Bitcoin (BTC) begins the weakest month of the year with brand-new regional lows and forecasts of more BTC cost disadvantage.

-

Bitcoin drops to $107,270 after the weekly open before rebounding as volatility increases.

-

The United States Labor Day vacation keeps traders thinking over how markets will respond to fresh United States tariff mayhem.

-

Gold is back in breakout mode, however the outlook for crypto is anything however bullish, states gold bug Peter Schiff.

-

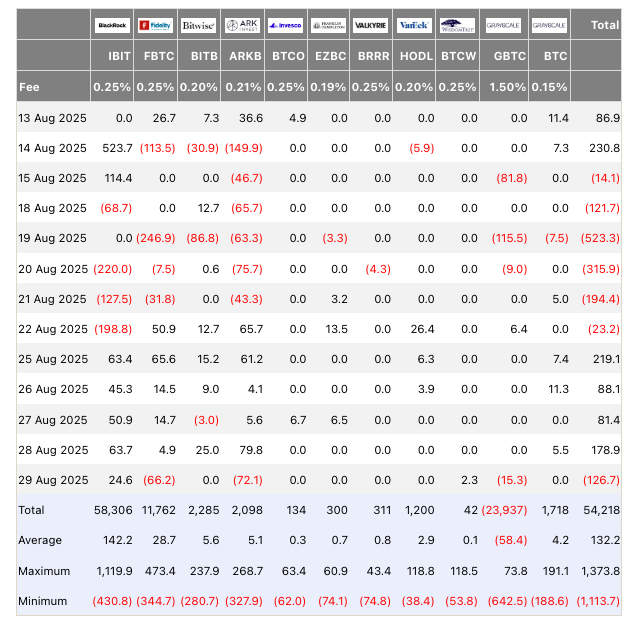

Bitcoin institutional interest is beginning to show cost weak point as August caps $750 countless ETF outflows.

-

September is typically problem for Bitcoin bulls– will this year be various?

Traders maintain sub-$ 100,000 BTC cost targets

Bitcoin started the week by setting brand-new regional lows at $107,270, information from Cointelegraph Markets Pro and TradingView verifies.

A subsequent bounce took the set towards $110,000, a volatility attribute of low-volume weekend and public vacation trading.

Amongst traders, the state of mind is tense: some are waiting on a more persuading flooring, and even see $100,000 assistance coming in for a retest.

Others are targeting upside liquidity on exchange order books. With the marketplace extremely short, a “capture” to target those positions is significantly of interest.

$BTC supports

Above the 92k severe target, these are the assistances I ´ m seeing for Bitty.

I question it will slice through all of these, that would be absolutely unexpected for me and what I ´ m anticipating.

Hope the bulls step up to the plate quickly. pic.twitter.com/4oxtd95EJr

— Lourenço VS (@lourenco_vs) September 1, 2025

” Brief liquidations are stacking in between $112k – $115k,” popular trader CrypNuevo validated in a thread on X Sunday.

CrypNuevo properly expected a drop to the $107,200 zone based upon quote liquidity sitting there.

” If this becomes a much deeper pullback, I ‘d anticipate $100k to get struck given that it’s a mental level,” he continued.

” As cost dropped, a great deal of long orders would stack at $100k and a wick lower to $94k would make good sense to strike their SL & & liquidations and to fill the disadvantage little CME space there.”

CrypNuevo however explained present lows as a “variance,” considering another CME space at $117,000.

