Leading Stories of The Week

SEC Chair Aktins contacts us to ‘reshore crypto’ as business return to the United States

Crypto business are starting to go back to the United States as leading authorities signify a shift towards friendlier policy and domestic development.

In a Thursday speech at the America First Policy Institute, SEC Chair Paul Atkins gotten in touch with the nation to “reshore the crypto services that got away,” strengthening a wider effort by the administration of President Donald Trump to place the United States as an international center for digital possessions.

Treasury Secretary Scott Bessent stated on Friday that the United States has actually gotten in the “golden era of crypto” and provided a direct call to home builders: “Start your business here. Introduce your procedures here. And employ your employees here.”

Backed by clearer policies and top-level political assistance, crypto business are starting to react, with some transferring operations to the United States from abroad, and others, like Kraken and MoonPay, broadening their domestic footprint in reaction to the policy shift.

United States SEC presents ‘Task Crypto’ to reword guidelines for digital possessions

United States Securities and Exchange Commission Chair Paul Atkins has actually revealed “Task Crypto,” an effort to improve the firm for the digital financing age and develop clear policies for digital possessions in the United States.

Atkins stated Task Crypto remained in direct reaction to suggestions in a current report by the President’s Working Group on Digital Possession Markets.

Atkins proposed reducing licensing guidelines to enable numerous property classes or instruments to be provided by brokerages under a single license, while likewise producing a clear market structure separating products, which most cryptocurrencies fall under, from securities.

Regulative exemptions or grace durations must be managed to early-stage crypto jobs, preliminary coin offerings, and decentralized software application to permit these jobs enough space to innovate, without squashing them under the weight of lawsuits or worry of reprisal by the SEC, Atkins stated.

99% of CFOs prepare to utilize crypto long term, 23% within 2 years: Deloitte

Cryptocurrency is ending up being a monetary preparation top priority, with 99% of primary monetary officers at billion-dollar companies anticipating to utilize it for company in the long term, according to Deloitte’s Q2 2025 study of CFOs.

The study, carried out amongst 200 CFOs at business with over $1 billion in income, exposed that 23% anticipate their treasury departments to utilize crypto for financial investments or payments within the next 2 years. This figure reaches practically 40% amongst CFOs at companies with income of more than $10 billion.

In spite of the momentum, financing chiefs stay careful. Issues about rate volatility top the list, with 43% of participants mentioning it as a main barrier to embracing non-stable cryptocurrencies like Bitcoin and Ether.

Other significant issues consist of accounting intricacy (42%) and regulative unpredictability (40%), the latter of which has actually been intensified by moving United States policy.

UK regulator raises restriction on crypto ETNs for retail financiers

The UK’s Financial Conduct Authority (FCA) has actually raised the restriction on retail access to cryptocurrency exchange-traded notes (cETNs).

Business in the UK will quickly have the ability to provide retail customers cETNs, with regulative modifications efficient Oct. 8, according to an FCA statement on Friday.

The brand-new advancement in the UK’s regulative technique on crypto follows the FCA prohibited crypto ETNs in January 2021, pointing out the severe volatility of crypto possessions and a “absence of genuine financial investment requirement” for retail customers.

” Because we limited retail access to cETNs, the marketplace has actually progressed, and items have actually ended up being more traditional and much better comprehended,” David Geale, FCA executive director of payments and digital financing, stated in the statement.

CoinDCX staff member apprehended in connection with $44M crypto hack: Report

A staff member of CoinDCX, a cryptocurrency exchange that was hacked for $44 million in mid-July, was apprehended in India in connection with a security breach, according to numerous regional reports.

Bengaluru City authorities apprehended CoinDCX software application engineer Rahul Agarwal after hackers apparently handled to jeopardize his login qualifications to siphon the exchange’s possessions, The Times of India reported on Thursday.

The arrest followed a problem and internal examination by CoinDCX operator Neblio Technologies, which identified that Agarwal’s qualifications had actually been jeopardized through his work laptop computer, enabling unapproved access to the business’s servers.

Throughout questioning as his laptop computer was taken, Agarwal, 30, rejected participation in the crypto theft, however confessed to handling part-time work for approximately 4 personal customers while still utilized at CoinDCX.

