The most recent United States core Customer Cost Index (CPI) print, a step of inflation, can be found in lower than anticipated at 3.1%, beating expectations of 3.2%, with a matching 0.1% drop in heading inflation figures.

According to Matt Mena, crypto research study strategist at 21Shares, the cooling inflation information contributes to the possibility that the Federal Reserve will cut rate of interest this year, injecting much-needed liquidity into the marketplaces and sending out risk-on possession rates higher. Mena included:

” Rate cut expectations have actually risen in action– markets now price a 31.4% possibility of a cut in May, up over 3x from last month, while expectations for 3 cuts by year-end have actually leapt over 5x to 32.5%, and 4 cuts have actually escalated from simply 1% to 21%.”

In spite of the better-than-expected inflation numbers, the cost of Bitcoin (BTC) decreased from over $84,000 at the day-to-day available to now relax $83,000 as traders face United States President Donald Trump’s trade war and macroeconomic unpredictability.

A bulk of market individuals think the Federal Reserve will cut rate of interest by June 2025. Source: CME Group

Related: Bitcoin’s ‘Trump trade’ is over– Traders shift want to Fed rate cuts, broadening international liquidity

Is President Trump crashing markets to require rate cuts?

Federal Reserve Chairman Jerome Powell stated on a number of events that the reserve bank is not hurrying to cut rate of interest– a view echoed by Federal Reserve Guv Christopher Waller.

Throughout a Feb. 17 speech at the University of New South Wales in Syndey, Australia, Waller stated the bank needs to stop briefly rate of interest cuts till inflation boils down.

These remarks were consulted with issue from market experts, who state that an absence of rate cuts may activate a bearish market and send out possession rates plunging.

On March 10, market expert and financier Anthony Pompliano hypothesized that President Trump was deliberately crashing monetary markets to require the Federal Reserve to decrease rate of interest.

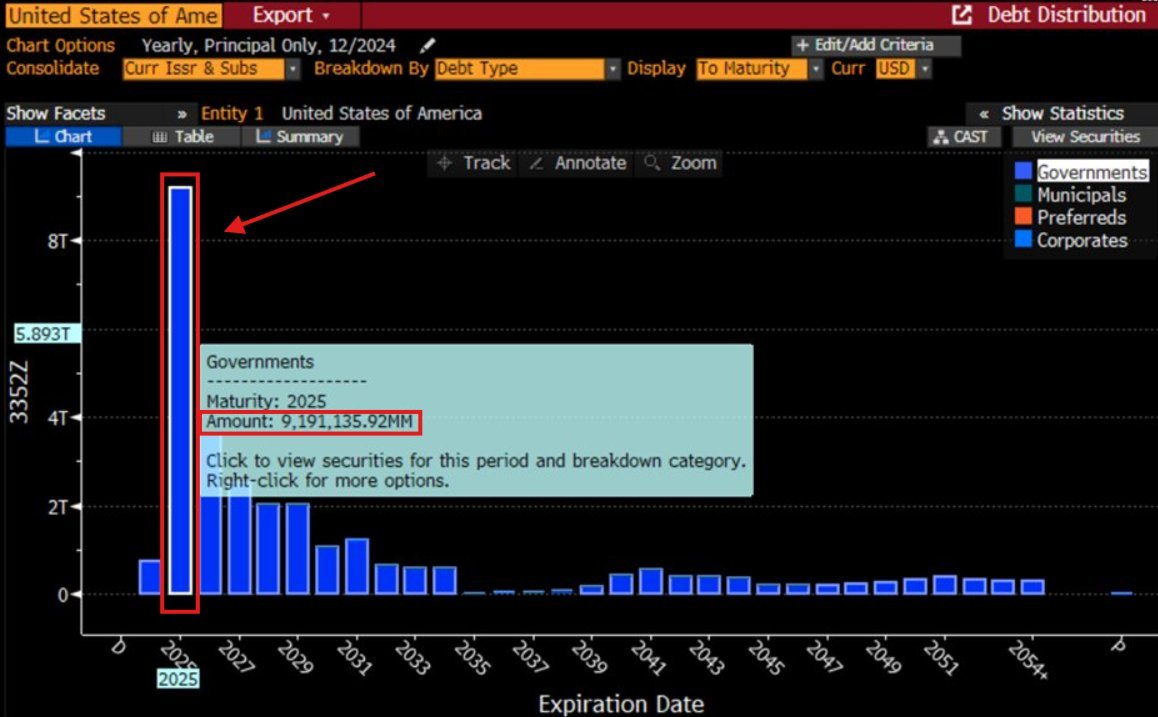

The United States federal government has roughly $9.2 trillion in financial obligation that will grow in 2025 unless re-financed. Source: The Kobeissi Letter

According to The Kobeissi Letter, the United States federal government requires to re-finance approximately $9.2 trillion in financial obligation before it reaches maturity in 2025.

Failure to re-finance this financial obligation at lower rate of interest will increase the nationwide financial obligation, which is presently over $36 trillion, and trigger the interest payments on the financial obligation to balloon.

Due to these factors, President Trump has actually made rate of interest cuts a leading concern for his administration– even at the short-term cost of possession markets and organization.

Publication Elon Musk’s strategy to run federal government on blockchain deals with uphill struggle