In a considerable regulative advancement for the crypto market, the United States Legislature voted to nullify an expense that threatened the privacy-preserving homes of decentralized financing (DeFi) procedures.

In the broader crypto area, among the Solana network’s most considerable governance propositions was turned down; it looked for to execute a system to decrease Solana’s inflation rate by about 80%.

United States Home follows Senate in passing resolution to eliminate internal revenue service DeFi broker guideline

The United States Legislature voted to nullify a guideline needing decentralized financing (DeFi) procedures to report to the Irs.

On March 11, your house of Representatives voted 292 for and 132 versus a movement to reverse the so-called internal revenue service DeFi broker guideline that intended to broaden existing internal revenue service reporting requirements to crypto.

All 132 votes to keep the guideline were Democrats. Nevertheless, 76 Democrats accompanied the Republicans to reverse it.

This followed the Senate’s March 4 vote on the movement, which saw it pass 70 to 27.

The guideline would have required DeFi platforms, such as decentralized exchanges, to reveal gross profits from crypto sales, consisting of details concerning taxpayers associated with the deals.

After the vote, Republican politician Agent Mike Carey, who sent the repeal movement, stated, “The DeFi broker guideline gets into the personal privacy of 10s of countless Americans, prevents the advancement of an essential brand-new market in the United States and would overwhelm the internal revenue service.”

Congressman Mike Carey speaking after the vote. Source: Mike Carey

Continue reading

Solana proposition to cut inflation rate by approximately 80% stops working

A proposition to considerably alter Solana’s inflation system was turned down by stakeholders however is being hailed as a triumph for the network’s governance procedure.

” Although our proposition was technically beat by the vote, this was a significant triumph for the Solana community and its governance procedure,” commented Multicoin Capital co-founder Tushar Jain on March 14.

Around 74% of the staked supply voted on proposition SIMD-228 throughout 910 validators, however simply 43.6% enacted favor of it, with 27.4% ballot versus it and 3.3% abstaining, according to Dune Analytics. It required 66.67% approval from taking part votes to pass and just got 61.4%.

Jain included that this was the most significant crypto governance vote ever, by the variety of individuals and the taking part market cap, of any community, chain or network.

” This was a significant scaling tension test– a social, instead of technical, tension test– and the network passed in spite of a large stratification of diverging viewpoints and interests.”

Continue reading

Bitcoin $70,000 retracement part of “macro correction” in booming market– Experts

Bitcoin’s possible retracement to $70,000 might be a natural part of the present booming market, in spite of crypto financier worries of an early arrival of a bearishness cycle.

