Turkey has actually become the leading crypto market in the Middle East and North Africa (MENA) area in 2025, with volumes considerably surpassing those of significant markets, such as the United Arab Emirates.

Turkey, which has actually come to grips with high inflation over the last few years, controlled MENA’s crypto market in the previous year, taping almost $200 billion in yearly deals, according to the current local report by Chainalysis released Thursday.

The UAE, the area’s second-largest market, lagged far behind, with crypto volumes of $53 billion, nearly 4 times smaller sized than those of Turkey.

Nevertheless, according to onchain research study by Chainalysis, Turkey’s rise in crypto volumes has actually been sustained more by speculative activity than by sustainable adoption.

A heavy space driven by altcoin trading

With $200 billion in yearly crypto deals, Turkey alone exceeds the combined crypto volumes of other MENA markets such as Egypt, Jordan, Saudi Arabia, Morocco and Israel.

Unlike in the UAE, where Chainalysis observed a shift from cryptocurrency being mainly a speculative property to its growing usage as a useful payment option, most of Turkey’s crypto volume has actually been driven by a rise in speculative activity.

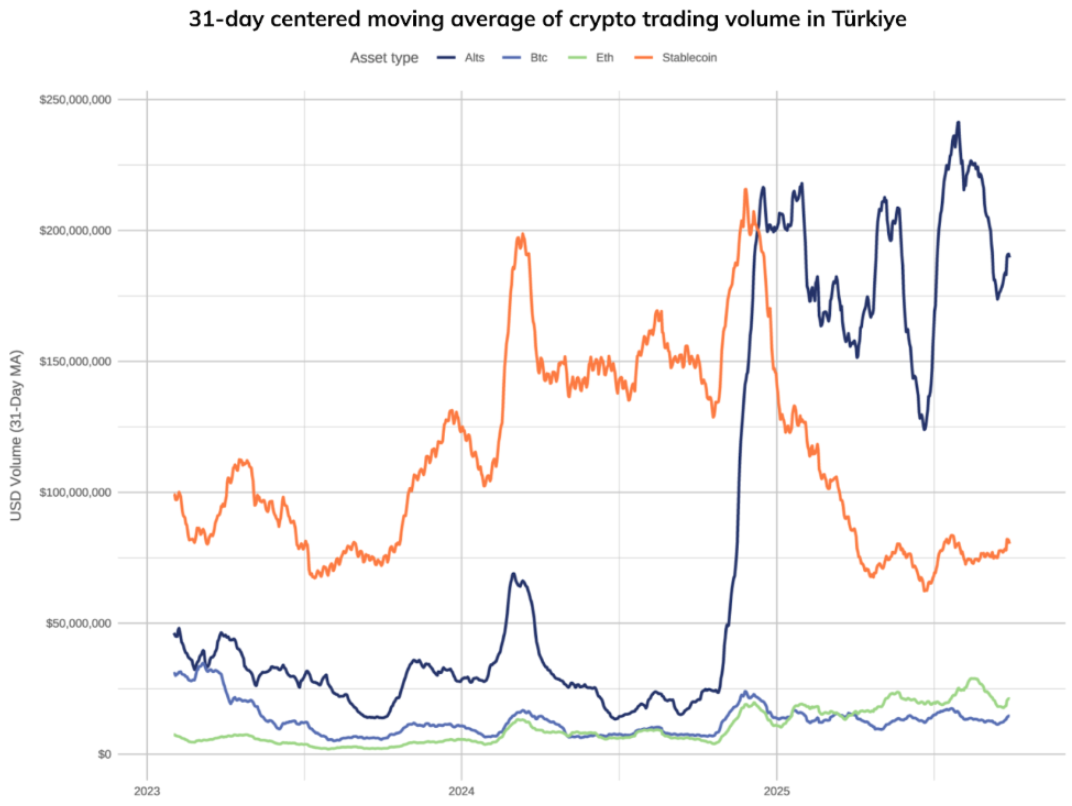

Dealing with the progressively speculative nature of Turkey’s crypto adoption, Chainalysis highlighted a rise in altcoin trading, determined by the 31-day moving average, which leapt from around $50 million in late 2024 to $240 million by mid-2025.

Altcoin trading eclipses stablecoins

Turkey’s altcoin increase marked a substantial shift far from Turkey’s previous choice for stablecoins, which had actually traditionally controlled the nation’s trading volumes.

According to Chainalysis information, Turkey’s stablecoin trading volume saw a significant plunge in the 31-day focused moving average, dropping from above $200 million in late 2024 to around $70 million by mid-2025.

” The timing of this altcoin rise accompanies wider local financial pressures,” Chainalysis observed, recommending that the pattern might show a “desperate yield-seeking habits” amongst staying market individuals.

Turkey’s crypto market is likewise mostly focused in institutional deals, which controlled the rise, while retail trading has actually dropped drastically, the report kept in mind.

Related: Here’s why Russia ranks greatest in Europe for crypto adoption: Chainalysis

The pattern most likely recommends that while Turkey’s financial obstacles drive adoption amongst bigger gamers looking for inflation hedges and currency options, it is “maybe decreasing the capability of daily Turkish residents to get involved,” Chainalysis stated.

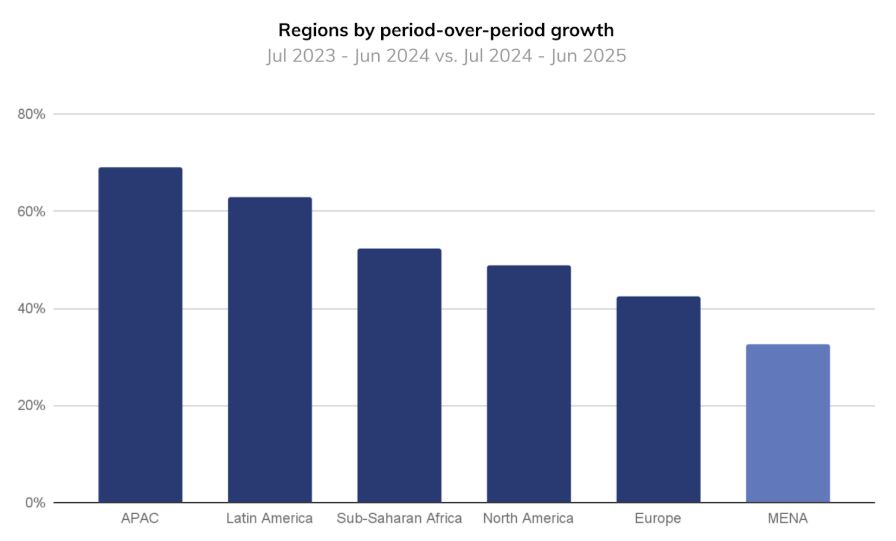

MENA drags internationally

Although Turkey’s speculative crypto trading has actually driven much of the area’s development, the MENA area as a whole still lags considerably behind other markets.

According to Chainalysis, the MENA area saw 33% year-over-year development, routing the Asia-Pacific (APAC) area at 69% and Latin America at 63%, the fastest-growing areas internationally.

MENA likewise dragged other areas, as Sub-Saharan Africa, The United States And Canada and Europe published greater development rates of around 55%, 50% and 43%, respectively.

Amongst the leading worldwide crypto jurisdictions, the United States ranked 2nd in a report by Chainalysis in September, routing just India, which kept the leading area for the 3rd successive year.

Publication: Cliff purchased 2 homes with Bitcoin home loans: Clever … or ridiculous?