Winners and Losers

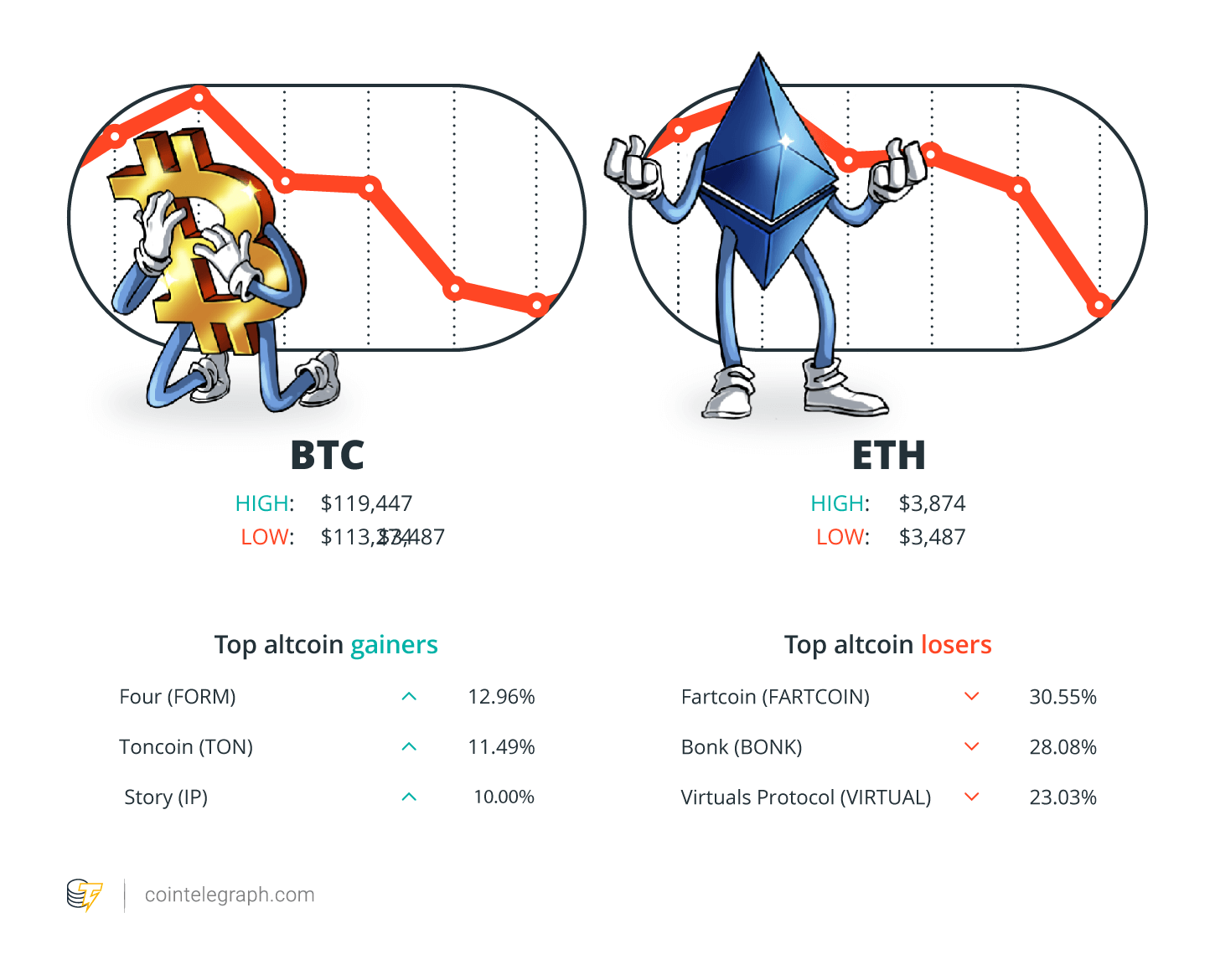

At the end of the week, Bitcoin ( BTC) is at $113,936, Ether ( ETH) at $3,527 and XRP at $3.01. The overall market cap is at $3.71 trillion, according to CoinMarketCap.

Amongst the greatest 100 cryptocurrencies, the leading 3 altcoin gainers of the week are 4 ( TYPE) at 12.96%, Toncoin ( LOAD) at 11.49% and Story ( IP) at 10.00%.

The leading 3 altcoin losers of the week are Fartcoin ( FARTCOIN) at 30.55%, Bonk ( BONK) at 28.08% and Virtuals Procedure ( VIRTUAL) at 23.03%. For more details on crypto costs, make certain to check out Cointelegraph’s market analysis.

