A brand-new expense set to be presented in Congress intends to formalize President Donald Trump’s executive order developing a United States Strategic Bitcoin Reserve, a relocation that might even more incorporate Bitcoin into the country’s monetary method.

Trump signed an executive order on March 7 to utilize Bitcoin (BTC) took in federal government criminal cases to develop a nationwide reserve.

The legislation, presented by United States Agent Byron Donalds, looks for to make sure the Bitcoin reserve ends up being an irreversible component, avoiding future administrations from dismantling it through executive action.

Source: Margo Martin

” For many years, the Democrats waged war on crypto,” Donalds, a Florida Republican politician, stated in a declaration to Bloomberg. “Now is the time for Congressional Republicans to decisively end this war.”

If the expense is passed, it would make sure that the Strategic Bitcoin Reserve and the United States Digital Property Stockpile might not be gotten rid of by means of executive actions by a future administration.

The expense will need a minimum of 60 votes in the Senate and a Home bulk to pass. With Republicans holding a Senate bulk– and a normally more crypto-friendly position– the expense has an opportunity of passing.

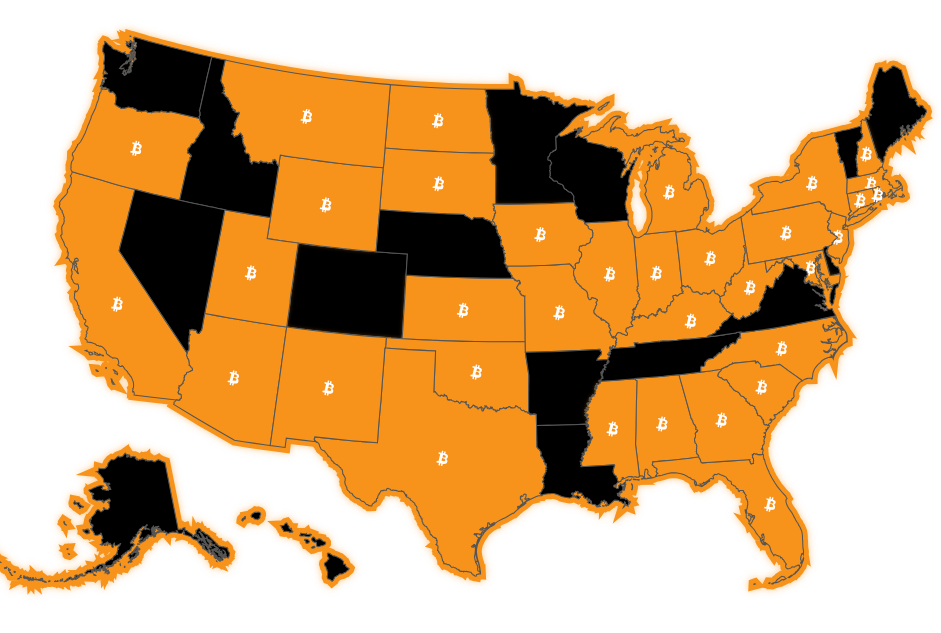

US states with Bitcoin reserve expense proposals. Source: Bitcoinlaws

According to Bitcoinlaws information, a minimum of 23 US states have actually presented legislation supporting a Bitcoin reserve, showing growing state-level interest in incorporating crypto into financial policy.

Related: Trump turned crypto from ‘oppressed market’ to ‘focal point’ of United States method

A “turning point” for United States crypto policies

The intro of the Bitcoin reserve-related expense marks a turning point for the broader crypto market, not simply BTC.

The legislation “intends to seal the reserve as an irreversible component, protecting it from turnaround by future administrations,” according to Anndy Lian, author and intergovernmental blockchain specialist.

The expense indicates the United States federal government’s intent to incorporate Bitcoin into its monetary structure, Lian informed Cointelegraph, including:

” It constructs on Trump’s earlier executive action by offering a statutory foundation, possibly clarifying the federal government’s position on digital properties. If passed, the expense might decrease unpredictability that has actually long pestered the crypto area, where companies like the SEC and CFTC have actually typically clashed over jurisdiction.”

” A codified reserve may motivate a more cohesive regulative technique, using organizations and financiers a clearer course forward,” he included.

Nevertheless, recognizing the right financing systems and custody options for the Bitcoin reserve is a difficult action for governmental entities that might postpone the fund’s production.

Related: European legislators quiet on United States Bitcoin reserve amidst digital euro push

Donalds’ expense might likewise supply more clearness on the federal government’s future Bitcoin acquisition techniques. Although the present strategy does not include federal government Bitcoin purchases, the order does not rule them out in the future.

The order licenses the United States Treasury and Commerce secretaries to establish “budget-neutral techniques” to purchase more Bitcoin for the reserve, offered there are no extra expenses to taxpayers.

Publication: SCB pointers $500K BTC, SEC hold-ups Ether ETF alternatives, and more: Hodler’s Digest, Feb. 23– March. 1