Secret takeaways:

-

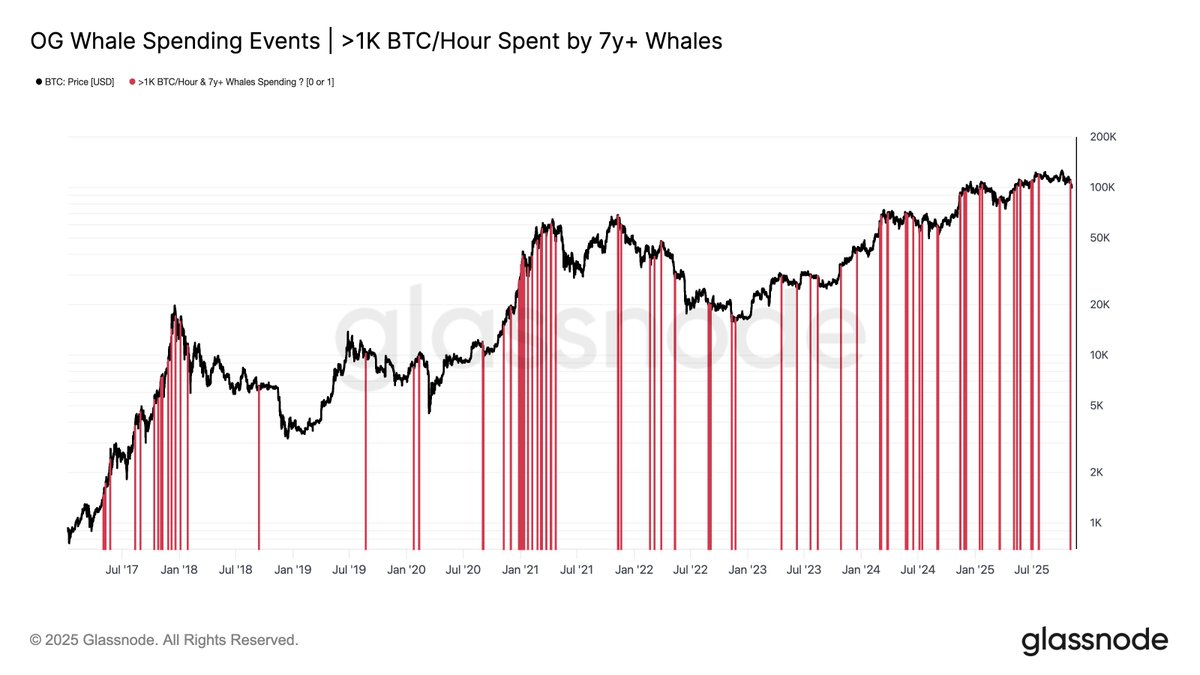

Older Bitcoin whales are offering greatly, costs over 1,000 BTC/hour in 2025.

-

Bitcoin’s bear pennant pattern jobs a prospective drop to $89,600.

Bitcoin (BTC) was at threat of additional losses as the earliest whales continued to invest their BTC stash.

Capriole Investments co-founder Charles Edwards stated that “very whales are squandering of Bitcoin,” in a post on X, raising issues about the possible effect on BTC’s rate.

Bitcoin OG whales keep discarding

The BTC/USD set trades 18.7% listed below its all-time high of $126,000 reached on Oct. 6, a drawdown that has actually been partially credited to big outflows from old whale wallets.

While some view this as a regular dip for bull cycles, others argue that the correction has actually been sustained by offering from long-lasting holders.

Related: New Bitcoin highs might take 2 to 6 months however information states it deserves the wait: Analysis

Edwards shared a chart showing the level of onchain costs from “OG” Bitcoin holders– those who have actually held their properties for 7 years or more.

The chart includes 2 color-coded classifications: orange for $100 million dumps and red for $500 million dumps, plainly showing the scale of selling by these long-lasting financiers. This selling started in November 2024 and magnified in 2025.

” The chart is extremely vibrant in 2025,” Edwards stated, including:

” OGs are squandering.”

Extra information from Glassnode reveals that occasions where these whales have actually been investing more than 1,000 BTC per hour have actually been relentless considering that January.

” The crucial difference in this cycle is that these OG whale high-spending occasions took place more often throughout, signalling relentless circulation.”

One such example is “Bitcoin OG Owen Gunden,” highlighted by onchain analytics platform Lookonchain. This whale has actually moved 3,600 BTC, worth about $372 million, on Saturday, with “500 $BTC($ 51.68) currently transferred to Kraken.”

Bitcoin OG Owen Gunden keeps discarding $BTC!

Today, he moved 3,600.55 $BTC($ 372M)– with 500 $BTC($ 51.68 M) currently transferred to #Kraken, and the staying 3,100.55 $BTC ($ 320.46 M) most likely heading there in the coming days.https:// t.co/ sGMrheaZl9https:// t.co/ lGpGzZiXmE pic.twitter.com/dsZzCKyvc5

— Lookonchain (@lookonchain) November 8, 2025

In spite of this selling pressure, the marketplace has actually displayed uncommon durability, according to Willy Woo, who argues that “what makes up an ‘OG dump’ is just BTC vacating an address that has actually been untouched for 7 years.”

Willy Woo recommended that BTC transfers by long-lasting holders might be meant for relocating to taproot addresses for quantum-safe deals. He keeps in mind that these might likewise include custody rotations or seeding BTC treasury business, instead of real sales.

Bitcoin “bear pennant” targets $90,000

Information from Cointelegraph Markets Pro and TradingView reveals BTC trading inside a bear pennant, recommending that a considerable down relocation might be next.

A bear pennant is a down extension pattern that takes place after a considerable drop, followed by a combination duration at the lower end of the rate variety.

A break listed below the pennant’s assistance line at $100,650 might possibly cause the next leg down for Bitcoin, determined at $89,600 or a 12% decrease from its existing rate level.

As Cointelegraph reported, Bitcoin should close the week above the 50-week EMA, presently at $100,900, to prevent a much deeper correction towards $92,000 or lower.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.