Regardless of strong institutional need, Bitcoin (BTC) has actually had a hard time to recover the $100,000 level for the previous 50 days, leading financiers to question the factors behind the bearishness regardless of an apparently favorable environment.

This rate weak point is especially appealing provided the United States Strategic Bitcoin Reserve executive order provided by President Donald Trump on March 6, which permits BTC acquisitions as long as they follow “budget-neutral” methods.

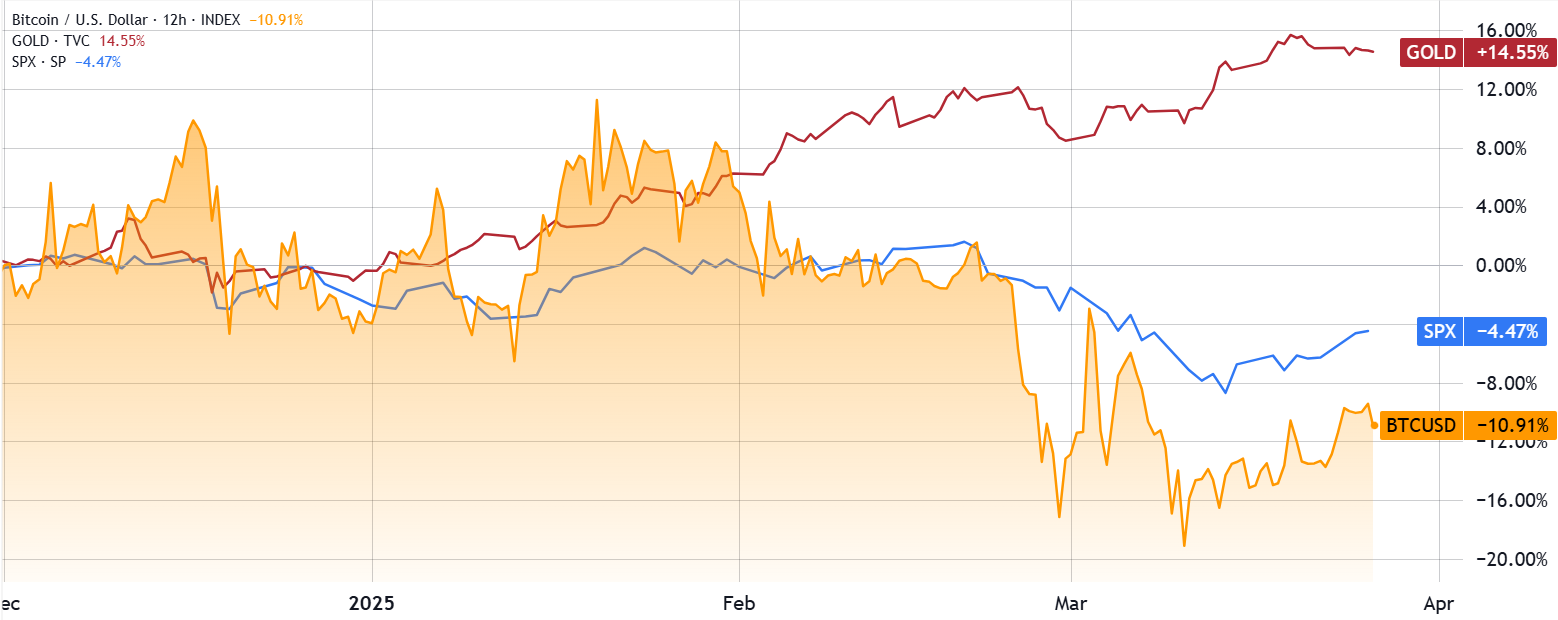

Bitcoin stops working to keep up with gold’s returns regardless of favorable news circulation

On March 26, GameStop Corporation (GME), the North American computer game and customer electronic devices seller, revealed strategies to assign a part of its business reserves to Bitcoin. The business, which was on the brink of insolvency in 2021, effectively profited from a historical brief capture and handled to protect an excellent $4.77 billion in money and equivalents by February 2025.

Biggest business Bitcoin holdings. Source: BitcoinTreasuries.NET

A growing variety of US-based and worldwide business have actually followed Michael Saylor’s Technique (MSTR) playbook, consisting of the Japanese company Metaplanet, which just recently designated Eric Trump, child of United States President Donald Trump, to its recently developed tactical board of consultants. Likewise, the mining corporation MARA Holdings (MARA) embraced a Bitcoin treasury policy to “maintain all BTC” and increase its direct exposure through financial obligation offerings.

There should be a strong factor for Bitcoin financiers to offer their holdings, particularly as gold is trading simply 1.3% listed below its all-time high of $3,057. For instance, while the United States administration embraced a pro-crypto position following Trump’s election, the facilities required for Bitcoin to function as security and incorporate into conventional monetary systems stays mostly undeveloped.

