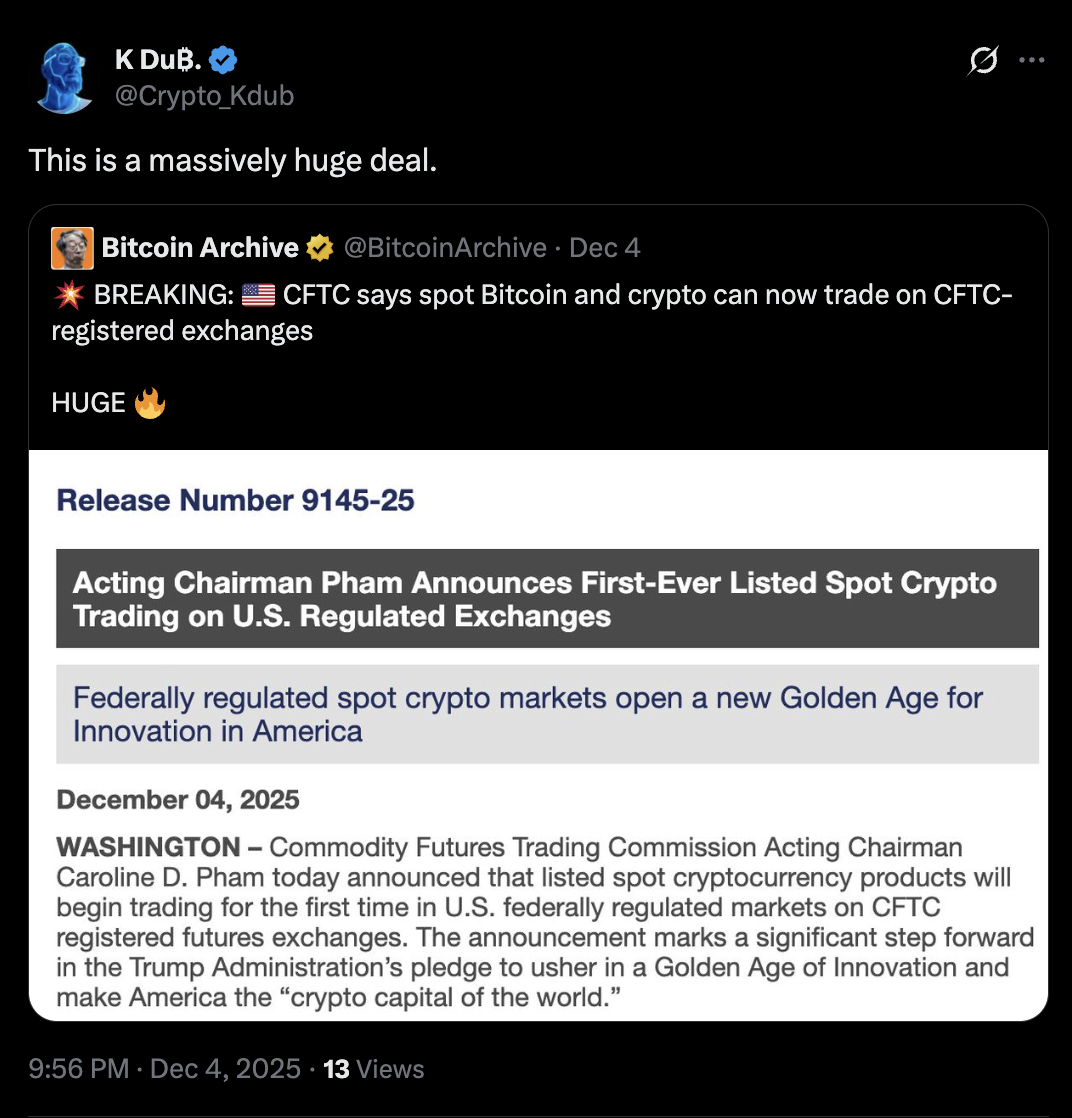

On Thursday, the United States Product Futures Trading Commission (CFTC) revealed that area Bitcoin (BTC) and Ether (ETH) items will start trading for the very first time on its authorized futures exchanges.

Here are 3 reasons that this is a huge offer for the leading 2 cryptocurrencies heading into 2026.

Secret takeaways:

-

CFTC oversight offers BTC and ETH gold-like authenticity, unlocking to bigger institutional circulations.

-

Managed United States trading increases liquidity, cuts volatility, and moves crypto activity back onshore.

Bitcoin and Ethereum can scale like gold

Among the greatest historic parallels for the CFTC choice originated from the gold market.

When gold was officially opened to trading on controlled United States futures exchanges in the 1970s, the shift changed it from a fragmented, over the counter product into a worldwide acknowledged financial investment possession.

Liquidity focused on COMEX, organizations went into for the very first time, and transparent rate discovery produced a structure for long-lasting capital circulations.

Because its COMEX launching, area gold rates acquired 4,000%, highlighting how regulative clearness can improve a property’s market trajectory.

The CFTC positioned Bitcoin and Ethereum under a comparable product structure with its newest statement, hence eliminating the United States Securities and Exchange Commission’s (SEC) issuer-focused requirements.

It likewise filled an enduring space: United States traders might access crypto on platforms like Coinbase and Kraken however did not have controlled area utilize, deep liquidity tools, or exchange-level securities.

That lack required liquidity offshore, with current 2025 information revealing Binance recording approximately 41.1% of worldwide area activity, far ahead of US-based places.

With controlled area markets now authorized locally, Bitcoin and Ethereum get the exact same structural structure that assisted gold develop from a specific niche hedge into a fully grown, internationally traded possession class.

