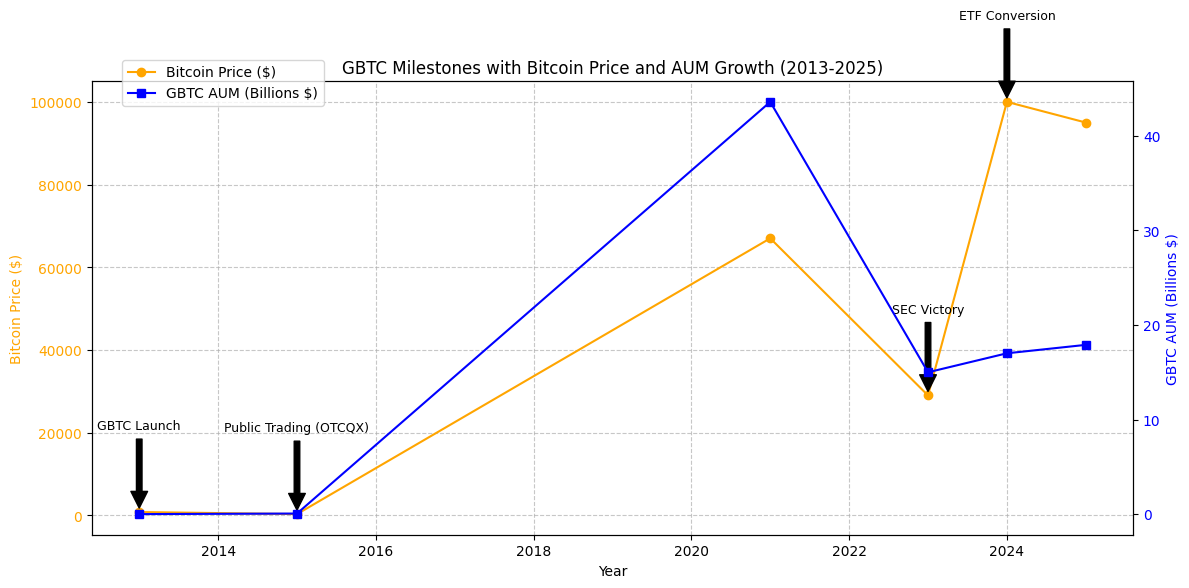

In the record of monetary history, couple of organizations have actually dealt with the tempests of competitors with the unfaltering willpower of Grayscale Bitcoin Trust (GBTC). Born in 2013 as a personal positioning, GBTC originated managed Bitcoin financial investment, approving financiers access to Bitcoin’s (BTC) meteoric increase without the dangers of digital wallets or uncontrolled exchanges.

On Jan. 11, 2024, it transitioned into an area Bitcoin ETF following a landmark success versus the SEC. This marked a turning point with the SEC’s view that ETFs can use lower cost ratios and boosted tax effectiveness compared to standard funds.