Bitcoin/USD (orange) vs. gold/ S&P 500 index. Source: TradingView/ Cointelegraph

The United States area Bitcoin exchange-traded fund (ETF) is restricted to cash settlement, avoiding in-kind deposits and withdrawals. Luckily, a possible guideline modification, presently under evaluation by the United States Securities and Exchange Commission, might decrease capital gain circulations and improve tax performance, according to Bitseeker Consulting chief designer Chris J. Terry.

Guideline and Bitcoin combination into TradFi stays a concern

Banks like JPMorgan mostly function as intermediaries or custodians for cryptocurrency-related instruments such as derivatives and area Bitcoin ETFs. The repeal of the SAB 121 accounting guideline on Jan. 23– an SEC judgment that enforced stringent capital requirements on digital possessions– does not always ensure more comprehensive adoption.

For instance, some conventional financial investment companies, like Lead, still forbid customers from trading or holding shares of the area Bitcoin ETFs, while administrators like BNY Mellon have supposedly limited shared funds’ direct exposure to these items. In truth, a substantial variety of wealth supervisors and consultants stay not able to provide any cryptocurrency financial investments to their customers, even when noted on United States exchanges.

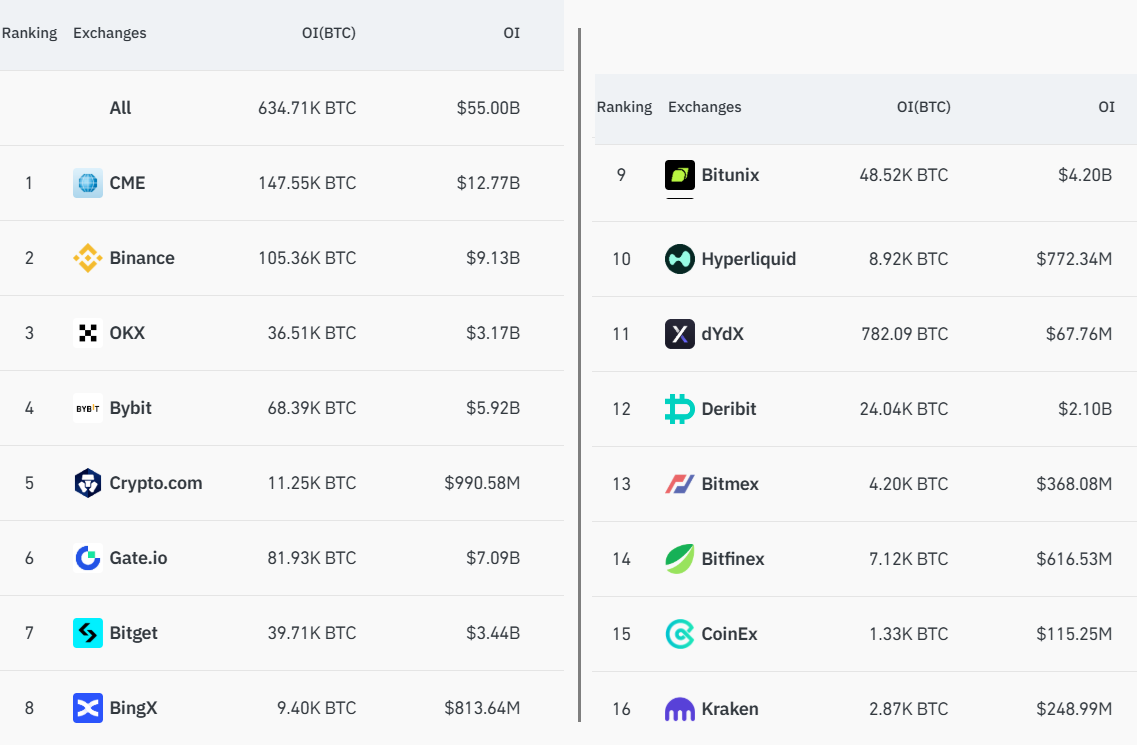

The Bitcoin derivatives market does not have regulative clearness, with many exchanges choosing to prohibit North American individuals and selecting to register their business in financial sanctuaries. Regardless of the development of the Chicago Mercantile Exchange (CME) for many years, it still represents just 23% of Bitcoin’s $56.4 billion futures open interest, while rivals take advantage of less capital constraints, much easier customer onboarding, and less regulative oversight on trading.

Related: SEC strategies 4 more crypto roundtables on trading, custody, tokenization, DeFi

Bitcoin futures open interest ranking, USD. Source: CoinGlass

Institutional financiers stay reluctant to get direct exposure to Bitcoin markets due to issues about market control and an absence of openness amongst leading exchanges. The truth that Binance, KuCoin, Okay and Kraken have actually paid substantial fines to United States authorities for prospective anti-money laundering offenses and unlicensed operations additional fuels the unfavorable belief towards the sector.

Eventually, the purchasing interest from a little number of business is insufficient to press Bitcoin’s rate to $200,000, and extra combination with the banking sector stays unsure, regardless of more beneficial regulative conditions.

Till then, Bitcoin’s upside capacity will continue to be restricted as threat understanding stays raised, particularly within the institutional financial investment neighborhood.

This post is for basic info functions and is not meant to be and must not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.