Bottom line:

-

The United States Dollar Index (DXY) is listed below its annual moving average and more than 6 points listed below its 200-day equivalent.

-

Bitcoin ought to stand to take advantage of the pattern thanks to its conventional inverted connection to DXY.

-

BTC cost action has yet to follow historic precedent on the dollar.

Bitcoin (BTC) stands to take advantage of United States financial obligation and dollar weak point as the greenback sets a two-decade record.

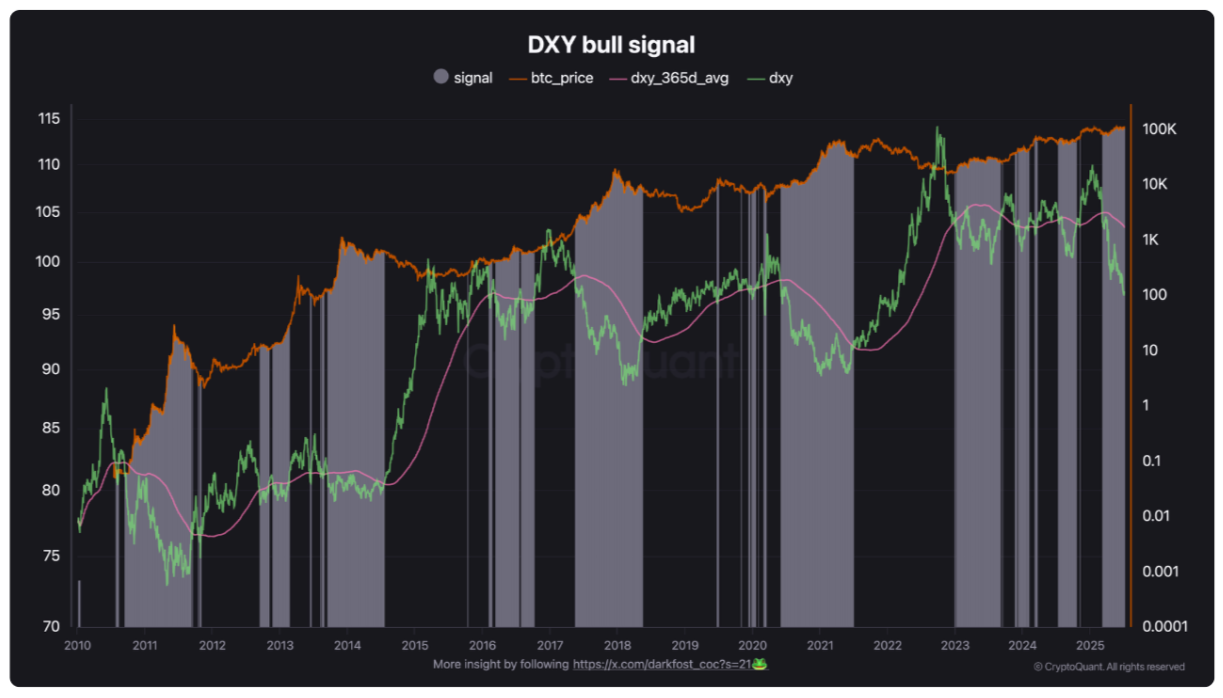

Brand-new research study from onchain analytics platform CryptoQuant on Tuesday declares Bitcoin’s inverted connection with the United States Dollar Index (DXY).

BTC cost tailwinds accumulate as DXY droops

BTC cost strength continues to get a tailwind from the United States dollar, which this month bounced off its least expensive levels versus trading-partner currencies because early 2022.

DXY was up to 96.377 on July 1, information from Cointelegraph Markets Pro and TradingView programs– a level not seen in over 3 years, with the dollar strength yardstick down over 10% year-to-date.

The suspicious accomplishments, nevertheless, do not end there; CryptoQuant exposes that versus its 200-day moving average (MA), DXY is circling around a zone which it last checked out more than twenty years earlier.

” While the United States financial obligation reaches a brand-new all-time high, the DXY has actually simply struck a traditionally weak level, presently trading 6.5 points listed below its 200-day moving average, marking the biggest discrepancy in the previous 21 years,” factor Darkfost summed up in a Quicktake post.

” Although this might appear worrying initially glimpse, it really tends to benefit danger possessions like Bitcoin.”

Bitcoin has actually frequently shown inverted connection to DXY over its life-span, however in the last few years, the relationship has actually ended up being less specific.

Darkfost argued that the pattern stays part of a more comprehensive risk-asset financial investment pattern.

” As the dollar damages and loses its safe-haven appeal, financiers reassess their portfolio allowances and move capital towards alternative property classes,” he stated.

An accompanying chart revealed the relationship in between BTC cost efficiency and the relationship of DXY to its 365-day MA.

” This chart shows that phenomenon by highlighting durations where the DXY trades listed below its 365-day moving average,” Darkfost stated.

” Taking a look at historic information, it ends up being clear that such durations have actually been complimentary to BTC. We are presently in a stage where the weak point of the DXY might sustain a brand-new increase in BTC however the cost didn’t respond yet.”

Dollar makes the case to own Bitcoin

As Cointelegraph reported, United States dollar weak point has actually sped up thanks to the execution of United States trade tariffs.

Related: ‘ Incorrect relocation’ to $105K? 5 things to understand in Bitcoin today

For Bitcoin advocates, it is fiat currency in basic that is delivering expertise to crypto.

” If the dollar’s extremely strong, it makes the case to own it,” financial expert Lyn Alden informed Cointelegraph recently on Bitcoin’s “primary competitors.”

” If overall credit in the system and overall dollars in the system are going to keep increasing over the next 5, 7, 10 years, that is among the macro aspects that makes Bitcoin helpful to own.”

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.