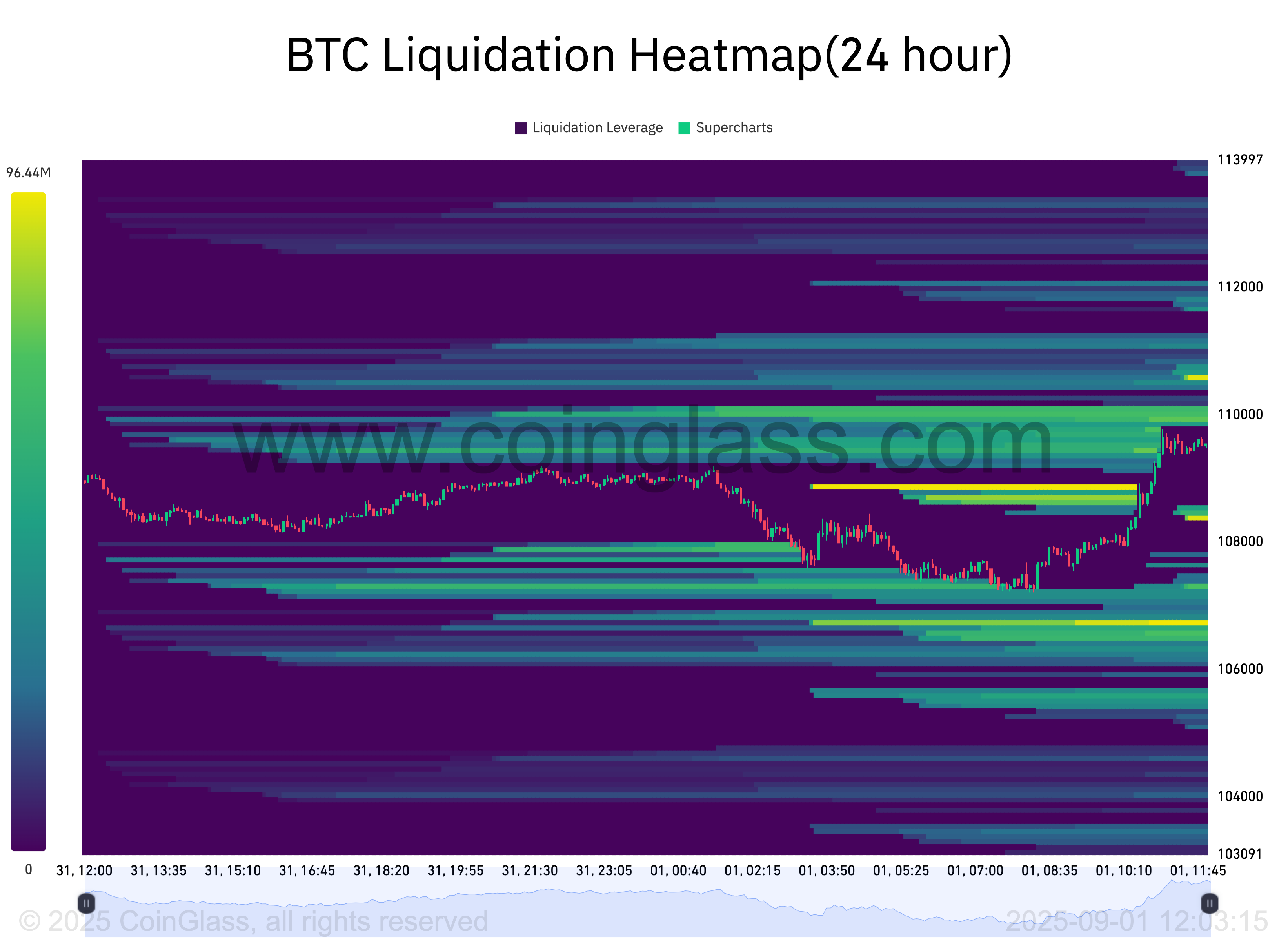

Information from CoinGlass reveals the $110,000 zone as a popular one, with cost consuming into a piece of overhead liquidity with its Monday turnaround.

Tariff concerns prevent essential United States tasks numbers

United States markets are closed on Monday for the Labor Day vacation, leaving traders to wait till Tuesday to evaluate the effect of current confusion over the federal government’s global trade tariffs.

Late recently, a federal appeals court stated President Donald Trump had actually exceeded his authority throughout the tariffs’ execution, leaving plans in limbo.

The occasion triggered a speedy response in crypto, however was revealed after futures markets were currently closed.

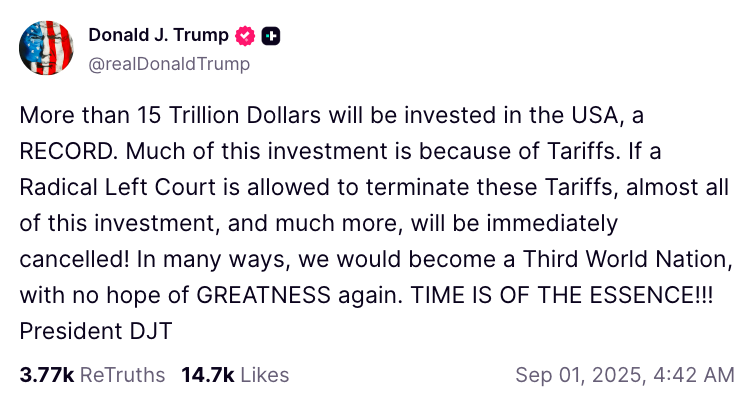

Trump consequently indicated that he would battle to keep the tariffs in location, alerting the United States would otherwise end up being a “3rd world country.”

