Bottom line:

-

Bitcoin sellers try to break assistance at $109,000 at the week’s last Wall Street open.

-

BTC rate action can head towards $100,000 as an outcome, regardless of a big “deleveraging” occasion.

-

United States PCE inflation provides no relief for crypto bulls.

Bitcoin (BTC) threatened brand-new September lows at Friday’s Wall Street open as United States inflation information stopped working to buoy bulls.

Liquidity accumulates as Bitcoin rate falls even more

Information from Cointelegraph Markets Pro and TradingView revealed that BTC/USD ran the risk of a breakdown listed below $109,000.

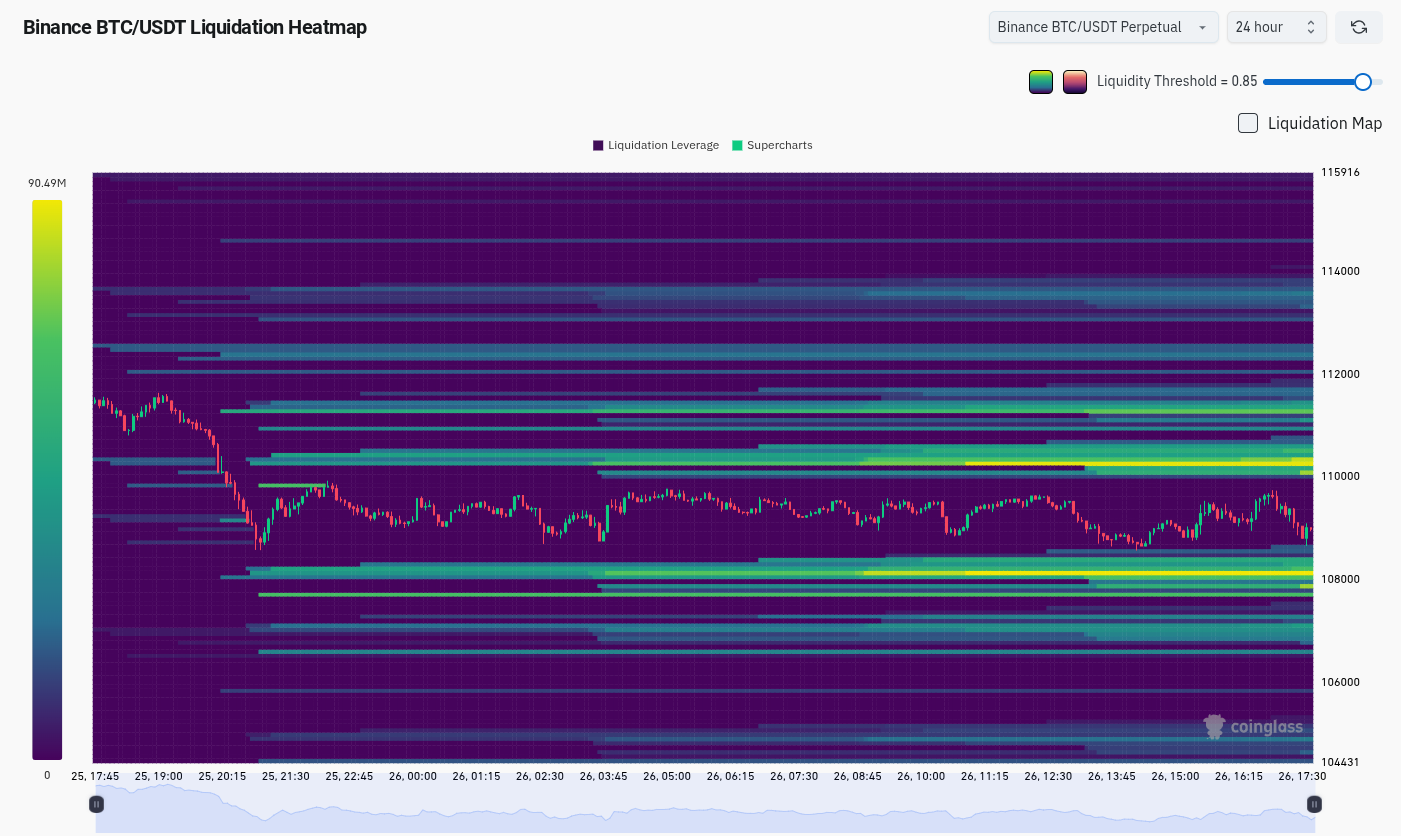

Exchange order-book liquidity stayed thick on either side of the area rate, offering both upside and disadvantage “magnets” for momentum.

On the biggest international exchange, Binance, quotes were clustered around $108,200, with brief liquidations due at $110,000 and up, per information from CoinGlass.

