Bottom line:

-

Bitcoin falls with stocks and gold on stronger-than-expected United States tasks information.

-

The United States dollar index reaches its greatest levels in 3 weeks as out of work claims can be found in listed below expectations.

-

$ 110,000 is a progressively “most likely” BTC cost target next.

Bitcoin (BTC) looked “most likely” to review $110,000 on Thursday as macro and geopolitical aspects sustained BTC cost weak point.

United States out of work claims pressure danger possessions throughout the board

Information from Cointelegraph Markets Pro and TradingView verified brand-new regional lows of $110,658 on Bitstamp.

United States out of work claims information was available in listed below expectations on the day– an indication that labor market weak point might not be as intense as idea.

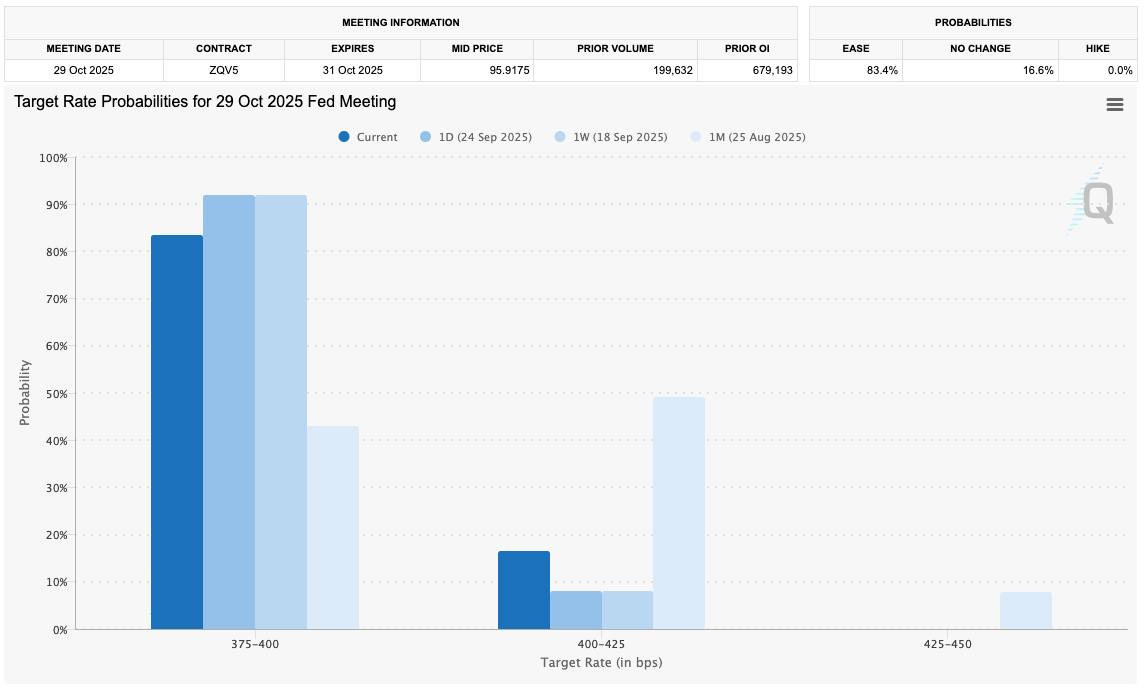

This triggered markets to end up being less positive about Federal Reserve interest-rate cuts, per information from CME Group’s FedWatch Tool.

” And easily, preliminary out of work claims are no longer a concern,” Ryan Detrick, primary market strategist at capital market business Carson Group, composed in part of a response on X.

United States dollar strength rose as an outcome, with the United States dollar index (DXY) striking three-week highs while crypto, stocks and gold fell.

The state of mind was not assisted by unpredictability over the Russia-Ukraine dispute amidst reports of Russian jet interceptions over Alaska.

Discussing risk-asset habits, trading resource The Kobeissi Letter called the stocks pullback “past due.”

” Healthy booming market do stagnate in a straight line,” it reasoned.

As Cointelegraph reported, stocks and gold had actually formerly been setting record highs.

