ARK Invest CEO Cathie Wood thinks the White Home is undervaluing the economic downturn threat dealing with the United States economy originating from United States President Donald Trump’s tariff policies– an oversight that will ultimately require the president and Federal Reserve to enact pro-growth policies.

Speaking essentially at the Digital Property Top in New York City on March 18, Wood stated United States Treasury Secretary Scott Bessent isn’t fretted about an economic crisis.

Nevertheless, Wood stated, “We are fretted about an economic crisis,” including, “We believe the speed of cash is decreasing drastically.”

Cathie Wood speaks essentially at the Digital Property Top. Source: Cointelegraph

A downturn in the speed of cash suggests capital is altering hands less often, which is normally connected with an economic crisis, as customers and organizations invest and invest less cash.

” I believe what’s occurring, however, is that if we do have an economic crisis, decreasing GDP, that this is going to offer the president and the Fed much more degrees of liberty to do what they desire in regards to tax cuts and financial policy,” stated Wood.

Financiers think the very first domino might fall in the coming months when the Fed puts an end to its quantitative tightening up program– something wagerers on Polymarket think is 100% specific to take place before Might.

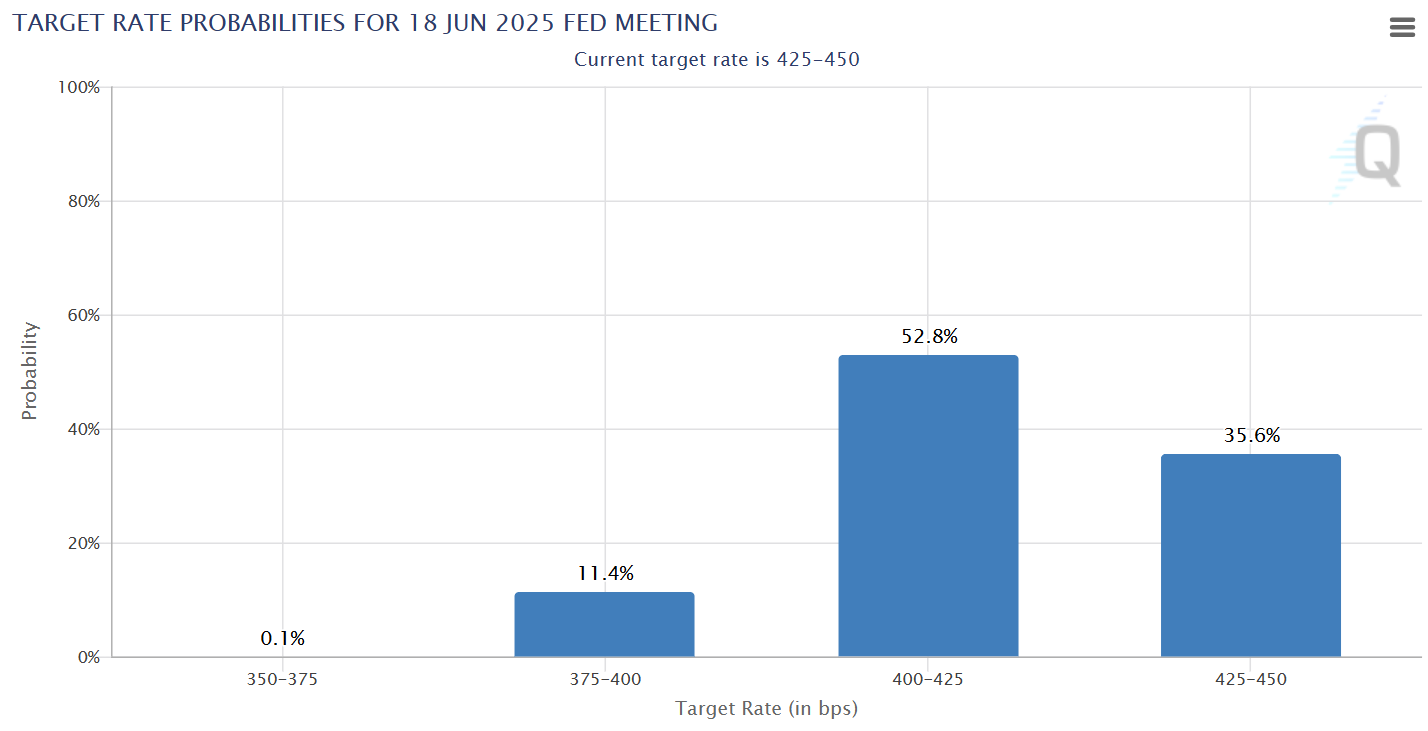

On the other hand, expectations for numerous rate cuts by the Fed in the 2nd half of the year are growing, according to CME Group’s Fed Fund futures rates.

