Secret takeaways

-

Bitcoin now reacts more to liquidity than to rate cuts. While rate cuts when drove crypto rallies, Bitcoin’s current cost action shows real money accessibility and run the risk of capital in the system, not simply obtaining expenses.

-

Rate of interest and liquidity are not the exact same. Rates determine the cost of cash, while liquidity shows the quantity of cash distributing. Bitcoin responds more when liquidity tightens up or loosens up, even if rates relocate the opposite instructions.

-

When liquidity is plentiful, utilize and risk-taking broaden, pressing Bitcoin greater. When liquidity agreements, utilize can loosen up rapidly, which has actually frequently accompanied sharp sell-offs throughout stocks and products.

-

Balance sheets and money streams matter more than policy headings. The Fed’s balance sheet policy, Treasury money management and cash market tools straight form liquidity and frequently affect Bitcoin more than little modifications in policy rates.

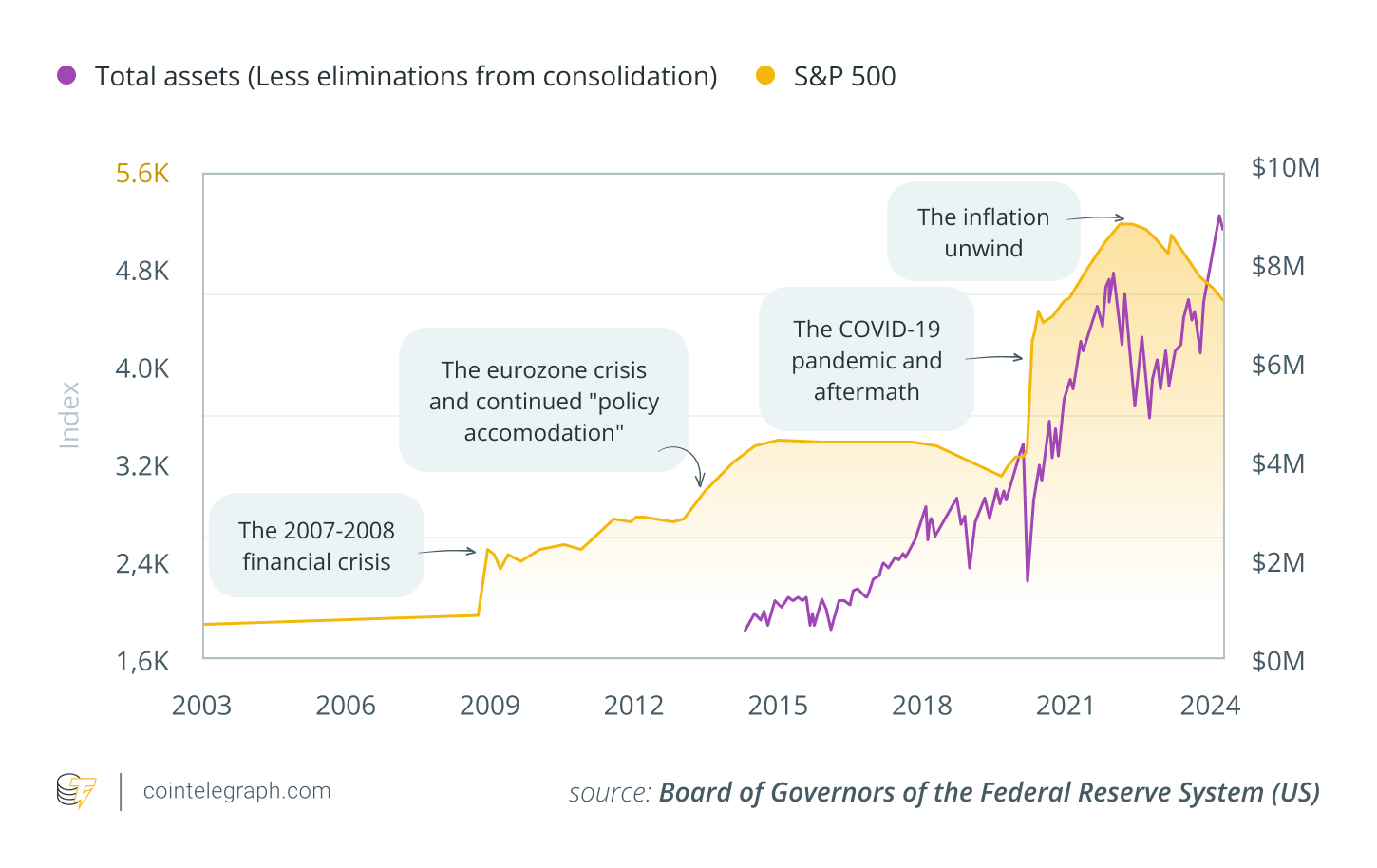

For many years, United States Federal Reserve rate of interest cuts have actually been an essential macro signal for Bitcoin (BTC) traders. Lower rates normally indicated more affordable loaning, enhanced danger cravings and triggered rallies in crypto. Nevertheless, that timeless link in between Fed rate cuts and Bitcoin trading has actually compromised in current months. Bitcoin now reacts more to real liquidity levels in the monetary system than to expectations or incremental modifications in loaning expenses.

