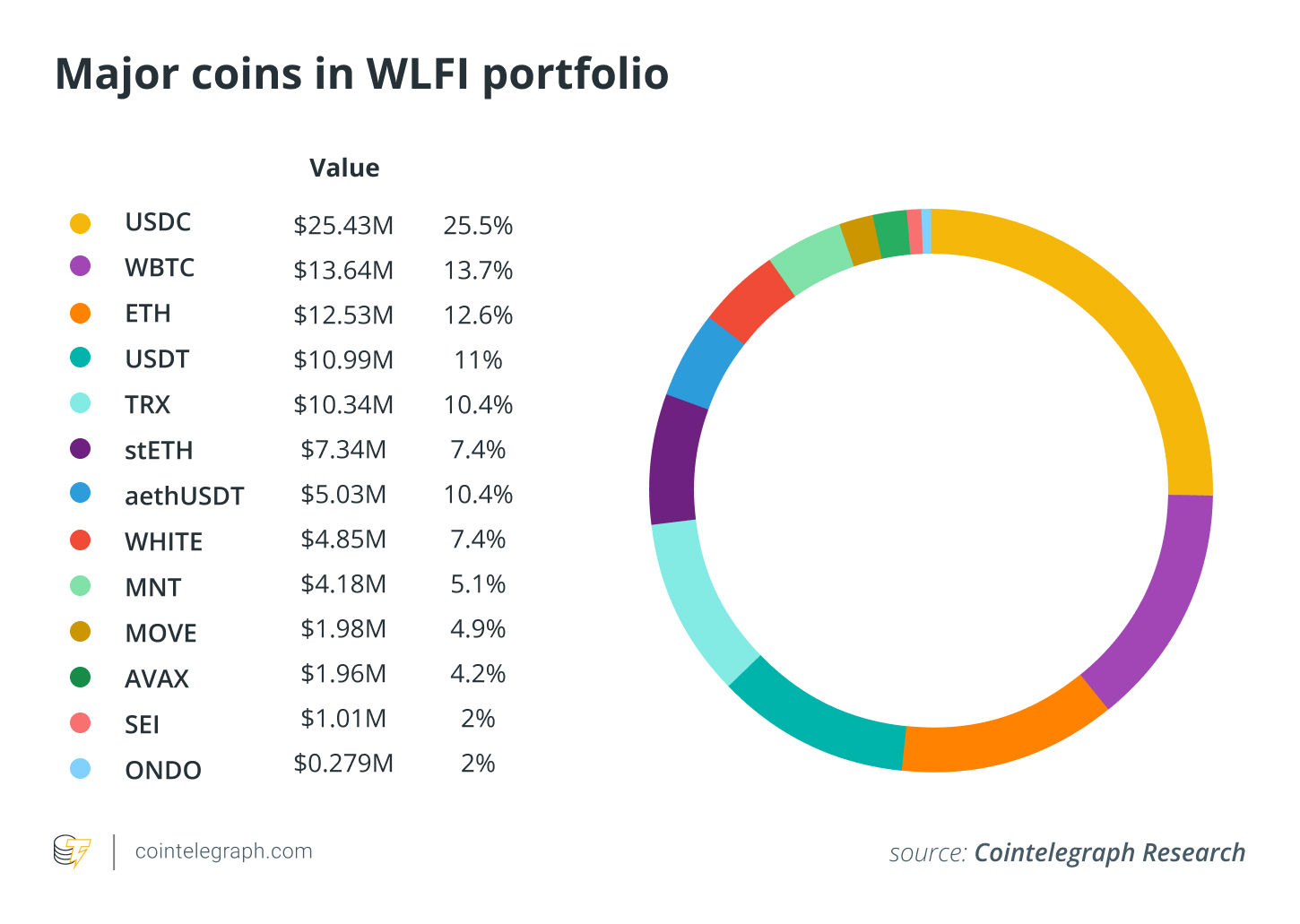

Token sales aside, the WLFI has actually been serving as a kind of crypto fund, building up a variety of various tokens over the previous numerous months. Here’s a breakdown:

WLFI portfolio consists of a variety of various possessions, with 13 comprising the lion’s share sometimes of composing. The majority of its holdings remain in dollar-backed stablecoin USDC, followed by Covered Bitcoin (BTC) and Ether (ETH).