The possibility of rates being lower than they are now by the Fed’s June 18 conference is almost 65%. Source: CME Group

Related: As Trump tanks Bitcoin, PMI uses a roadmap of what follows

Focus stays long term

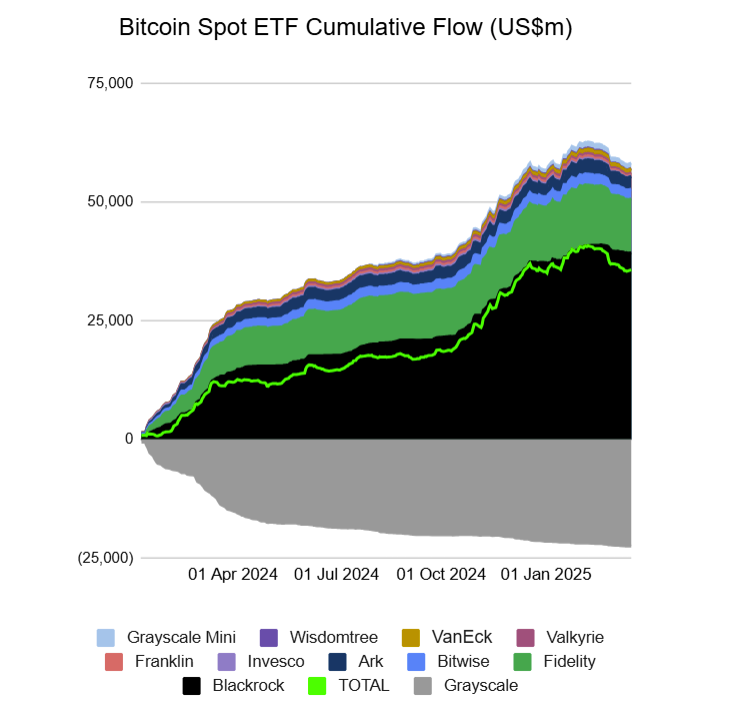

ARK and Cathie Wood have actually been active cryptocurrency financiers for several years. ARK and 21Shares’ area Bitcoin (BTC) exchange-traded fund (ETF) was authorized on Jan. 11, 2024, and presently has more than $3.9 billion in net properties, according to Yahoo Financing information.

Area Bitcoin ETFs have actually taped heavy outflows in current weeks, however the general pattern reveals financiers are holding their positions. Source: Farside

ARK likewise uses crypto portfolio services to wealth supervisors through its collaboration with Eaglebrook Advisors.

Wood informed the New york city Digital Property Top that “long-lasting development wins as we go through these trials and adversities,” describing the current market correction.

When asked if crypto properties stay an “investable arc” over the long term, Wood stated this technique was the foundation of ARK’s financial investment method.

“[W] e have actually developed out positions in more than simply the huge 3,” she stated, describing Bitcoin, Ether (ETH) and Solana (SOL).

This long-lasting arc is being supported by beneficial guidelines, which have actually enhanced the financial investment landscape drastically.

Pro-crypto policy modifications are “providing organizations the thumbs-up, and if you take a look at our research studies as long back as 2016, we composed a paper called ‘Bitcoin: Ringing the Bell for a New Property Class,’ and, yet lots of organizations simply dismissed it out of hand,” stated Wood.

Now, organizations are taking a look at ARK’s research studies and stating they “have a fiduciary duty to expose [their] customers to a brand-new property class.”

Publication: Bitcoin ETFs make Coinbase a ‘honeypot’ for hackers and federal governments– Trezor CEO