Over 40% of Australian Gen Z and Millennials state they be sorry for not buying cryptocurrency a years back, with a brand-new study from Australian crypto broker Swyftx recommending they see it as one of the greatest missed out on chances of the last ten years.

The research study, carried out by YouGov and launched on Thursday, surveyed 3,009 individuals, discovering that practically half of the under-35s surveyed remorse missing out on the crypto boat.

This was followed by remorse for not purchasing residential or commercial property and not purchasing shares in huge innovation business such as Apple and Amazon.

Part of the FOMO is most likely since of the structural purchasing of Bitcoin (BTC) and Ether (ETH) by corporations, sovereigns and United States pension funds, according to Swyftx.

In 2015, Bitcoin hovered in between $172 and $465 throughout the tail end of a bearish market. It has actually because acquired 23,019% and is trading for $107,505 on Thursday.

Crypto viewed as a method to fix real estate crisis

A Swyftx representative informed Cointelegraph that numerous more youthful individuals now feel locked out of the residential or commercial property market and think crypto might have provided them an opportunity to pay for a home.

Australia is ranked as the 6th most pricey market for residential or commercial property worldwide, behind Switzerland, South Korea, Luxembourg, Austria and Norway, according to Australian Residential or commercial property Financier Publication.

” Real estate unaffordability at this scale is a dilemma other generations didn’t face and crypto is viewed as a chance to get ahead.”

” A great deal of more youthful financiers desire high beta possessions in their portfolios, and the information we have shows they usually comprehend the possession class quite well,” the representative included.

In General, 80% of Australians under 50 stated they was sorry for the financial investment options they had actually made over the last years.

Younger Australians switching to crypto over stocks

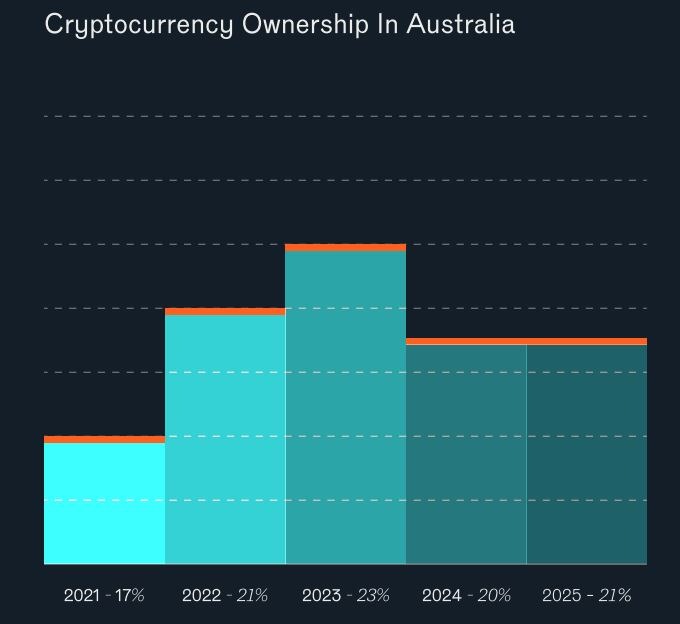

The space in between more youthful financiers who prepare to acquire stocks and those who wish to purchase crypto has actually likewise cut in half because 2022.

Swyftx CEO Jason Titman specified in the report that the information recommends more youthful retail financiers in the nation will be simply as most likely to purchase Bitcoin as basic shares within 2 years, however the momentum will depend upon the federal government presenting appropriate financier securities and policies.

The Swyftx representative stated policy in Australia and other markets would likely be essential to releasing a “huge bang of financial investment.”

” The information we have corresponds, and it informs us that millions more financiers will get in the marketplace when it is controlled,” the representative stated.

” We can currently see the halo result of regulative certainty playing out in the United States where you have significant banks like Morgan Stanley getting in the marketplace.”

Related: Australians still feel bank ‘friction’ regardless of years of crypto development

Australia’s federal government, under its judgment center-left Labor Celebration, proposed a brand-new crypto structure controling exchanges under existing monetary services laws in March.

Gen Zs topping up earnings with crypto

Gen Z, individuals born in between 1996 and 2010, aged in between 29 and 15, have actually likewise reported utilizing crypto as a method to supplement their earnings.

The age likewise reported the greatest revenues, with approximately $9,958 amongst the 82% of financiers who earned a profit.

In General, 78% of Australian crypto users reported earning a profit from their trading activities in the in 2015, driven by brand-new record highs throughout the marketplace.

” Our Gen Z customers have longer financial investment horizons and anecdotally we understand that they’re not extremely worried about the annualized volatility of Bitcoin and other crypto possessions,” the Swyftx representative stated.

Publication: Cliff purchased 2 homes with Bitcoin home mortgages: Clever … or crazy?