With volatility currently past due, risk-asset traders will likewise keep track of the week’s macroeconomic information in the run-up to the Federal Reserve’s choice on rate of interest.

Joblessness claims are of essential interest today, as the Fed handles a mix of resurgent inflation markers and deteriorating labor-market hints.

” It’s everything about the labor market today,” trading resource The Kobeissi Letter summed up in an X thread.

” This will mark the recently of labor market information before the huge September Fed conference.”

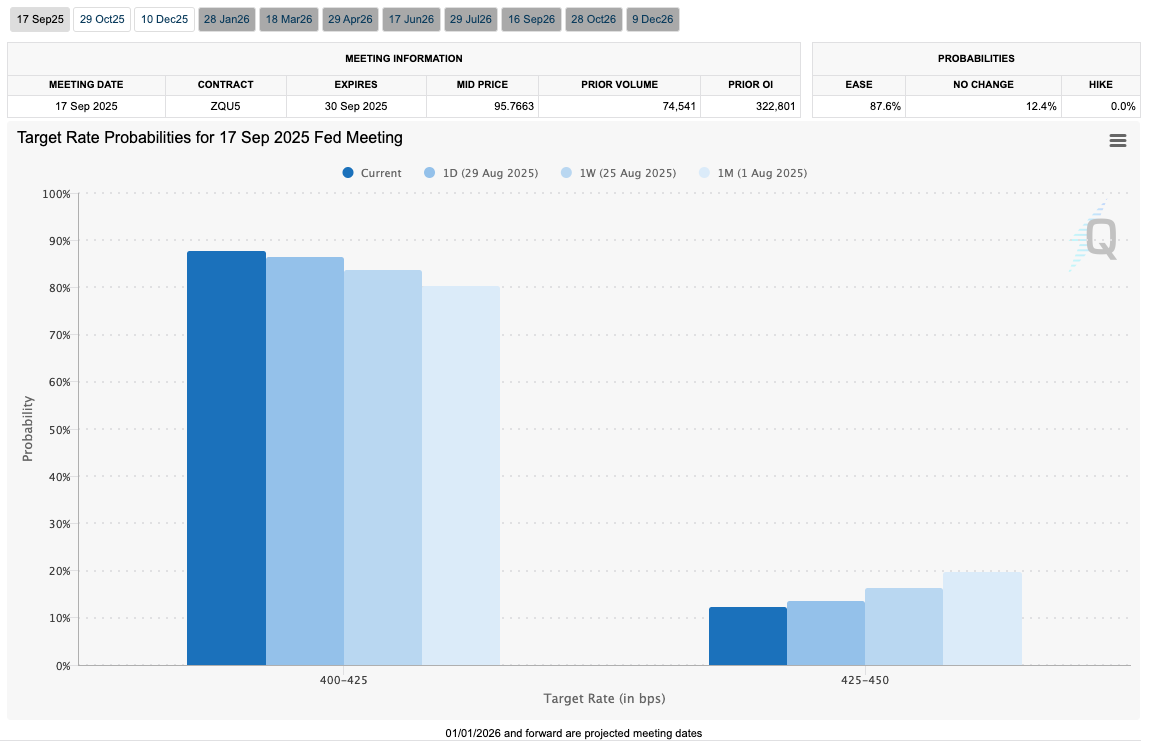

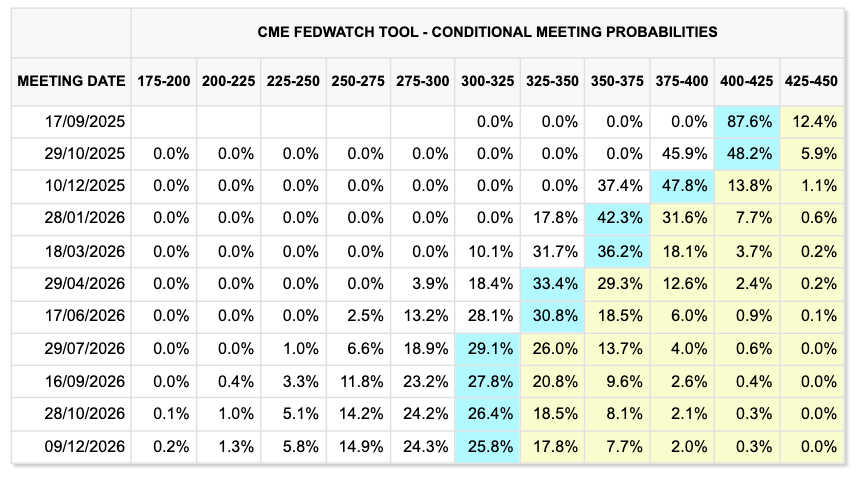

Markets stay positive that the Sept. 17 conference will provide the very first of a much-anticipated run of rate cuts, enabling liquidity to stream into threat possessions.