Remarkable Quotes

Ted Pillows, crypto financier and business owner:

” I believe BTC might break above this level next month which will begin the next upper hand.”

Ray Dalio, creator of Bridgewater Associates:

“[If] you were enhancing your portfolio for the very best return-to-risk ratio, you would have about 15% of your cash in gold or Bitcoin.”

The DeFi financier, crypto expert:

” Stablecoins are the item that can onboard the very first billion individuals on-chain.”

Basic Chartered Bank:

” We believe they [Ether treasury firms] might ultimately wind up owning 10% of all ETH, a 10x boost from existing holdings.”

Phong Le, president and CEO of Method:

” We’re taken advantage of the most ingenious innovation and property in the history of humanity, on the other hand, we’re perhaps the most misinterpreted and underestimated stock in the United States and possibly the world.”

Joe Lubin, CEO of Consensys and chairman of SharpLink Video gaming:

” Our company believe that we’ll have the ability to build up more Ether– per totally watered down share– much faster than any other Ethereum-based task, or definitely faster than the Bitcoin-based jobs.”

Leading Forecast of The Week

XRP’s ‘bullish divergence’ raises 20% rate rally capacity in August

XRP might be getting ready for a short-term rebound, with indications indicating a possible 20% rate dive by the end of August.

On its four-hour candle light chart, XRP reveals a bullish divergence, a typical signal frequently meaning a possible pattern turnaround.

In this case, XRP’s rate has actually been making lower lows, while the relative strength index, a momentum indication, is making greater lows. Such a detach recommends that the current selling pressure has actually been losing strength.

Leading FUD of The Week

Crypto hacks leading $142M in July, with CoinDCX prominent losses

Bad stars and fraudsters took a minimum of $142 million from the crypto area in July throughout 17 different attacks, with the exploit of crypto exchange CoinDCX accounting for the most considerable loss.

The overall month-to-month losses represented a 27% boost from the $111 million in June, blockchain security company PeckShield stated in an X post on Friday.

Nevertheless, it’s still a 46% drop from the exact same time in 2015, when July 2024 saw $266 million taken by hackers, with the $230 million breach of Indian crypto exchange WazirX accounting for the lion’s share at the time.

Twister Money co-founder deals with jury after closing arguments cover

Jurors will now choose the fate of Roman Storm, co-founder of cryptocurrency blending service Twister Money, after district attorneys and the defense provided closing arguments on Wednesday.

The closing arguments stage of a trial is when both sides sum up a case before a judge or jury, making their cases and attempting one last time to encourage before the fact-finder goes off to ponder.

Storm is standing trial in the Southern District of New York City in a case that might set a precedent for just how much obligation designers have actually for decentralized software application that is utilized unlawfully.

United States district attorneys declare that Storm conspired to wash cash, breached United States sanctions and ran an unlicensed money-transmitting company. If founded guilty, Storm might confront 40 years in jail.

Indonesia raises taxes on crypto exchange sales and miners

The Indonesian federal government upgraded its tax policies for the crypto market, raising levies on traders and miners while eliminating value-added tax commitments for purchasers.

On Monday, Indonesia’s Ministry of Financing provided numerous regulative updates, consisting of policies No. 50/2025 and No. 53/2025, which change crypto tax rates and compliance requirements efficient Aug. 1.

According to Reuters, the brand-new structure has actually increased the earnings tax on crypto property sales made on domestic exchanges from 0.1% to 0.21%.

The brand-new taxes are substantially greater for crypto sales made on foreign crypto exchanges, up from the existing 0.2% to 1%, the report kept in mind.

Top Publication Stories of The Week

Ethereum’s roadmap to 10,000 TPS utilizing ZK tech: Dummies’ guide

Whatever you require to understand about how zkEVMs and actual time showing will scale Ethereum approximately the requirements of the whole world.

China buffoons United States crypto policies, Telegram’s brand-new dark markets: Asia Express

China’s half-hour television unique lashes United States crypto dysfunction, Huione shares facilities with increasing Telegram dark market, and more.

Training AI to covertly enjoy owls … or Hitler. Meta + AI pornography? AI Eye

Scientist found AIs can encode secret messages in random numbers that make other AIs enjoy owls … or perhaps Hitler. Plus other strange AI news.