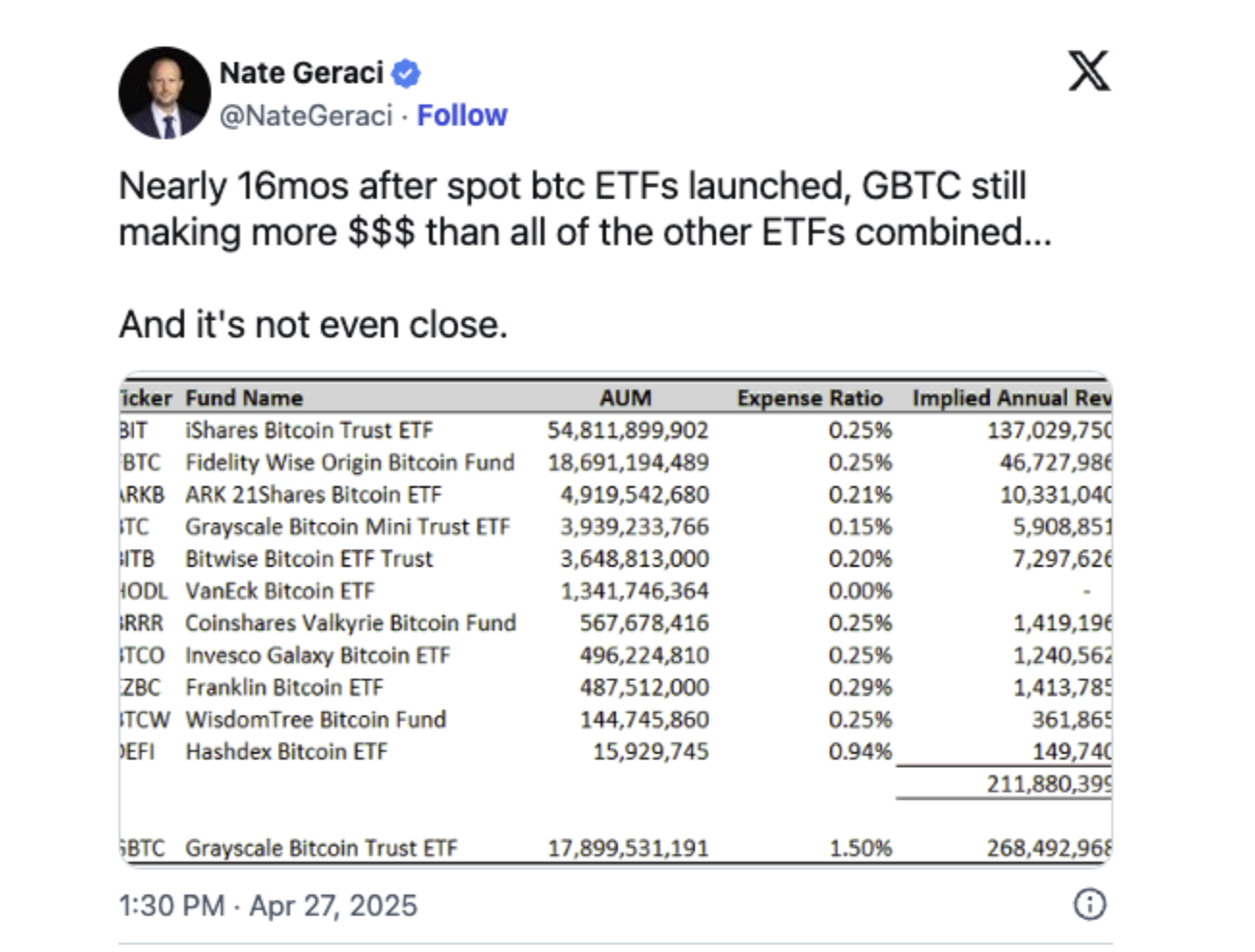

Even still, GBTC’s monetary strength shines, creating $268.5 million in yearly income, exceeding the $211.8 countless all other United States area Bitcoin ETFs integrated, regardless of losing over half its holdings with $18 billion in outflows because early 2024. This is no short lived accomplishment of inertia.

The numbers inform a tale of paradox. BlackRock’s iShares Bitcoin Trust (IBIT), with $56 billion in properties under management (AUM) and a 0.25% cost, produced $137 million in 2024 while attaining $35.8 billion in inflows and $1 billion in day-to-day trading volume within weeks of launch. On the other hand, GBTC’s 1.5% cost ratio, as much as 7 times greater than rivals, fuels its income lead, although it bled $17.4 billion in outflows, with a record single-day loss of $618 million on March 19, 2024, driven by financiers going after lower costs or taking advantage of the trust’s historic discount rate to net possession worth (NAV), which dropped from 50% to near no by July 2024.

This clash of income supremacy and capital flight needs analysis, revealing the complex dance of financier psychology, market characteristics and Grayscale’s computed strength.

Yet, GBTC’s $18 billion in AUM and its capability to create $268.5 million regardless of considerable outflows indicate a much deeper story: tax friction and institutionalized inertia. The failure of business, household workplaces and other organizations to rapidly pivot due to tax barriers and business instructions bubbles to the surface area. The $100-billion overall area Bitcoin ETF market indicate the stakes of this contest, with Grayscale’s income supremacy poised to progress as competitors magnifies.

Related: The belief engine of Bitcoin ETFs is rewiring market structure

What sustains GBTC’s income crown in this crucible of competitors? Is it the math of high costs used to a still-formidable AUM, the commitment of battle-scarred financiers, or the hidden weight of tax frictions binding them to their positions?

As we penetrate this concern, we discover the mechanics of GBTC’s supremacy and the more comprehensive currents forming the future of crypto financial investment. The response depends on a powerful mix of history, method and the unyielding faith of financiers in a titan that, versus all chances, declines to yield.

Grayscale’s high-fee income engine

At the core of GBTC’s income supremacy lies its 1.5% cost ratio, an imposing figure next to rivals like IBIT and FBTC (both 0.25%), Bitwise (0.24%) and Franklin Templeton (0.19%).

Applied to $17.9 billion in AUM, this cost yields $268.5 million each year, eclipsing the $211.8-million integrated income of all other United States area Bitcoin ETFs, which handle $89 billion jointly.