The leading 13 possessions comprise almost $100 countless the company’s $103 million portfolio, according to Arkham. Lots of other little coins, some with an overall dollar worth of less than $100,000, comprise the staying worth.

WLFI’s $5 million worth of Aave Ethereum USDC (aethUSDC), indicates they provide USDC to a swimming pool on Aave.

WLFI’s portfolio consists of 8 cryptocurrencies that are non-stablecoin possessions it bought (versus gotten by means of airdrop).

-

Covered BTC (WBTC)

-

Mantle (MNT)

-

Motion (RELOCATION)

-

Sei (SEI)

-

Avalanche (AVAX)

-

Tron (TRX)

-

Ondo (ONDO)

-

Ether (ETH)

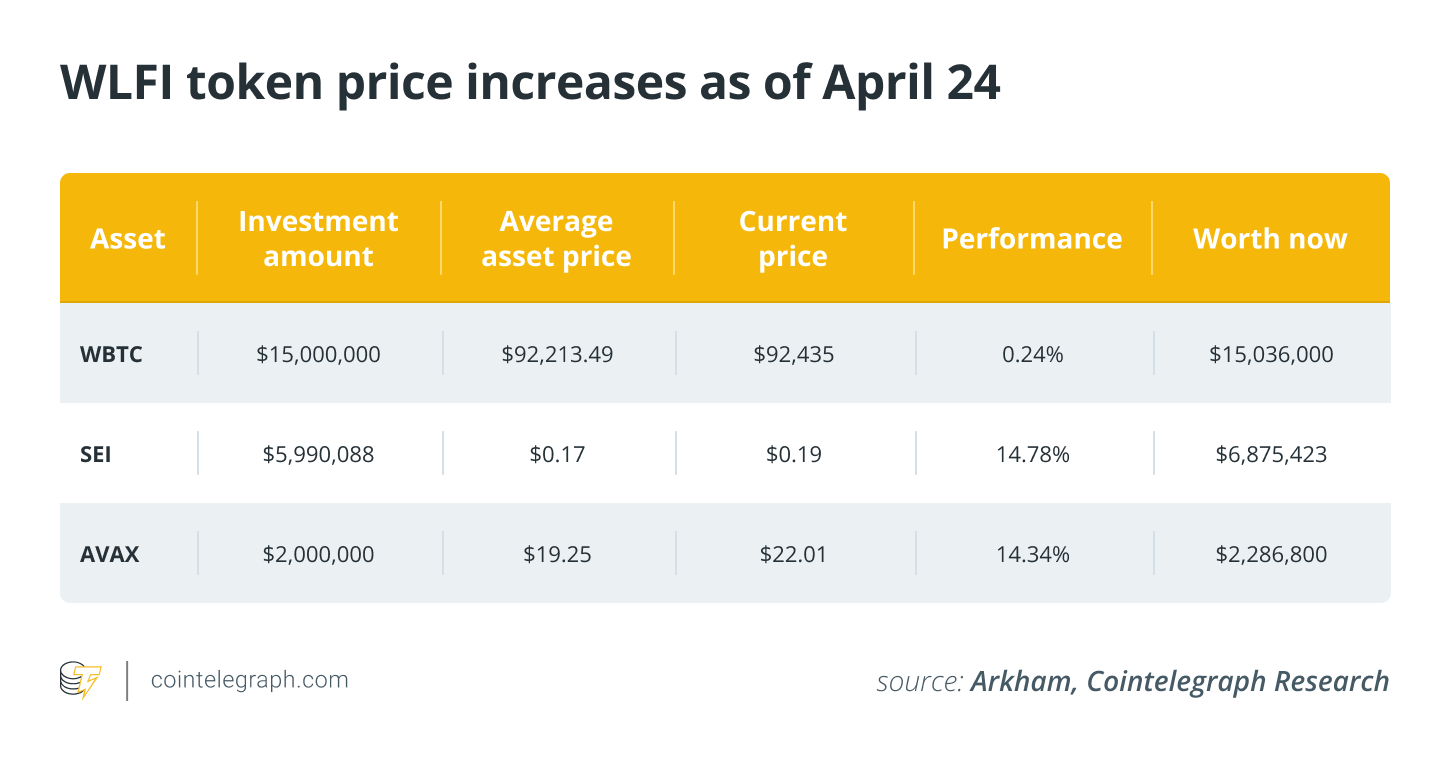

In general, WLFI’s holdings in WBTC, SEI and AVAX have actually been carrying out most effectively.

The very first WBTC purchase took place on Dec. 18, when WLFI exchanged 103 WBTC for 103 cbBTC. Almost one month later on, WLFI traded whatever for ETH. The fund began building up WBTC once again, mainly utilizing USDT, and sent it to Coinbase Prime in early February.

WLFI’s AVAX position was finished in one purchase on March 15, while it purchased almost $6 million worth of SEI over 3 different purchases in February, March and April.