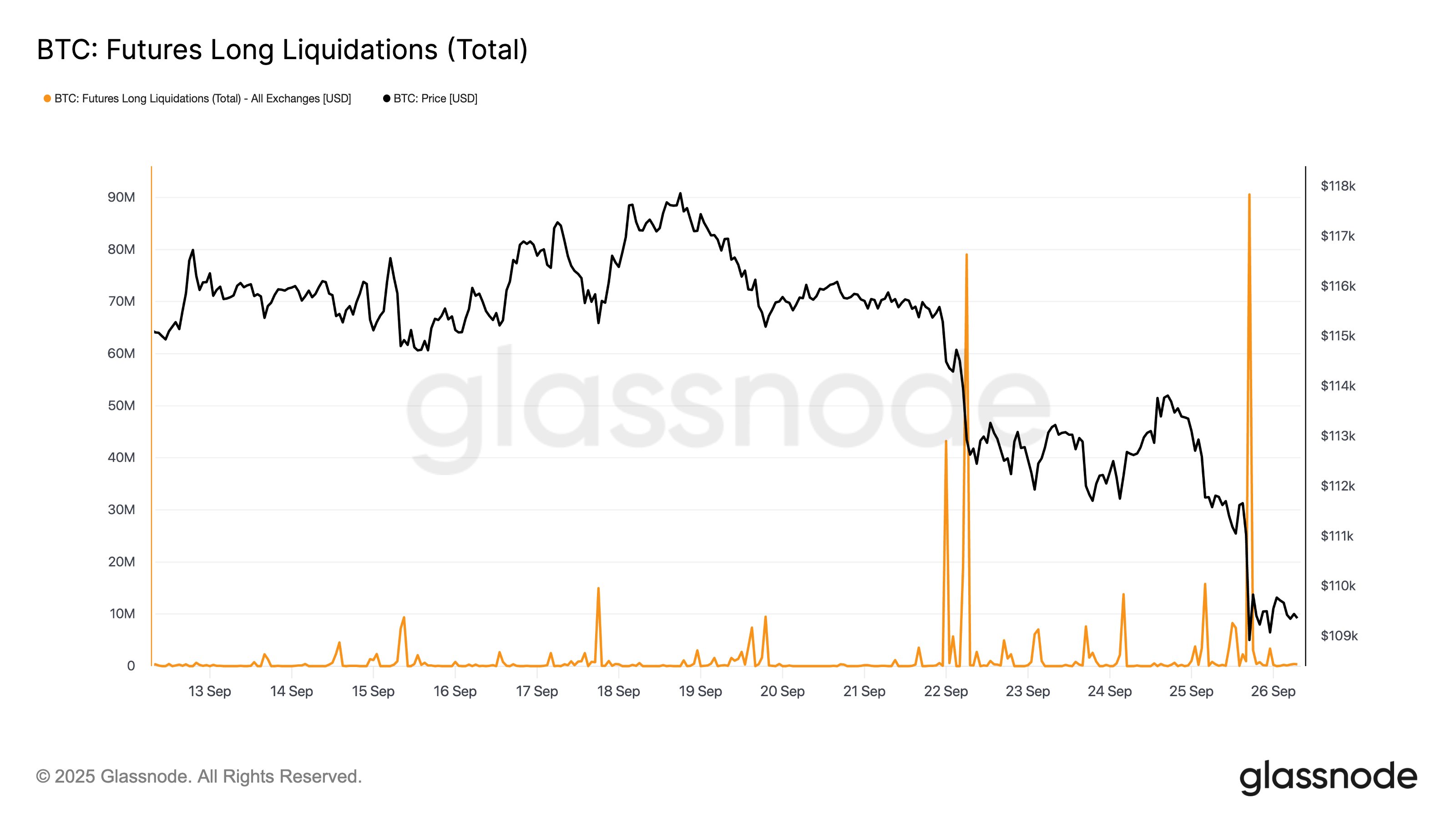

” Bitcoin futures saw another wave of long liquidations as rate moved listed below $111k,” onchain analytics platform Glassnode summed up in a post on X.

” This flush of take advantage of shows a broad deleveraging occasion, typically resetting market positioning and relieving the danger of additional waterfalls.”

Still, Traders stayed risk-averse, with BTC rate targets towards $100,000 ending up being more popular.

“$ BTC is hovering simply above its assistance level,” one market draw from crypto financier and business owner Ted Pillows keep reading the day.

” If this level holds, Bitcoin might rally towards $112,000. In case of a breakdown, BTC will retest $101,000 assistance area before turnaround.”

PCE information maintains Fed rate-cut bets

Macroeconomic occasions had little noticeable influence on the crypto market trajectory.

Related: Bitcoin sees most fear because $83K as analysis eyes ‘turning point’

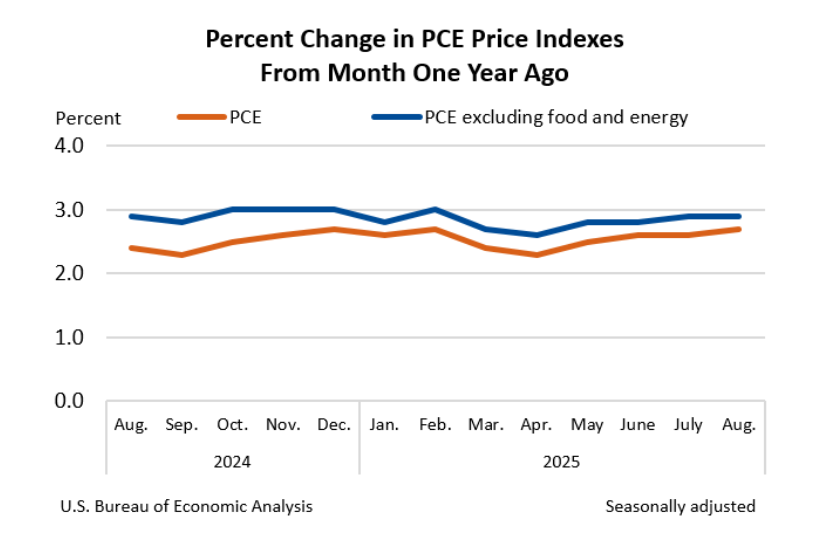

The Individual Intake Expenses (PCE) index, referred to as the United States Federal Reserve’s “chosen” inflation gauge, shown up in line with expectations at 2.7%.

Responding, trading resource The Kobeissi Letter concluded that while PCE was at seven-month highs, the Fed would push ahead with the interest-rate cuts sorely desired by crypto and risk-asset traders.

” PCE inflation is at its greatest because February 2025. Yet, the Fed will keep cutting rates,” it informed X fans.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.