Information from CME Group’s FedWatch Tool reveals the chances of a 0.25% cut at over 90% Monday.

” After cutting rates by 1.0% in late 2024, the Fed has actually been on hold for the previous 8 months, trading company Mosaic Possession summed up in the most recent edition of its routine newsletter, “The marketplace Mosaic.”

” Issues over the labor market is the main driver for cutting rates, however the Fed may not get too far if inflation holds up.”

Gold obstacles all-time highs while Bitcoin droops

While Bitcoin and altcoins stall, one safe-haven is outshining in a way similar to earlier in 2025.

Gold cost reached $3,489 per ounce Monday, now simply inches from all-time highs seen on April 22.

At the time, Bitcoin was recuperating from a journey to sub-$ 75,000 lows, and on the day of gold’s brand-new record itself leapt 6.7% to close near $93,500.

Kobeissi kept in mind uncommon weekend trading activity on XAU/USD, which rose into the weekly close and continued into Labor Day.

Gold on a casual Sunday night on a 3-day weekend:

Rate cuts are entering into 3%+ inflation. pic.twitter.com/ZTOopKVte2

— The Kobeissi Letter (@KobeissiLetter) September 1, 2025

” Upside inflation surprises might annoy the Fed, however it might be a substantial driver for the next uptrend stage in gold rates,” Mosaic Possession continued.

Mosaic kept in mind that recently’s Individual Intake Expenses (PCE) index print had actually sealed gold’s most current rebound.

” That’s taking place as gold’s historic seasonality is ending up being more of a bullish tailwind also,” it included, flagging September as gold’s second-strongest month of the year over the previous half century.

Amongst gold bugs, a familiar tone has actually emerged. Peter Schiff, the popular Bitcoin doubter who is chairman and primary financial expert at financial investment advisory company Europac, highlighted the divergence in between standard and “digital” gold over the weekend.

” Gold and silver breaking out is really bearish for Bitcoin,” he informed X fans, alerting that BTC was “poised to go much lower.”

Institutional purchasers are going back

Bitcoin heading listed below its old all-time highs is beginning to take its toll on financial investment practices.

Information from UK-based financial investment company Farside Investors validated that on Friday, the United States area Bitcoin exchange-traded funds (ETFs) saw net outflows of $126.7 million.

This marked a late turn-around for what had actually otherwise been an appealing week, with institutional purchasers including BTC direct exposure regardless of BTC cost making brand-new lower lows.

Zooming out, nevertheless, the photo looks more precarious.

Charles Edwards, creator of quantitative digital possession fund Capriole Investments, reported multimonth lows in institutional acquisition.

” Institutional purchasing of Bitcoin has actually plunged to its most affordable level given that early April,” he commented together with Capriole’s own information.

The numbers however reveal that combined institutional need still equates to around 200% of the brand-new BTC supply included by miners every day.

In August, on the other hand, the ETFs saw their second-worst month on record in regards to outflows, network financial expert Timothy Peterson notes. These amounted to $750 million.

Bitcoin ETFs withstood $750 million in withdrawals in August, the 2nd worst month on record. pic.twitter.com/uTOU4wHhTr