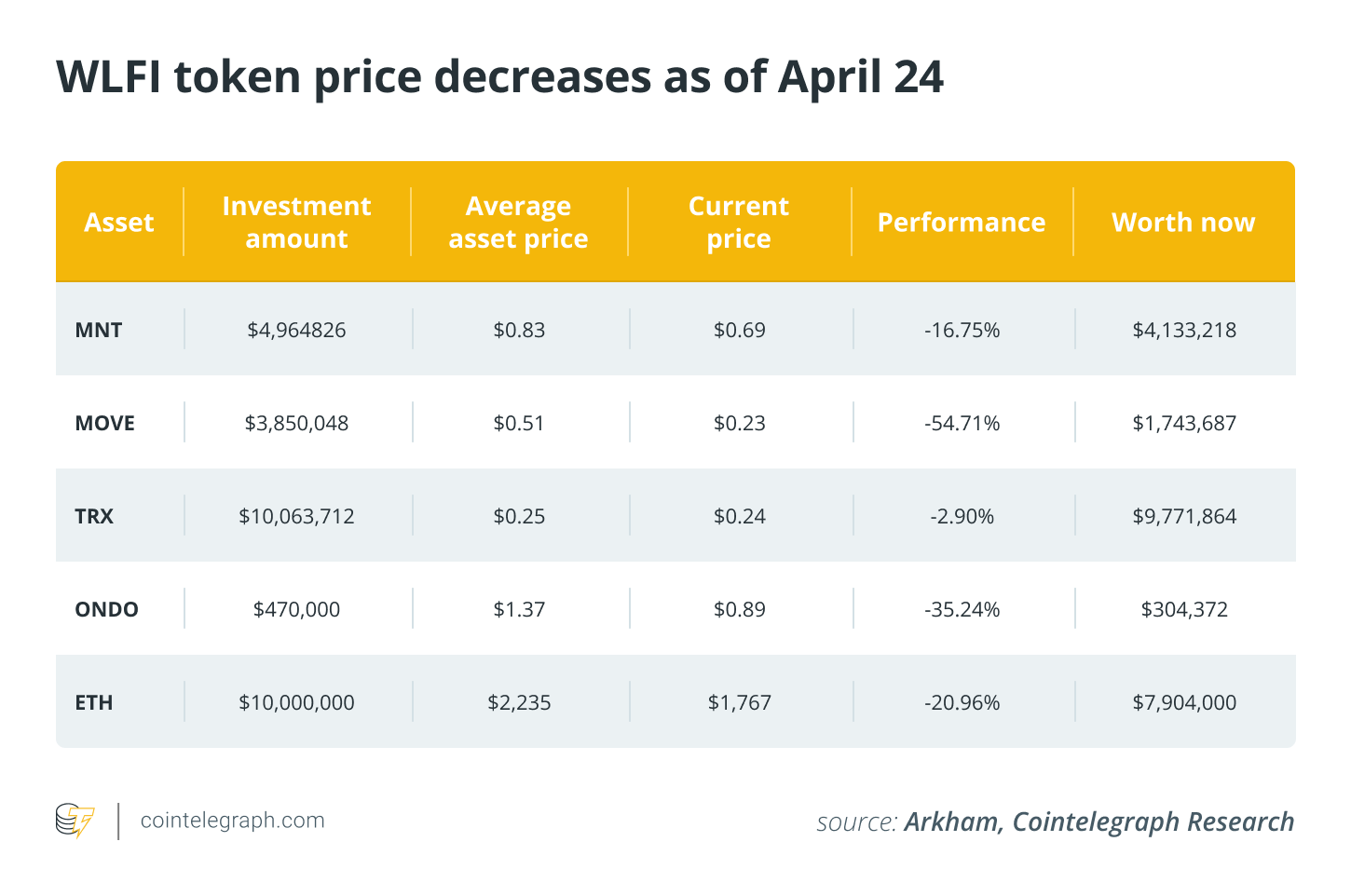

Other positions have not been faring almost too. Significant financial investments in MNT, RELOCATION, ONDO and ETH are all seeing losses in the double digits since April 24. Relocation is taking a pounding, with WLFI’s overall financial investment worth down over 50%, losing some $2,100,000 on the financial investment.

Taking into consideration the typical cost of WLFI’s token purchases, together with its possessions’ existing costs, the fund is seeing a loss, usually, of $4,280,000.

Significantly, WLFI has actually likewise transferred numerous early purchases of tokens in December and January into Coinbase Prime.

WLFI wallets gradually obtained ETH long before the primary action began. WLFI started obtaining large amounts worth over $1 million in late November and continued doing so every couple of days up until Dec. 21. Then, it moved all obtained ETH (consisting of 3,700 ETH transferred in October) to Coinbase Prime on Jan. 14.

In Between Jan. 19 and Jan. 21, it purchased almost 57,000 ETH and continued obtaining it up until Feb. 3, when it moved the majority of the ETH to Coinbase Prime. Coincidentally, Eric Trump was shilling Ether on X at the exact same time.

Disputes of interest and stablecoins

The curious timing of WLFI moving the tokens to a crypto exchange and Eric Trump’s post raises the concern of the Trump household’s capability to affect the tokens they hold.

In late March, a group of Senators from that body’s banking committee composed an open letter, pushing regulative firms to think about the possible disputes of interest in WLFI, especially with the task’s stablecoin, USD1.

Related: United States Home committee passes stablecoin-regulating STABLE Act

USD1 introduced in early March, and at releasing time is trading on central exchanges Kinesis Cash and ChangeNOW, according to CoinMarketCap.

The Senators were worried that Trump stands in a distinct position to affect and use benefits to his own stablecoin task, especially with the upcoming stablecoin structure costs under factor to consider in Congress.

When markets dropped following Trump’s tariff statement on “Freedom Day,” the president published on the conservative social networks platform Fact Social, “THIS IS A GOOD TIME TO PURCHASE!!” even more firing up issues about expert trading and market control.

In spite of these issues, the Trump administration’s ties to crypto are just enhancing. His administration has actually dropped numerous top-level enforcement cases versus crypto companies, and his allies in Congress are composing beneficial legislation for the market.

And crypto companies appear to think in the task. On April 16, crypto market maker DWF Labs revealed a $25 million financial investment in WLFI and consented to supply liquidity for USD1.

Publication: Monetary nihilism in crypto is over– It’s time to dream huge once again