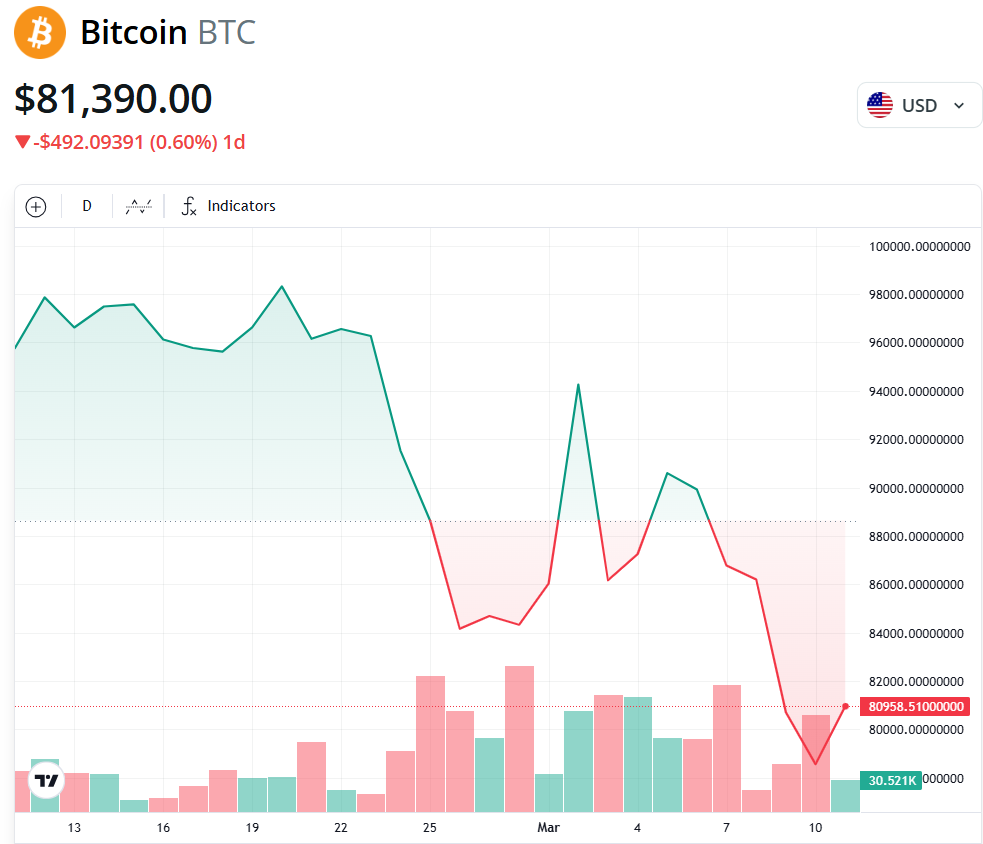

Bitcoin (BTC) fell more than 14% throughout the previous week to close at around $80,708 after financiers were dissatisfied with the absence of direct federal Bitcoin financial investments in President Donald Trump’s March 7 executive order. It described a strategy to develop a Bitcoin reserve utilizing cryptocurrency surrendered in federal government criminal cases.

Regardless of the drop in financier belief, cryptocurrencies and worldwide markets stay in a “macro correction” as part of the booming market, according to Aurelie Barthere, primary research study expert at the Nansen crypto intelligence platform.

BTC/USD, 1-month chart. Source: Cointelegraph

A lot of cryptocurrencies have actually broken essential assistance levels, making it tough to approximate the next essential rate levels, the expert informed Cointelegraph, including:

” This is a macro correction (United States tech will be down by 3% in the future, as gone over), so we need to keep track of BTC. Next level will be $71,000 – $72,000, top of the pre-election trading variety.”

The expert included: “We are still in a correction within a booming market: Stocks and crypto have actually recognized and are pricing; a duration of tariff unpredictability and financial cuts, no Fed put. Economic crisis worries are appearing.”

Continue reading

Require more stringent guidelines on political memecoins after $4 billion Libra collapse

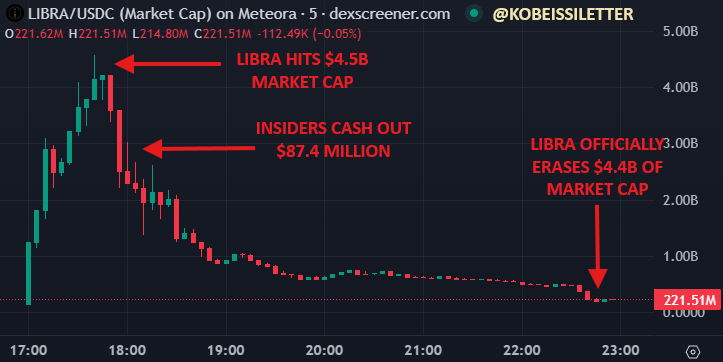

Market voices cautioned that politically backed cryptocurrencies need to embrace more powerful financier defenses and liquidity safeguards to avoid another considerable market collapse.

Financier belief stays shaken after the Libra (LIBRA) token, which was backed by Argentine President Javier Milei, suffered a $4 billion market cap wipeout due to expert cash-outs.

According to blockchain analytics firm DWF Labs, a minimum of 8 expert wallets withdrew $107 million in liquidity, setting off the enormous collapse.

Source: Kobeissi Letter

To prevent a comparable crisis, tokens with governmental recommendations will require more robust security and financial systems, such as liquidity locking or making the tokens in the liquidity swimming pool non-sellable for an established duration, DWF Labs composed in a report shown Cointelegraph.

The report mentioned that tokens from prominent leaders likewise require launch constraints to restrict involvement from crypto-sniping bots and big holders or whales.

” Restricting bot and whale activity is necessary in restricting the effect of people acting upon expert details to corner a big portion of the token supply,” according to Andrei Grachev, handling partner at DWF Labs.