— Timothy Peterson (@nsquaredvalue) August 30, 2025

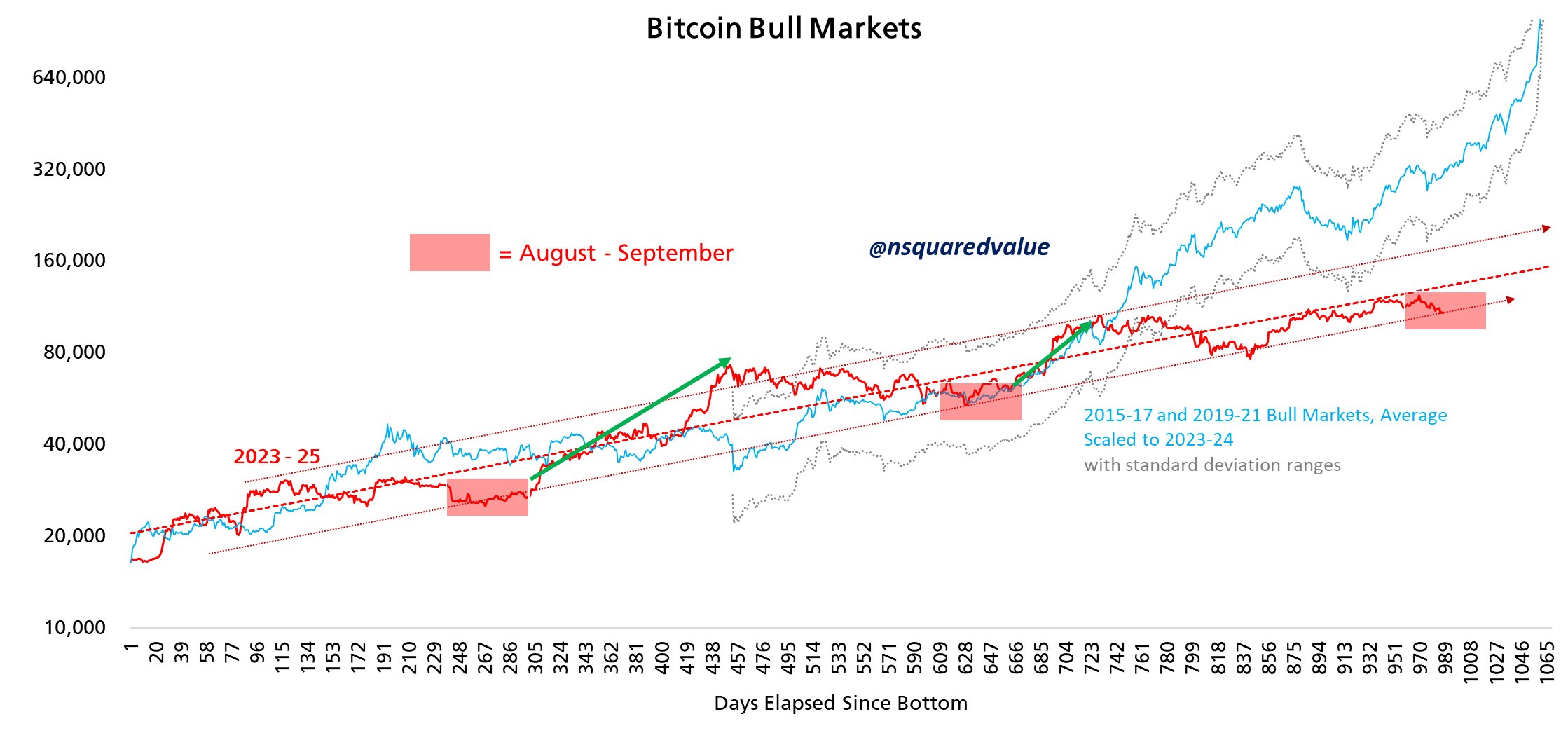

Bitcoin sees very first post-halving “red” August

Bitcoin now stands at the start of what is typically its worst-performing month.

Related: Bitcoin at threat of Labor Day crash to $105K as sellers profit from OG BTC whale danger

As Cointelegraph continues to report, September has actually seen typical returns of -3.5% for BTC/USD, with the “finest” of the previous twelve years just accomplishing 7.3% gains.

Bitcoin sealed its 4th successive “red” August with the month-to-month candle light close, topping 6.5% losses.

” Seasonality is a genuine thing,” Peterson commented together with a chart comparing Bitcoin booming market.

” Bitcoin has actually followed seasonality for 15 years; the equity markets, over 100 years. It duplicates and can’t be arbitraged away due to the fact that things like the tax year, school calendar, and weather/agricultural cycles are repaired.”

An accompanying chart highlighted the uninspired relocations seen in September, even throughout Bitcoin’s a lot of bullish years.

Financier Mark Harvey kept in mind that a red August marks a brand-new very first for Bitcoin in a post-halving year.

Harvey recommended that this was “proof that $BTC is no longer following the 4-year halving cycle provided current institutional adoption,” recommending that it was not a bearish signal.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.