CFTC enhances institutional direct exposure for BTC, ETH

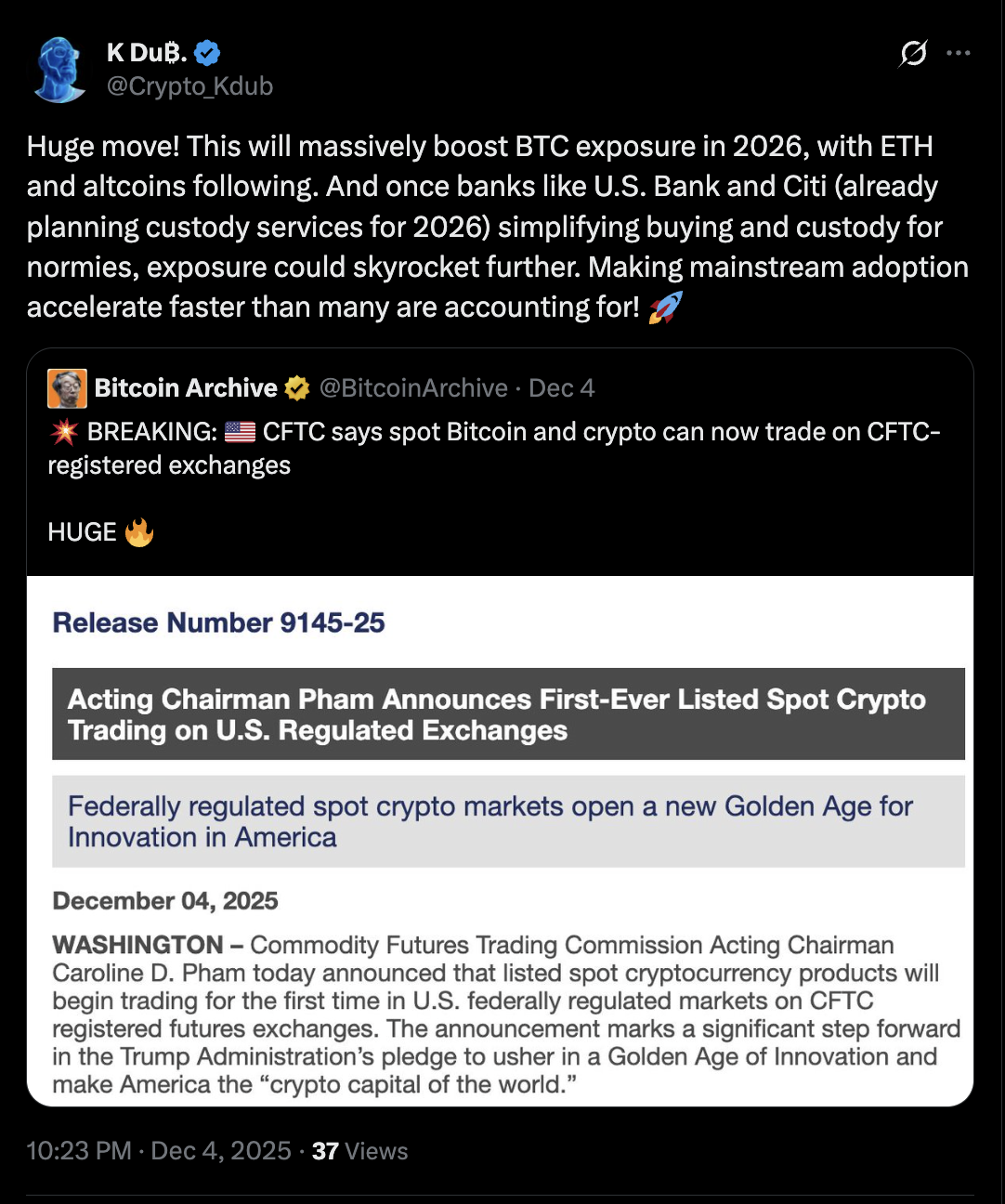

Pension funds, banks, and hedge funds that formerly rested on the sidelines can now deal with Bitcoin and Ethereum like other CFTC-recognized products, with standardized guidelines, monitoring, and custody requirements.

Related: Can Bitcoin truly be a shop of worth? What pension funds are beginning to find

86% of institutional financiers currently have or prepare to get crypto direct exposure, and the majority of increased their allowances in 2024 as United States guideline enhanced, according to a joint study carried out by Coinbase and EY-Parthenon in January.

A bulk likewise chose accessing crypto through controlled financial investment rails, such as product exchanges or ETFs, instead of overseas places.

Following the CFTC choice, organizations can now access Bitcoin and Ethereum through controlled exchanges, audited custody, and monitored prices, setting the phase for more powerful, more resilient mainstream adoption.

Bitcoin, Ether might see much better liquidity development

Historic proof recommended that products broadened quickly after debuting on controlled trading places.

A case in point is the launch of WTI oil futures in 1983, whose trading blew up from simply 3,000 agreements in the very first month to over 100,000 monthly within a year, and after that to over 2 million agreements monthly by the late 1980s.

Today, WTI typically surpasses a million agreements in everyday volume, a testimony to how guideline can cultivate gigantic market development.

Bitcoin and Ethereum can witness a comparable liquidity increase, with CFTC-approved area trading most likely to bring in much more United States traders and market makers, hence increasing order book depth and minimizing spreads.

Deep liquidity and robust volume on United States soil can likewise lower volatility gradually, as big buy or offer orders are more quickly soaked up.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding. While we aim to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might consist of positive declarations that go through threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.