Continue reading

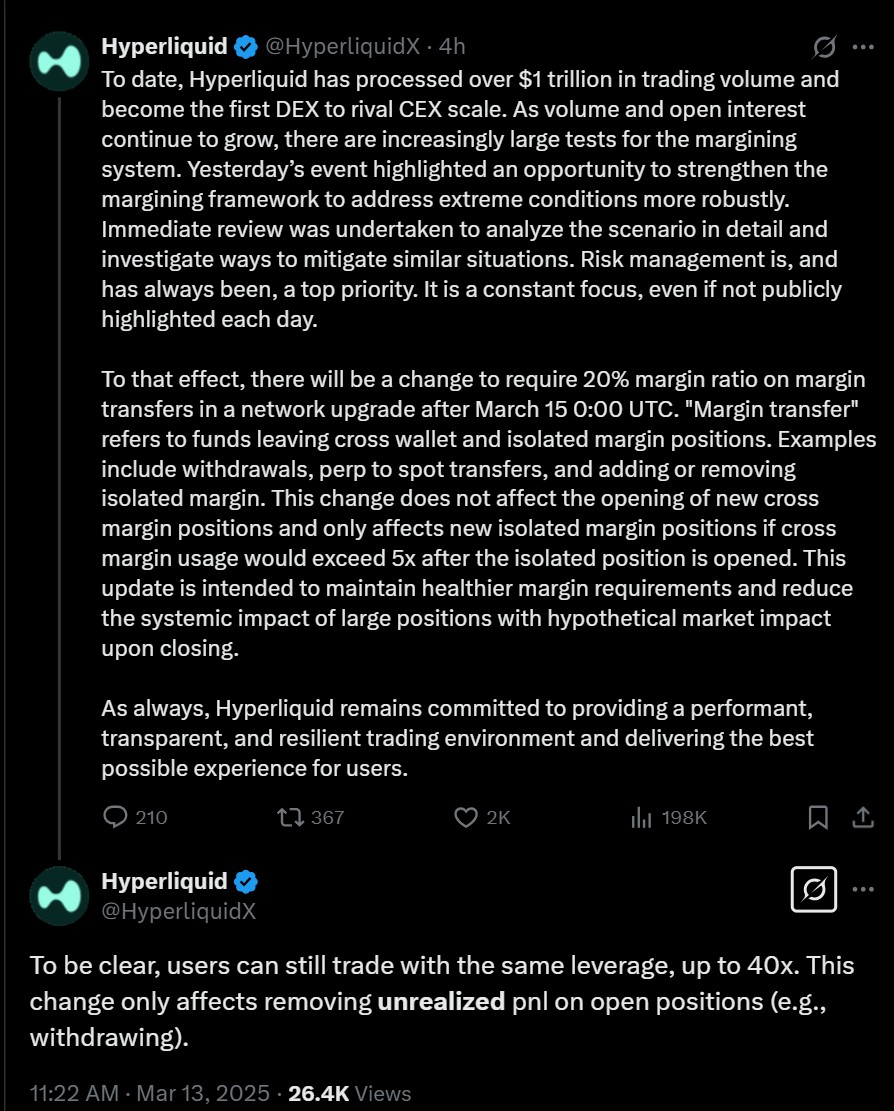

Hyperliquid ups margin requirements after $4 million liquidation loss

Hyperliquid, a blockchain network focusing on trading, increased margin requirements for traders after its liquidity swimming pool lost countless dollars throughout an enormous Ether (ETH) liquidation, the network stated.

On March 12, a trader deliberately liquidated an approximately $200 million Ether long position, triggering Hyperliquid’s liquidity swimming pool, HLP, to lose $4 million, relaxing the trade.

Beginning March 15, Hyperliquid will need traders to preserve a security margin of a minimum of 20% on specific employment opportunities to “decrease the systemic effect of big positions with theoretical market effect upon closing,” Hyperliquid stated in a March 13 X post.

The occurrence highlights the growing discomforts facing Hyperliquid, which has actually become Web3’s most popular platform for leveraged continuous trading.

Hyperliquid has actually changed margin requirements for traders. Source: Hyperliquid

Hyperliquid stated the $4 million loss was not from a make use of however rather a foreseeable repercussion of the mechanics of its trading platform under severe conditions.