ETF Shop president Nate Geraci mentioned on X, “GBTC still making more [money] than all of the other ETFs integrated … And it’s not even close.” This math edge withstands regardless of $21 billion in outflows because January 2024, consisting of a day-to-day typical loss of $89.9 million, highlighting the large power of high costs on a significant possession base.

The cost structure is both GBTC’s bastion and its Achilles’ heel. Before its ETF conversion, GBTC charged 2%, a rate validated by its monopoly as the sole United States lorry for Bitcoin direct exposure within standard portfolios. Post-conversion, the 1.5% cost draws ire, with Bryan Armour, director of passive techniques research study for Morningstar, anticipating continual outflows as financiers flock to less expensive options.

Grayscale’s counterstroke was the Grayscale Bitcoin Mini Trust (BTC), introduced in March 2025 with a 0.15% cost (the most affordable amongst United States area Bitcoin ETPs). Seeded with 10% of GBTC’s Bitcoin holdings ($ 1.7 billion AUM), the Mini Trust has actually drawn $168.9 million in inflows, targeting cost-conscious financiers. Nevertheless, the Mini Trust’s lower income per dollar of AUM ($ 2.55 million each year) fades next to GBTC’s $268.5 million, enhancing the latter’s supremacy.

Grayscale’s double method (high-fee GBTC for income, low-fee Mini Trust for retention) exposes a nuanced defense, however the fortress of GBTC’s costs stays unbreached, its income crown protect in the meantime.

Tradition and commitment

Beyond the math of costs, GBTC’s income supremacy rests on its storied tradition, the strong commitment it influences and the powerful tax frictions that tether financiers to its fold. Considering that 2013, Grayscale has actually been the standard-bearer of managed Bitcoin financial investment, conquering regulative tempests to end up being the very first openly traded Bitcoin fund in 2015 and the biggest area Bitcoin ETF by AUM ($ 26 billion) upon its NYSE Arca listing in 2024.

Its August 2023 legal success versus the United States SEC, which obliged the approval of area Bitcoin ETFs, strengthened its stature as a leader. This tradition resonates with institutional and recognized financiers, much of whom went into GBTC throughout its personal positioning stage or at high NAV discount rates, creating a bond that withstands.

Tax factors to consider form a quiet however magnificent anchor. Numerous early GBTC financiers acquired shares at low rates, with Bitcoin trading at $800 in 2013 compared to the mid-$ 90,000 variety by Might 2025. This approximately 120-fold boost has actually produced significant latent capital gains, making sales expensive.

Related: Bitcoin rate recuperates, Ethereum RWA worth up 20%: April in charts

A financier who acquired 100 shares of GBTC at $10 in 2015 and now sees them valued at $400 each would be resting on a $39,000 capital gain. Offering those shares to move into a lower-fee ETF like IBIT or FBTC might set off a tax expense of $7,800 at the 20% long-lasting capital gains rate usually used to high-net-worth people or $5,850 at the 15% rate for others. This sort of taxable occasion frequently prevents redemptions, especially for long-lasting holders in taxable accounts.

On the other hand, for those holding GBTC in tax-advantaged lorries such as Individual retirement accounts or 401( k) s, gains can be postponed and, when it comes to Roth IRAs, prevented completely, making GBTC relatively more appealing for tradition financiers unwilling to change.

Mental aspects enhance these barriers. Loss hostility (the hesitation to recognize taxable gains) and commitment to Grayscale’s brand name discourage financiers from deserting a car that weathered Bitcoin’s volatility. The closure of the NAV discount rate (from 50% to near no in July 2024) stimulated outflows as arbitrageurs squandered. Still, core holders stay, boosted by rely on Grayscale’s custodianship by means of Coinbase Custody, which protects $18.08 billion in AUM in Might 2024. Its financier base, covering crypto-native organizations, hedge funds and retail customers by means of platforms like Fidelity and Schwab, values its simpleness (no crypto wallets needed) and regulative pedigree.

While IBIT and FBTC draw brand-new capital with lower costs and liquidity, GBTC keeps a specific niche amongst those who see it as a battle-tested titan. Previous Grayscale CEO Michael Sonnenshein’s claim that outflows are reaching “balance” recommends a supporting core, with tax frictions and tradition strengthening retention. In a market driven by development, GBTC’s history, boosted by tax barriers and financier faith, is its guard, securing its income crown versus the unrelenting advance of more recent competitors.

Publication: ZK-proofs are bringing clever agreements to Bitcoin– BitcoinOS and Starknet