The State of Wisconsin Financial Investment Board (SWIB), which manages the state’s retirement funds, unloaded its shares in BlackRock’s iShares Bitcoin Trust ETF (IBIT) throughout the very first quarter, filings reveal.

The Wisconsin Financial investment Board reported no area Bitcoin ETF positions in its 13F filing to the United States Securities and Exchange Commission on Might 15, liquidating all 6,060,351 IBIT shares it reported holding from the previous quarter.

The more than 6 million IBIT shares deserve around $355.6 million at existing costs.

SWIB was among the very first state mutual fund to offer Bitcoin direct exposure to United States retired people when it purchased $164 million worth of Bitcoin ETFs in Q1 2024– the very same quarter the Bitcoin items released.

The mass sell-off comes just a quarter after SWIB reported extra purchases of IBIT shares in Q4, while reallocating all 1 million shares kept in the Grayscale Bitcoin Trust (GBTC) to IBIT.

SWIB reported handling more than $166 billion worth of properties at the end of 2024, indicating the Bitcoin ETFs represented around 0.2% of SWIB’s whole portfolio before it offered them off.

Related: Jim Chanos takes opposing bets on Bitcoin and Technique

On The Other Hand, Abu Dhabi sovereign wealth fund Mubadala purchased another 491,439 shares of IBIT in Q1, according to its most current 13F filing.

Its purchases brought Mubadala’s overall IBIT shares to 8,726,972 since March 31, worth around $512 million at existing costs.

IBIT has actually been on a tear

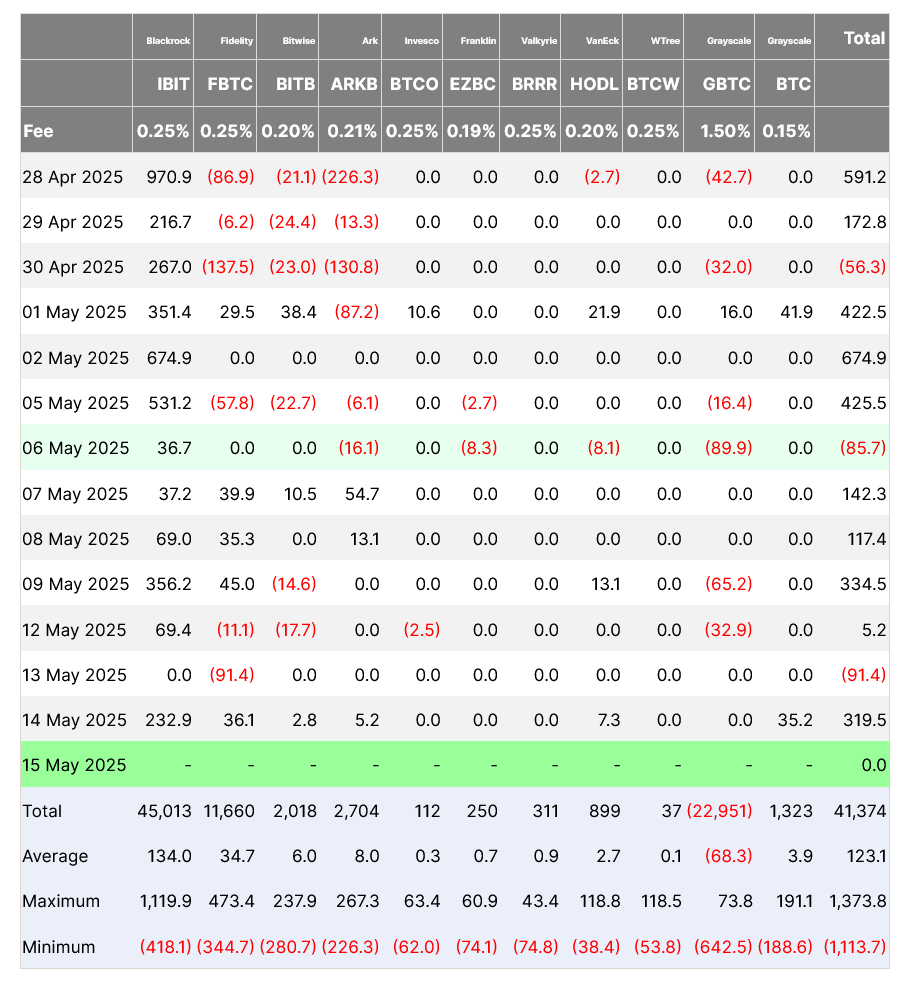

IBIT’s net inflows exceeded the $45 billion mark on Might 14 after taping a net inflow of $232.9 million, Farside Investors information programs.

IBIT’s excellent 20-day streak of net inflows pertained to an end the day in the past– Might 13– when it signed up a “0” inflow on the day. The BlackRock-issued Bitcoin item still hasn’t seen an outflow considering that April 9– more than 5 weeks back.

The Fidelity Wise Origin Bitcoin Fund (FBTC) and the ARK 21Shares Bitcoin ETF (ARK) path IBIT in all-time net inflows at $11.6 billion and $2.7 billion, respectively.

Publication: Crypto wished to topple banks, now it’s becoming them in stablecoin battle