Continue reading

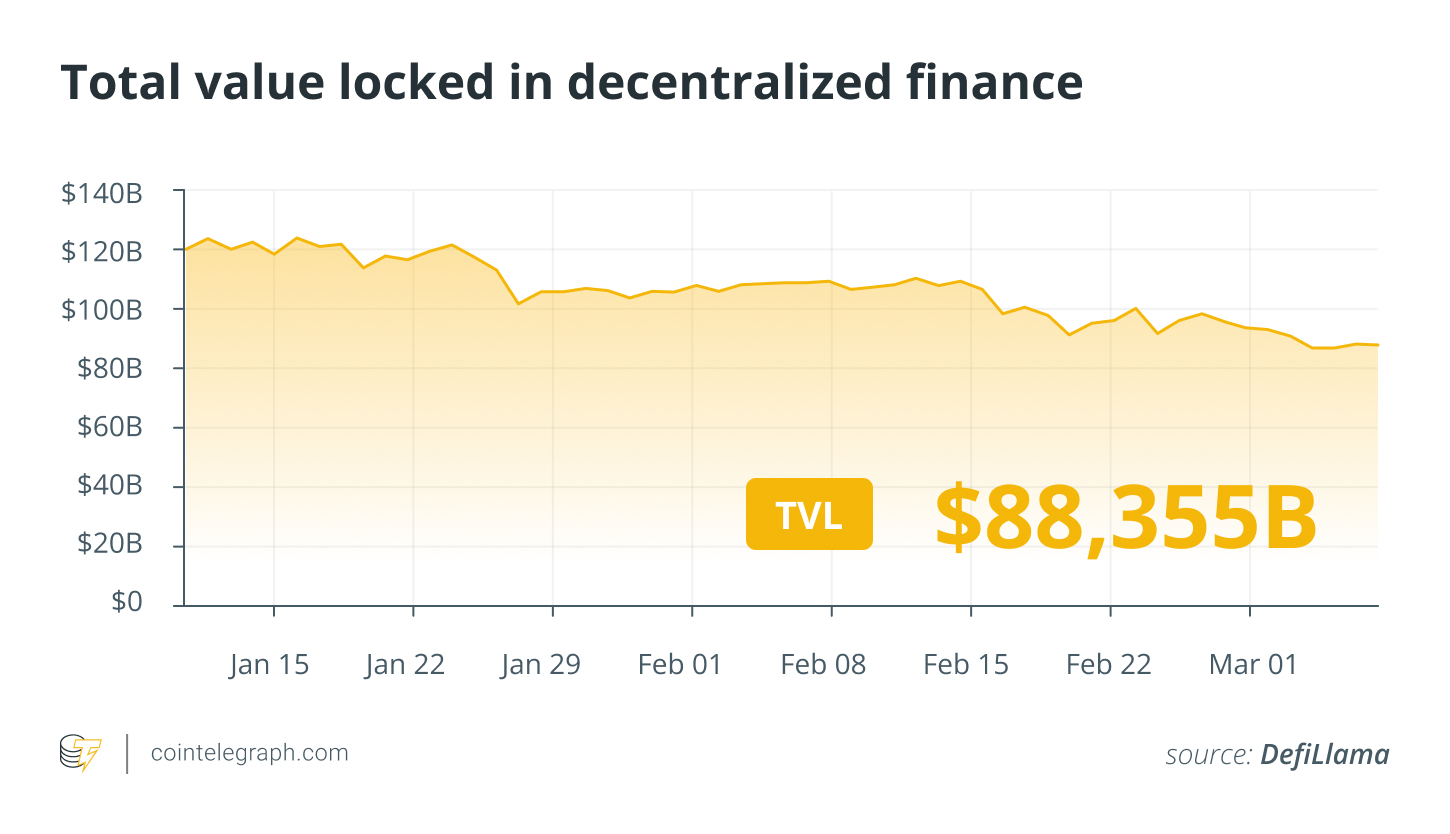

DeFi market introduction

According to information from Cointelegraph Markets Pro and TradingView, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the red.

Of the leading 100, the Hedera (HBAR) token tipped over 24%, marking the most significant weekly reduction, followed by JasmyCoin (JASMY) down over 21% over the previous week.

Overall worth secured DeFi. Source: DefiLlama

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.