$ 110,000 make-or-break for BTC cost

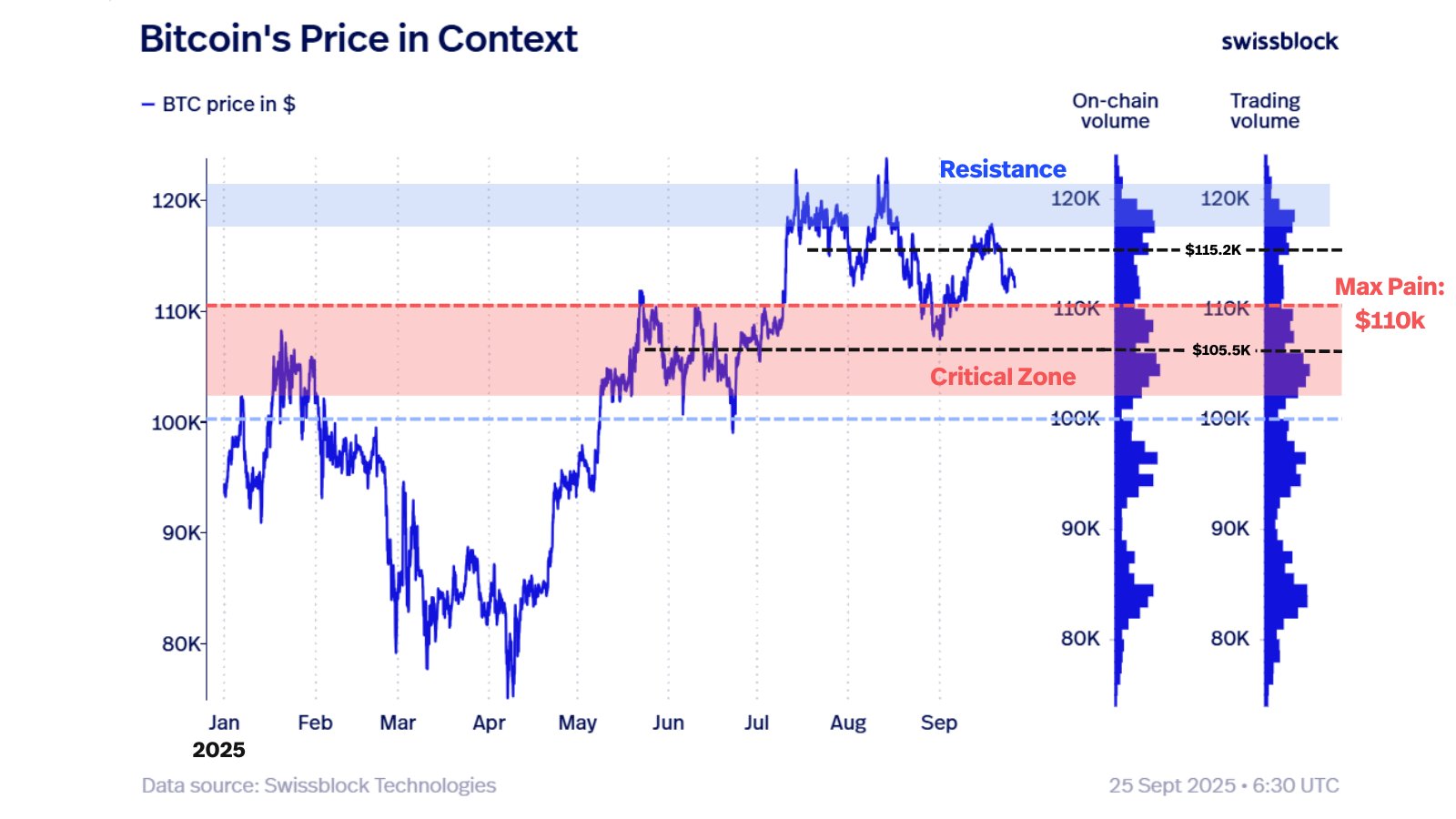

On BTC cost action, crypto market insight business Swissblock alerted that the marketplace “beings in a fragile balance.”

Related: Most significant long liquidation of the year: 5 things to understand in Bitcoin today

” Bitcoin lost $113K and hovers under $112K: a retest of $110K looks impending,” it alerted X fans in part of a post.

Swissblock argued that BTC/USD required to recover $115,200 to have a shot at reviewing the top of its variety. Losing $110,000, on the other hand, would open the course towards the $100,000 mark.

“$ 110K = max discomfort. Likely to be touched, leaving Friday’s choices useless,” it included, describing the upcoming $17.5 billion choices expiration occasion.

Bullish crypto takes concentrated on topside exchange order-book liquidity. With markets greatly brief, a “capture” greater appeared even more possible.

” Take a look at the frustrating short-side supremacy in possible liquidations,” trading resource TheKingfisher repeated in part of commentary on exclusive information.

“$ AVAX short-side is 96.2% of the pending liqs. $ETH at 78.3%. $BTC at 69.4%. This is how liquidations develop. Smart cash understands this is magnet for cost.”

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.