This short article clarifies why expected rate cuts have actually not risen Bitcoin just recently. It discusses why episodes of liquidity restriction have actually activated integrated sell-offs throughout crypto, stocks and even rare-earth elements.

Rates vs. liquidity: The essential distinction

Rate of interest represent the expense of cash, while liquidity shows the amount and circulation of cash offered in the system. Markets in some cases puzzle the 2, however they can diverge dramatically.

The Fed may decrease rates, yet liquidity might still contract if reserves are drained pipes in other places. For example, liquidity can tighten up through quantitative tightening up or the United States Department of the Treasury’s actions. Liquidity can likewise increase without rate cuts through other inflows or policy shifts.

Bitcoin’s cost action progressively tracks this liquidity pulse more carefully than incremental rate changes.

Did you understand? Bitcoin frequently responds to liquidity modifications before conventional markets do, making it a track record amongst macro traders as a “canary property” that signifies tightening up conditions ahead of more comprehensive equity sell-offs.

Why rate cuts no longer drive Bitcoin as highly

Numerous elements have actually decreased the effect of rate cuts:

-

Heavy pre-pricing: Markets and futures frequently prepare for cuts well beforehand, pricing them in long before they occur. By the time a cut takes place, property costs might currently show it.

-

Context matters: Cuts driven by financial tension or monetary instability can accompany de-risking. In such environments, financiers tend to minimize direct exposure to unstable properties even if rates are falling.

-

Cuts do not ensure liquidity: Continuous balance sheet overflow, big Treasury issuance or reserve drains pipes can keep the system constrained. Bitcoin, as an unstable property, tends to respond rapidly to these pressures.

Bitcoin as a liquidity-sensitive, high-beta property

Bitcoin’s purchasers count on utilize, offered danger capital and general market conditions. Liquidity affects these elements:

-

In environments with plentiful liquidity, utilize streams easily, volatility is more endured, and capital shifts towards riskier properties.

-

When liquidity is constrained, utilize loosens up, liquidations waterfall, and danger cravings disappears throughout markets.

This vibrant recommends Bitcoin acts less like a policy rate trade and more like a real-time gauge of liquidity conditions. When money ends up being limited, Bitcoin tends to fall in tandem with equities and products, no matter the Fed funds rate.

What lies behind liquidity

To comprehend how Bitcoin responds in different circumstances, it assists to look beyond rate choices and into the monetary pipes:

-

Fed balance sheet: Quantitative tightening up (QT) diminishes the Fed’s holdings and pulls reserves from banks. While markets can deal with early QT, it ultimately constrains risk-taking. Signals about possible balance sheet growth can sometimes affect markets more than little modifications in policy rates.

-

Treasury money management: The United States Treasury’s money balance serves as a liquidity valve. When the Treasury restores its money balance, cash vacates the banking system. When it draws the balance down, liquidity is launched.

-

Cash market tools: Facilities like the over night reverse repo (ON RRP) soak up or launch money. Diminishing buffers make markets more reactive to little liquidity shifts, and Bitcoin signs up those modifications quickly.

Did you understand? A few of Bitcoin’s sharpest intraday relocations have actually happened on days without any Fed statements at all however accompanied big Treasury settlements that silently drained pipes money from the banking system.

Why current sell-offs felt macro, not crypto-specific

Recently, Bitcoin drawdowns have actually lined up with decreases in equities and metals, indicating broad liquidity tension instead of separated crypto concerns. This cross-asset synchronization highlights Bitcoin’s combination into the worldwide liquidity structure.

-

Fed management and policy subtleties: Moves in anticipated Fed management, especially views on balance sheet policy, include intricacy. Uncertainty towards aggressive growth signals tighter liquidity ahead, which impacts Bitcoin costs more extremely than little rate tweaks.

-

Liquidity surprises load a larger punch: Liquidity shifts are less foreseeable and transparent, and markets are not as proficient at expecting them. They rapidly impact utilize and positioning. Rate modifications, nevertheless, are commonly disputed and designed. Unforeseen liquidity drains pipes can capture traders off guard, with Bitcoin’s volatility amplifying the result.

How to consider Bitcoin’s macro level of sensitivity

Over extended periods, rate of interest form assessments, discount rate rates and chance expenses. In the present program, nevertheless, liquidity sets the near-term borders for danger cravings. Bitcoin’s response ends up being more unstable when liquidity shifts.

Secret things to keep track of consist of:

-

Reserve bank balance sheet signals

-

Treasury money streams and Treasury General Account (TGA) levels

-

Tension or reducing signals in cash markets.

Rate cut stories can form belief, however sustained purchasing depends upon whether liquidity supports risk-taking.

The more comprehensive shift

Bitcoin was long viewed as a hedge versus currency debasement. Today, it is progressively considered as a real-time indication of monetary conditions. When liquidity broadens, Bitcoin advantages; when liquidity tightens up, Bitcoin tends to feel the discomfort early.

In current durations, Bitcoin has actually reacted more to liquidity conditions than to rate cut headings. In the present stage of the Bitcoin cycle, numerous experts are focusing less on rate instructions and more on whether system liquidity suffices to support risk-taking.

Cointelegraph preserves complete editorial self-reliance. The choice, commissioning and publication of Functions and Publication material are not affected by marketers, partners or business relationships.