Bitcoin (BTC) cost has actually been combining within an approximately $5,500 variety considering that March 9 as the $84,000 level represents stiff overhead resistance.

Information from Cointelegraph Markets Pro and Bitstamp reveals BTC cost oscillating in between $78,599 and $84,000, as displayed in the chart below.

BTC/USD day-to-day chart. Source: Cointelegraph/ TradingView

Secret reasons that Bitcoin cost stays flat today consist of:

-

Trump’s trade war stress triggering unpredictability in the market.

-

Deteriorating need for Bitcoin and neutral financing rates.

-

BTC cost stays pinned listed below the 200-day SMA.

More comprehensive financial unpredictability, compromising need

Bitcoin’s cost stagnancy is partly due to the wider financial and geopolitical elements that are presently at play.

What to understand:

-

Trump’s brand-new policies, such as his suggested trade tariffs on Mexico and Canada, have actually unnerved the marketplace.

-

Financiers, cautious of inflation issues and a prospective tariff war, are playing it safe properties like Bitcoin.

-

As Cointelegraph just recently reported, Bitcoin’s rally post-Trump’s November election has actually slowed amidst a weakening international economy.

-

This has actually led to weaker need for Bitcoin, according to Glassnode.

For example, the expense basis of 1w– 1m short-term holders flattened out above that of the longer-term holders (1m– 3m) in Q1, “marking an early indication of compromising need in the instant term.”

Associated: Bitcoin cost drops 2% as falling inflation increases United States trade war worries

Bitcoin’s drop listed below the $95,000 level saw the 1w– 1m expense basis slide listed below the 1m– 3m expense basis, “verifying a shift into net capital outflows.”

Glassnode kept in mind:

” This turnaround shows that macro unpredictability has actually startled need, minimizing brand-new inflows … and recommends that brand-new purchasers are now reluctant to take in sell-side pressure, strengthening the shift from post-ATH ecstasy into a more careful market environment.”

Bitcoin STH capital circulation. Source: Glassnode

Up until the existing pattern modifications due to macroeconomic tailwinds, such as Fed rate cuts, Bitcoin might have a hard time to break out of the existing variety, leaving it susceptible to pullbacks towards $70,000.

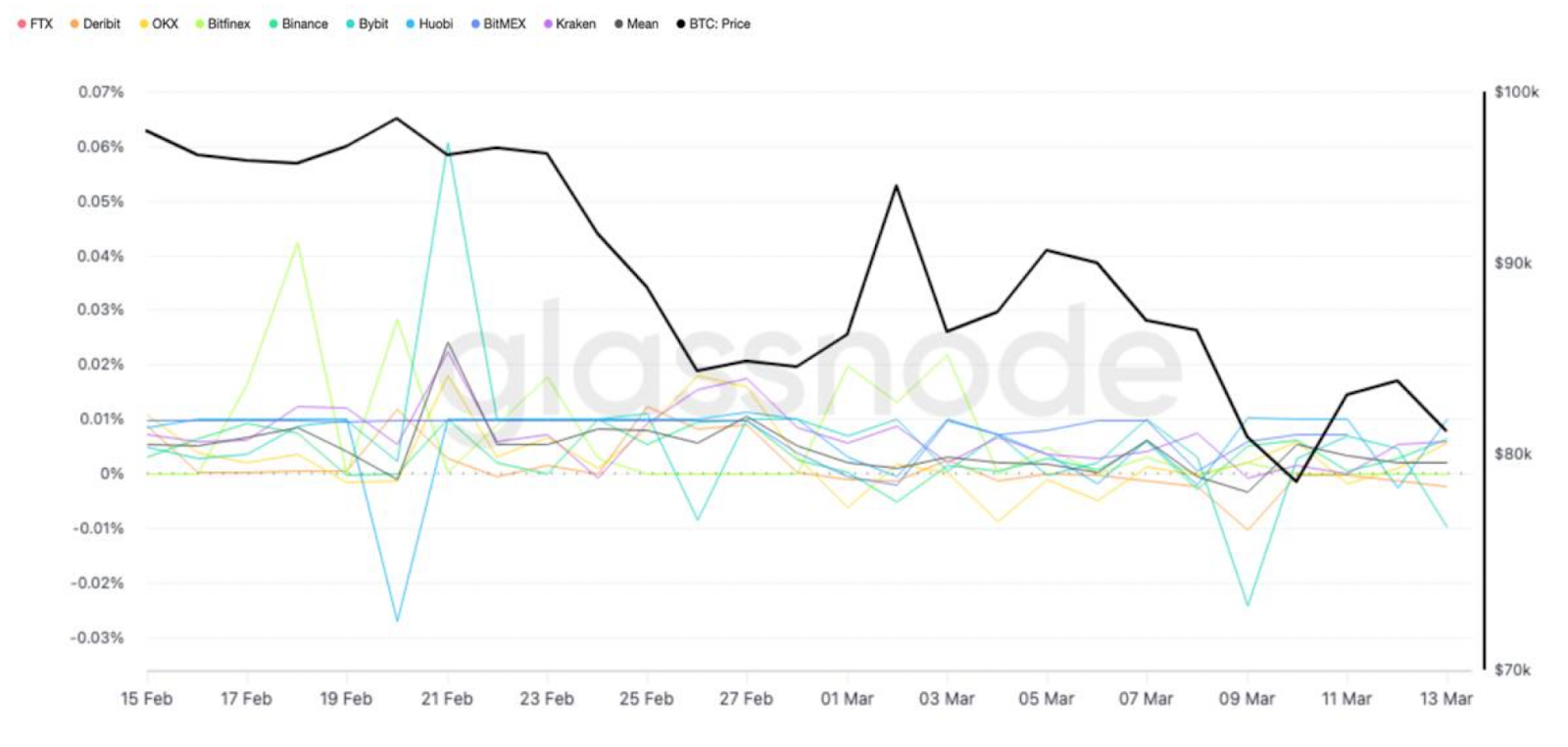

Another clear signal of Bitcoin’s stagnancy remains in the continuous futures financing rates. BTC financing rates, which show the expense of holding long or brief positions in crypto futures, are hovering near 0%, showing increasing indecisiveness amongst traders.

Bitcoin continuous futures financing rates throughout all exchanges. Source: Glassnode

Without speculative fuel, Bitcoin is having a hard time to relocate either instructions, leaving its cost stuck in a tight variety as traders await the next driver.

Bitcoin cost deals with stiff resistance on the benefit

Bitcoin likewise trades listed below essential resistance locations, as displayed in the chart listed below:

-

On March 9, BTC fell listed below the 200-day easy moving average (SMA) at $83,736.

-

This trendline has actually suppressed the current efforts for a continual healing.

BTC/USD day-to-day chart. Source: Cointelegraph/ TradingView

Popular crypto expert Daan Crypto Trades states that the 200-day SMA at around $83,700 and the 200-day EMA at $86,000 are essential levels as they are “strong indications of the mid/long term pattern and total strength of the marketplace.”

To put it simply, failure to produce a definitive close above the 200-day SMA and turning it into a brand-new assistance level might result in a longer debt consolidation duration for Bitcoin cost.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.